With more than 100 pips rebounded, the GBP/USD pair rallied during Monday's trading session, starting from the 1.2773 support to the 1.2898 resistance before settling around 1.2860 at the time of writing. This came after growing expectations that the Conservative Party would win a majority in the country's general elections on Dec. 12. In the same vein, the Brexit Party announced that it will not compete for the seats won by the Conservatives in the general election in 2017. Party Chairman Richard Tess said his party will not compete for the 317 constituencies won by the Conservatives in the last election. The party considers that the decision to withdraw from the Conservative seats was motivated by Prime Minister Boris Johnson's commitment not to extend the transitional period specified in the Brexit agreement beyond 2020, while also committing to seek a free trade agreement with the European Union, as is the case with the current trade agreement between the EU and Canada. The Conservatives welcomed the decision of the Brexit Party, where they consider that another suspended parliament is the biggest threat to end Britain's exit from the European Union.

A Conservative victory will ensure that the Brexit deal is easily passed through the House of Commons. This puts an end to months of instability for British companies.

The UK economy has been in urgent need of more confidence since the outcome of the Brexit referendum in June 2016, and the approval of the Brexit deal goes a long way towards achieving this goal. The UK's GDP grew at its slowest pace in a decade.

If the outcome of the next general election is a majority of Conservatives, the Pound will rise strongly. Market bets indicate that the probability of a pending parliament is within an implied probability of 34.5%, which is less than the 51% probability seen last Friday. Britain's exit from the EU has been delayed three times since its vote, and as global growth slowed markedly in recent quarters, the British economy has shown growing signs that it is suffering from the burden of chronic uncertainty about the country's future trade arrangements with its biggest partners. Uncertainty has weakened business confidence and impacted investment as well as consumer spending.

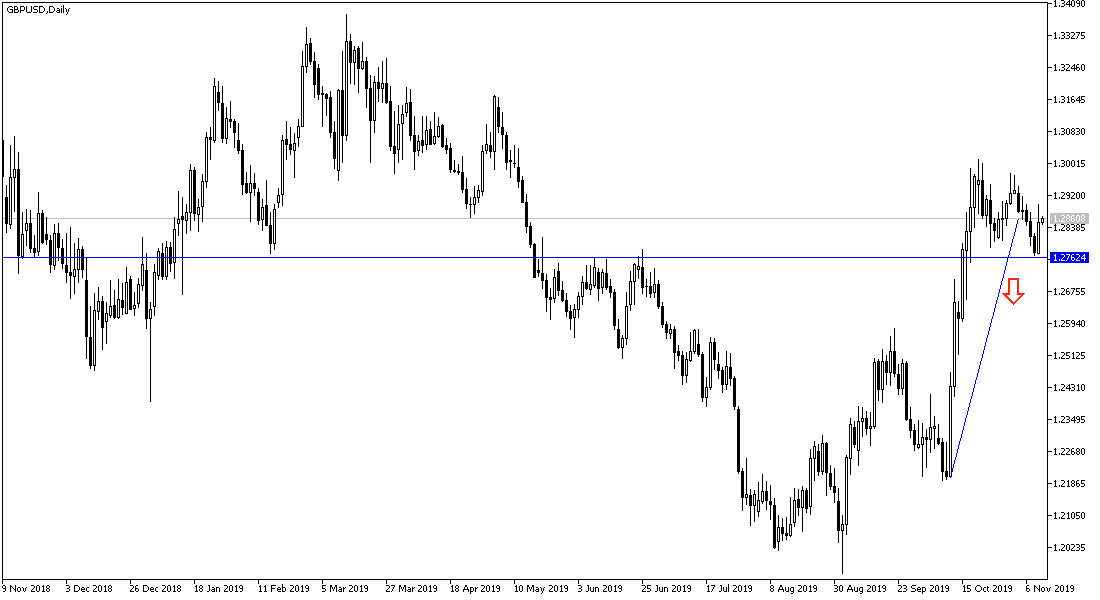

According to the technical analysis of the pair: Increased confidence in the victory of Boris Johnson in the upcoming elections may save the price of the pair GBP/USD from falling below the strong 1.2800 support. Bulls are waiting to return to the 1.3000 psychological resistance area to take control again. As for the bears, any move below 1.2800 support will spur them to move the price to the support levels at 1.2755, 1.2680 and 1.2600 respectively.

The focus will be on the UK data again with the release of the Average Wage, Employment Change and Unemployment Index. There are no important US data releases today.