Mixed results from the official jobs report may support the continuation of the bullish correction for the GBP/USD this week as well, while recent gains hit 1.2975 resistance, closest to 1.3000 psychological resistance. Recent concerns about the future of Brexit eased after the EU granted an extension of the British exit date from the block to January 31, 2020 instead of October 31, 2019. Eyes on who will win the country's early elections on Dec. 12 to break the political deadlock within the UK after the recent Brexit deal between Boris Johnson and the block through the British House of Commons reached a dead end.

So far, opinion polls still favor the ruling Conservative Party's victory, but there is still time to turn the tide toward any change, depending on each party's policy and voter conviction. In general, Britain will not leave the EU without a deal.

On the US side. The US central bank, led by Jerome Powell, cut the US interest rate by a quarter point to maintain the longest period of economic growth in the country's history and meet the challenges stemming from the global trade war. The US economy has succeeded in generating new jobs more than expected due to a general strike by GM, unemployment rose slightly from its 50-year low and average hourly wages increased. The US manufacturing sector has weakened recently with the prolonged trade dispute of the United States with the world's second largest economy.

On the global trade front. Leaders from fast-growing Southeast Asia, China and other regional powers vowed on Sunday to overcome disputes over trade policies and regional disputes for stronger economies and regional stability. President Donald Trump missed the ASEAN summit and instead sent his national security adviser, Robert O'Brien. Last year, Trump sent Vice President Mike Pines. Both are now busy campaigning, and analysts say their absence will leave room for China to further strengthen its position and influence in the region.

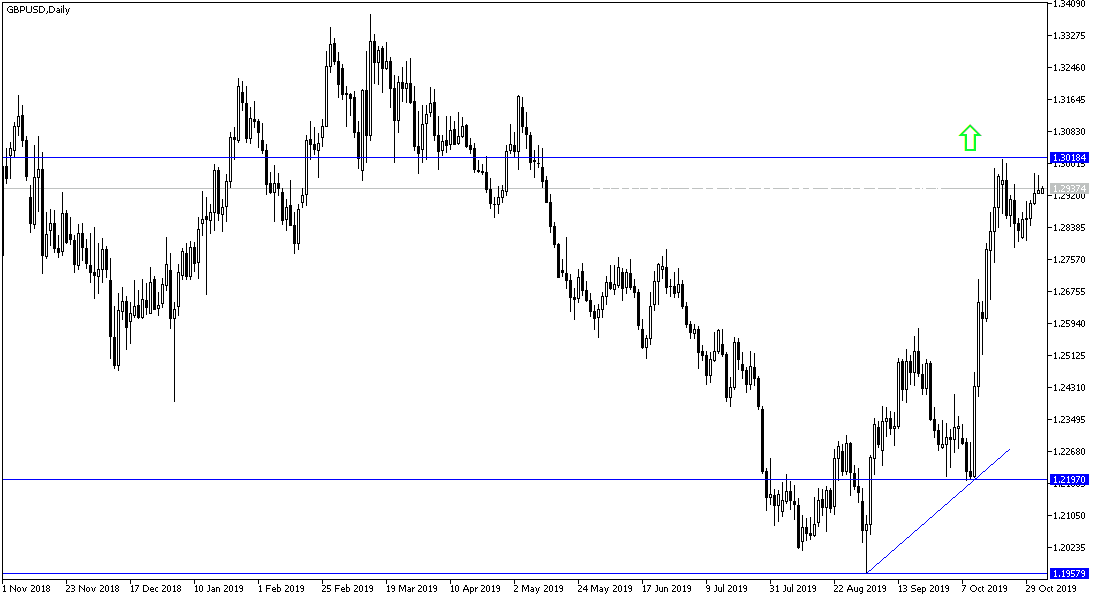

According to the technical analysis of the pair: The success of GBP/USD in breaching the 1.3000 psychological resistance will support more momentum for the bulls to move towards stronger resistance levels at 1.3065, 1.3120 and 1.3200, respectively. On the downside, the nearest support for the pair is currently at 1.2910, 1.2865 and 1.2790, and the last level is an ideal buying area for the pair at this time, taking into account monitoring Brexit developments, as they have the strongest influence on the Pound gains.