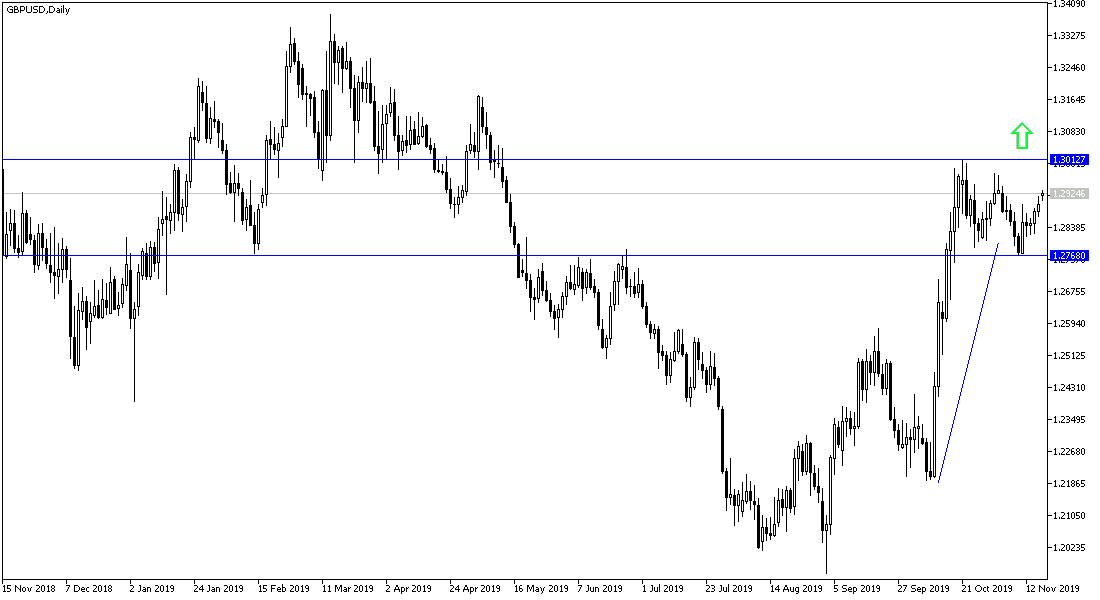

Throughout last week's trading, the GBP/USD pair had a bullish correction to the 1.2918 resistance amid continued optimism that the Conservatives could win a landslide victory in the country's upcoming elections on December 12, making it easier for the British government this time to pass the Brexit deal through the House of Commons. Prior to this optimism, the pair fell to the 1.2768 support, its lowest level in nearly a month.

The pound's gains did not stop even after weak retail sales and inflation in Britain emerged in October, amid an apparent improvement in the Conservative Party chances of winning the general election. Brexit Party candidates were suspended in more parliamentary seats across the country on Friday as part of an attempt to boost Prime Minister Boris Johnson's chances of winning the election by not distracting the vote in areas where conservatives have better chances of winning or already holding seats. The decision came after the newly formed party rejected more than 300 candidates in the previous week so as not to hinder Johnson's chances of winning.

Voting numbers and the flow of votes will continue to be the biggest impact on the Pound in the coming days. Prime Minister Johnson will be face-to-face with opposition Labor Party leader Jeremy Corbyn in a televised debate on Tuesday, and with no party's official statement expected before the end of the week, talk of rival visions of Britain as it emerges from the bloc is likely to dominate investor and analyst sentiment, especially after polls’ results after this important meeting.

According to the technical analysis of the pair: On the daily chart below, it seems clear that the GBP/USD is close to the head and shoulders formation and will be affected by this formation if the pair stabilized above the 1.3000 psychological resistance, which supports the upward trend, which still dominates the pair's direction. The bearish outlook will not strengthen again without stabilizing below 1.2800 support, and so far we still prefer to buy the pair from every bearish level.

Today's economic calendar has no significant economic data from the United States or Britain.