For the second day in a row, the price of the GBP/USD is trying to compensate for recent losses, which extended to the 1.2768 support level recorded during last Friday's session, the lowest for nearly a month. Earlier in the week, the pair attempted to rebound to 1.2897, but retreated back to 1.2815 before a fresh attempt to rebound, but with gains not exceeding 1.2873 before settling around 1.2852 at the time of writing, and ahead of the release of important US inflation figures and the testimony of Federal Reserve Governor Jerome Powell. The Sterling does not care much for the announcement of major economic releases from Britain, beginning with the growth of GDP, which averted a recession in the third quarter. Then the numbers of jobs and wages, which came in positive overall, as well as inflation figures today. The future of the country's upcoming elections will determine Sterling's direction in the coming days until it is completed on Dec. 12.

The Pound received fresh support after the YouGov poll showed that the Conservatives had widened the lead in the election. The YouGov poll from November 11 to 12 showed that the Conservatives got 42%, up 3 points in a similar poll on November 08. Labor also saw its share of votes grow, up 2 points to 28%. Liberal Democrats fell two points in the poll by 15%. However, the biggest loser seems to be the Brexit party, which lost 6 points in the poll and garnered 4%.

The main focus now for currency markets is the difference in points between the Labor and the Conservatives, with a 14-point hint suggesting a strong conservative majority on Dec. 12. Markets are particularly interested in YouGov surveys because of the organization's record. It proved to be the most accurate in the voting process for the 2017 election, including a sudden drop in support for Theresa May, who eventually saw the Conservatives losing their majority in parliament.

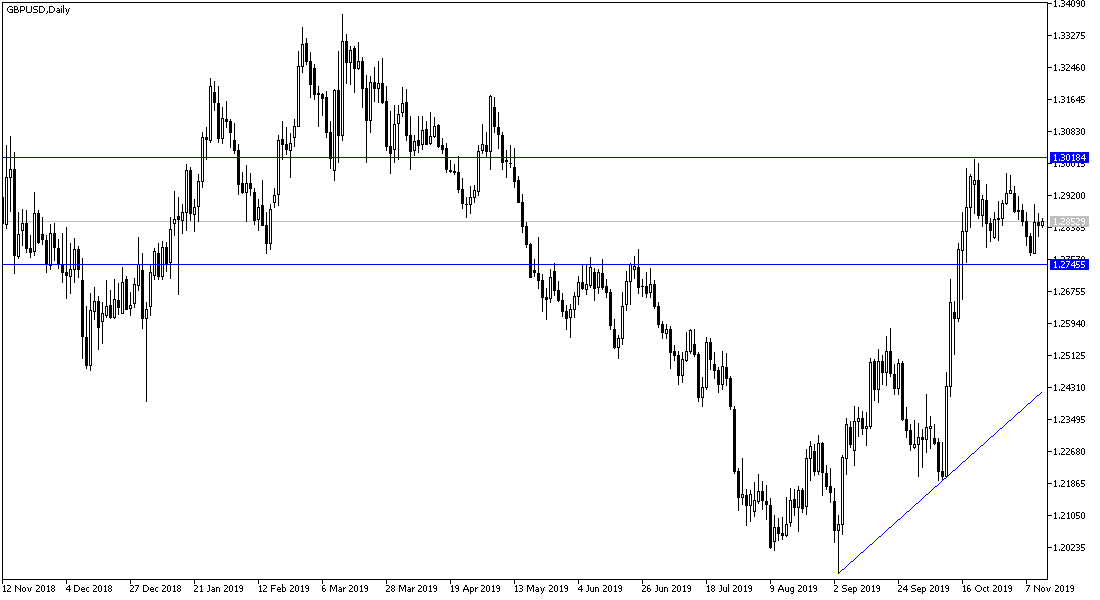

According to the technical analysis: The strength of the current bullish correction for the GBP/USD still needs to test the 1.3000 psychological resistance and get established above that to confirm the strength of the general trend, which is still bullish in the medium term. In contrast, it remains bearish in the long run. The failure of the correction, and the stability below 1.2800 support will support the bears to push the pair to new support levels near 1.2765, 1.2660 and 1.2500 respectively. The pair will remain very sensitive to the results of the polls until the December 12 elections.

For the economic calendar data: From the UK, there will be an announcement for a package of economic data; most notably the consumer price index, producer prices and retail prices. From the United States, ther is the release of the most important CPI readings to measure inflation in the country. Later, Federal Reserve Governor Jerome Powell will testify before a special congressional committee explaining the economic situation and the bank's plans to revive the world's largest economy.