British Prime Minister Boris Johnson and opposition leader Jeremy Corbyn attacked each other's policies on Brexit, health care and the economy in a televised debate likely to fail to answer the troubling question of many voters: Why should we trust you? . The politicians got rid of their weaknesses and ignored tough questions about their policies at the hour-long meeting, the first live television debate between a British prime minister and a key rival. The opposition Labor Party received support after that debate and the GBP/USD pair gave up some of its gains, which extended to the 1.2985 resistance a month ago, and retreated to 1.2900 support at the time of writing.

Later in the campaign, smaller party leaders, along with Labor and the Conservatives, will participate in two seven-way discussions, and Corbyn and Johnson are set to meet again in a BBC debate on 6 December. Overall, the stakes remain high for both Johnson and Corbyn as they try to beat the exhausted electorate of Brexit. Both are trying to overcome a mountain of mistrust. Johnson, who has pooled his usual desire for a more silent and serious approach, is under fire for failing to deliver on his often repeated pledge that Britain will leave the EU on 31 October 2019.

From the USA, a report released by the Ministry of Commerce showed a significant rebound in new residential construction during October. Housing starts jumped 3.8 percent to an annual rate of 1.314 million in October after falling 7.9 percent to a revised rate of 1.266 million in September. Economists had expected housing starts to jump 5.1 percent to 1.320 million from 1.256 million the previous month. Despite the notable recovery, housing starts are still below a 12-year high of 1.375 million in August. In contrast, building permits rose 5.0 percent to an annual rate of 1.461 million in October after falling 2.4 percent to a revised 1.391 million in September.

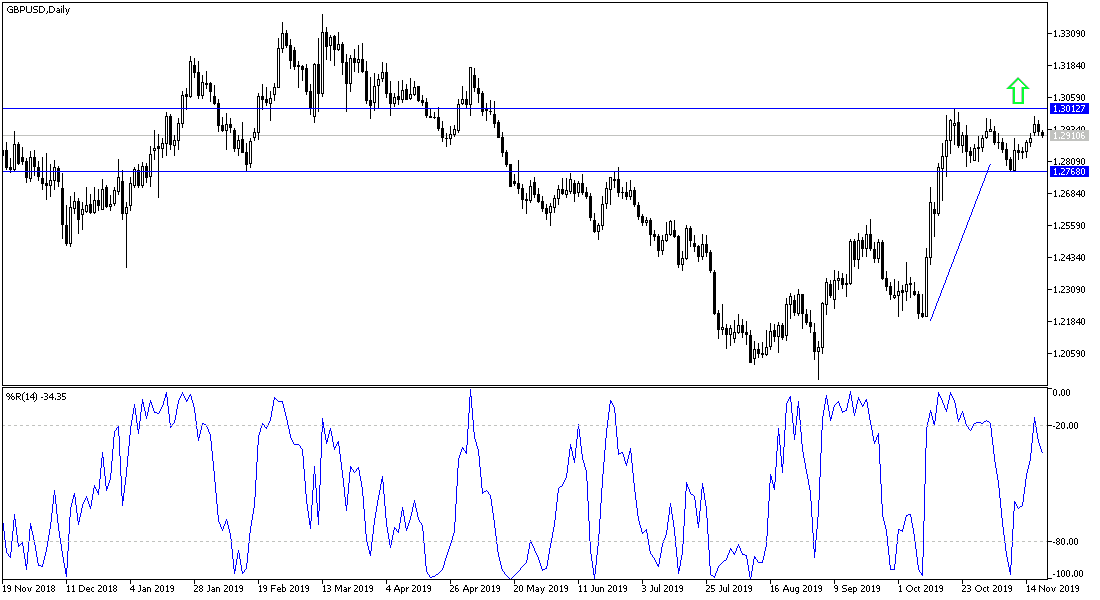

According to the technical analysis of the pair: The strength of the current bullish correction for the GBP/USD is still dependent on testing the 1.3000 psychological resistance because it may open the way for bulls to push the pair to higher resistance levels. On the downside, 1.2800 support remains the key to the downward correction, thus breaking the current bullish correction expectations. Expectations on who will win the general election in Britain next month will remain the most influential on the trend of the pair until Dec. 12, the date of the election.

As for the economic calendar data today: all focus will be on the release of the content of the Federal Reserve last meeting minutes to identify the future of US interest.