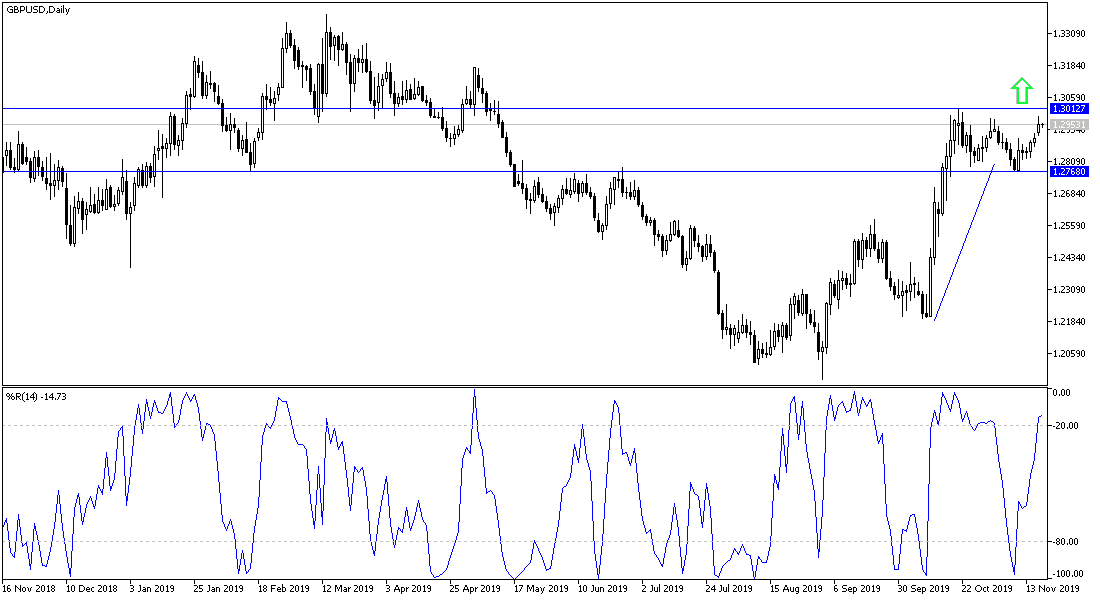

British political parties are stepping up their campaigns to attract the largest number of supporters to win the country's early elections on Dec. 12, which will determine the fate of Brexit. Opinion polls still favor the Conservative Party led by Prime Minister Boris Johnson. In case the conservatives win the election, it might be easier for him to pass the Brexit deal he signed with the bloc last month. This optimism still supports further gains for the GBP/USD which reached the 1.2985 resistance, and closer to the 1.3000 psychological resistance, which increases the bullish momentum as shown on the daily chart below.

A November 16 YouGov poll showed that conservatives led by Boris Johnson increased their lead at the expense of Labor Party by three points. The poll, which tracks changes with a similar poll conducted on November 12, showed: Conservatives: 45% (+3) - Labor: 28% (-). The Liberal Democrats: 15% (-). And Brexit party 4% (-). YouGov is the most important for the market vs to other polls, simply because of its accuracy in determining the final outcome of recent national votes. The strongest assumption is that the Conservative-led majority parliament will support a swift passage of the Brexit deal through the House of Commons, after which trade negotiations will begin. All this will eliminate much of the uncertainty that has surrounded the Pound since the Brexit referendum in 2016.

There will be the first major television debate for the campaign, with Jeremy Corbyn and Boris Johnson heading to ITV at 20:00 on Tuesday for a standoff that could affect the results of the current polls and thus the Pound's performance against other major currencies.

According to the technical analysis of the pair: No change in the technical outlook, the success of the GBP/USD pair to overcome the 1.3000 psychological resistance will consolidate the upward correction and increase buying, and therefore we may see a push to resistance levels at 1.3065, 1.3120 and 1.3200, respectively. Should the conservatives lose the current majority, the pair's gains could quickly collapse and support 1.2800 would remain the key to the downside strength again.

As for the economic calendar data today: All focus will be on US economic data with the release of building permits and housing starts.