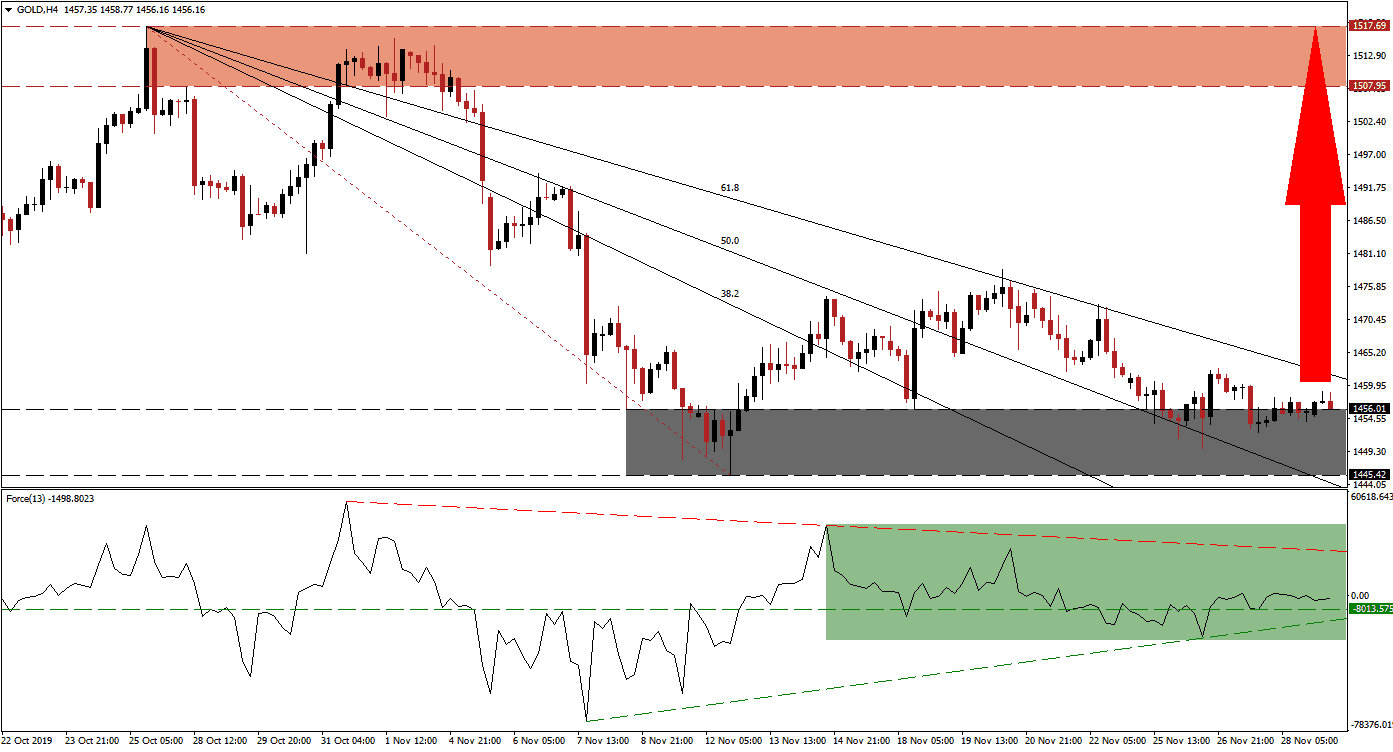

As global economic data continues to disappoint, safe-haven assets such as gold are expected to attract fresh capital. Hopes of a phase one trade deal between the US and China have resulted in a risk-on mood and pushed financial markets to all-time highs in some economies. The same hopes are once again under threat due to developments countering any progress made, like the US signing a bill into law supporting pro-democracy Hong Kong protesters. Gold is anticipated to complete a breakout above its 61.8 Fibonacci Retracement Fan Resistance Level and accelerate to the upside. You can learn more about the Fibonacci Retracement Fan here.

The Force Index, a next-generation technical indicator, ended its contraction after this commodity pushed out of its support zone and ended its corrective phase. An ascending support level emerged and the Force Index was able to eclipse its horizontal resistance level, turning it into support as marked by the green rectangle. The ascending support level is now on track to cross above its horizontal support level and provide more upside momentum, closing the gap to its descending resistance level. This technical indicator is additionally expected to move into positive conditions and place bulls in charge of gold.

A breakout in gold above its descending 61.8 Fibonacci Retracement Fan Resistance Level may initiate a short-covering rally and add volume to the advance. Another bullish development occurred inside the support zone, located between 1,445.42 and 1,456.01 as marked by the grey rectangle; price action recorded a higher low following a reversed breakout. The 61.8 Fibonacci Retracement Fan Resistance Level ended the previous advance and pressured this precious metal back down into its support zone. This safe-haven asset has now drifted out of this zone on the back of a build-up in bullish momentum. You can learn more about a support zone here.

After a sustained breakout materializes, the next key level to monitor is the intra-day high of 1,478.56; this represents the peak of the previously reversed breakout attempt. A breakout in price action above this level will clear the path to the upside and into its resistance zone located between 1,507.95 and 1,517.69 as marked by the red rectangle. This will additionally place gold back above the key psychological 1,500 mark, and more upside is possible as fundamental developments favor a higher price in gold. The next resistance zone awaits price action between 1,544.31 and 1,556.74; the current 2019 high.

Gold Technical Trading Set-Up - Breakout Extension Scenario

⦁ Long Entry @ 1,456.00

⦁ Take Profit @ 1,517.50

⦁ Stop Loss @ 1,436.50

⦁ Upside Potential: 6,150 pips

⦁ Downside Risk: 1,950 pips

⦁ Risk/Reward Ratio: 3.15

Should the Force Index reverse and complete a breakdown below its ascending support level, gold could be pressured into a breakdown. Given the long-term fundamental outlook, downside potential remains limited and any breakdown should be accepted as an excellent buying opportunity in this precious metal. The next support zone is located between 1,414.54 and 1,400.31.

Gold Technical Trading Set-Up - Limited Breakdown Scenario

⦁ Short Entry @ 1,428.00

⦁ Take Profit @ 1,403.00

⦁ Stop Loss @ 1,440.00

⦁ Downside Potential: 2,500 pips

⦁ Upside Risk: 1,200 pips

⦁ Risk/Reward Ratio: 2.08