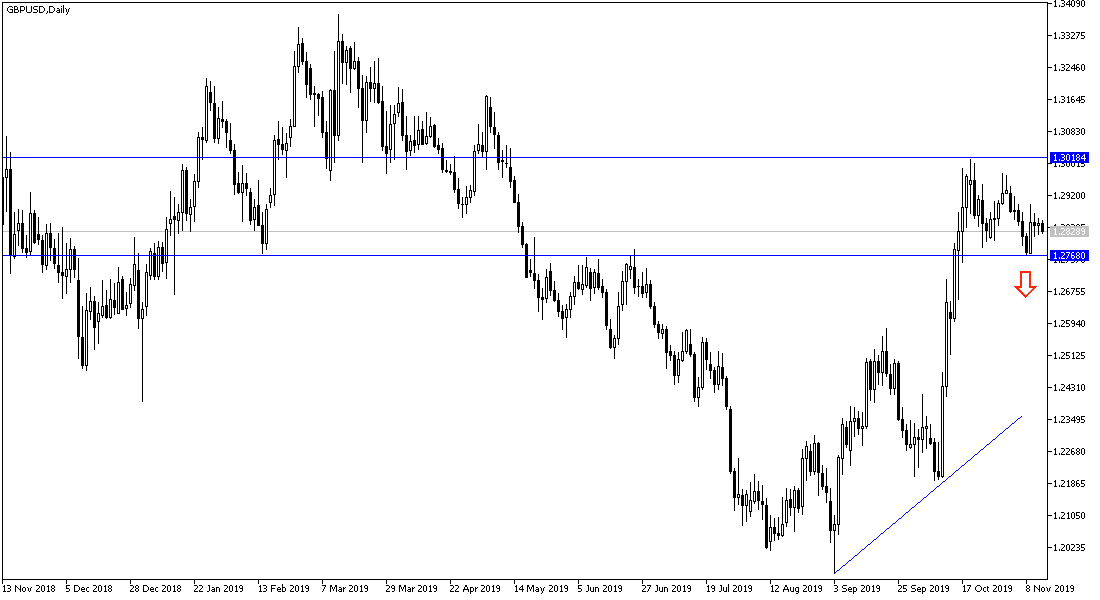

GBP/USD will not pay much attention to the release of important UK economic data, not even the US data and the recent testimony of Jerome Powell. The pair has been range-trading between the 1.2820 support and the 1.2873 resistance for the last two trading sessions. Even after the release of Britain's GDP growth which averted a recession in the third quarter of this year, not even after the release of the more positive results for jobs in the UK. The reaction was limited as UK inflation levels fell more than expected. UK consumer price inflation fell more-than-expected in October to its lowest level in three years, due to lower utility costs, thanks to lower energy prices.

The consumer price index rose 1.5 percent year on year after a 1.7 percent increase in September, and economists had expected inflation to fall to 1.6 percent. The latest inflation rate was the lowest since November 2016, when it was 1.2 percent. The Bank of England forecasts that inflation, currently under 2 percent, would fall to about 1.25 percent by the spring of next year. Thereafter, inflation is expected to gradually rise to just over 2 percent.

From the USA, Consumer prices rose slightly more than expected in October. The consumer price index rose 0.4 percent in October after a no change in September. Economists had expected consumer prices to rise 0.3 percent. The more-than-expected rise in consumer prices came with energy prices rising 2.7 percent in October after falling 1.4 percent in September.

Federal Reserve Chairman Jerome Powell noted that there were still notable risks to the outlook, citing slower growth abroad and trade uncertainty amid the ongoing US-China trade war. “Inflation pressures remain low and long-term inflation forecast indicators are at the lower end of their historical ranges,” he said. “Continued inflation below the target could lead to an unexpectedly low fall in long-term inflation expectations.” And added “We will continue monitoring these developments and their implications on the US economic activity and inflation”.

Powell's testimony comes a day after President Donald Trump renewed his attacks on the Fed in a speech to the Economic Club in New York on Tuesday, accusing the central bank of putting the United States "in a competitive position that is unfit for other countries."

According to the technical analysis of the pair: There is no change in the technical outlook for the GBP/USD, as the downward pressure for the current path will increase with stability below the 1.2800 support, and the targets for the bears then may move towards 1.2770, 1.2680 and 1.2600, respectively. Especially if the Conservatives lose the current lead in the polls on who will win the next fateful elections. On the upside, the 1.3000 psychological resistance remains the key to the upside correction.

For the economic calendar today: From the UK, we will have the Retail Sales figures. From the United States, the jobless claims, the producer price index and the second testimony of Federal Reserve Governor Jerome Powell, which is expected to confirm his initial testimony before Congress.