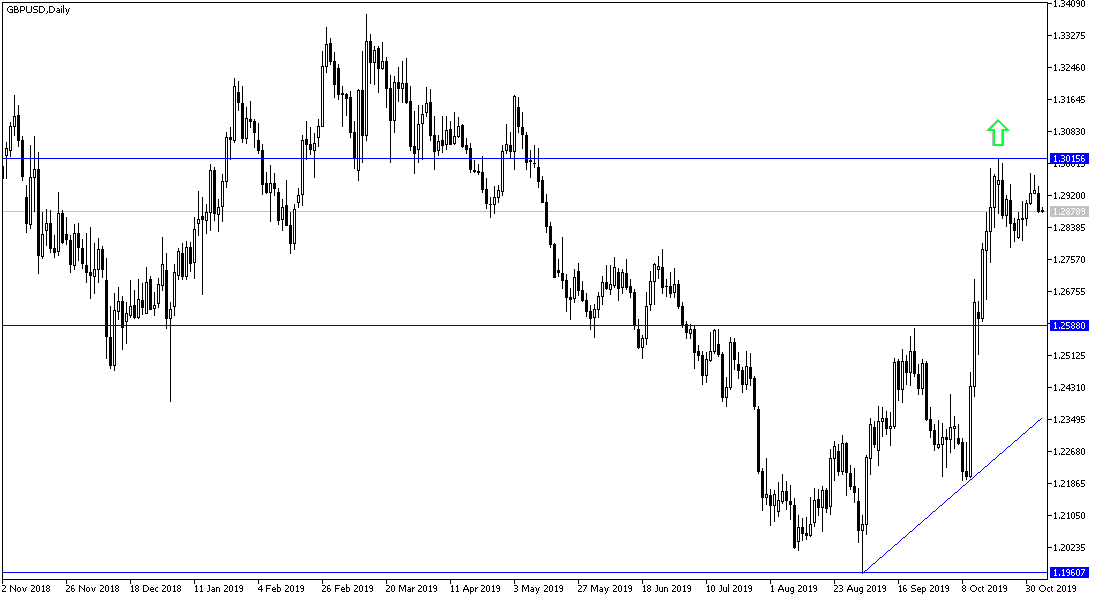

The future of the Pound will depend on the next general election on December 12, as UK citizens will have an opportunity to make a decisive judgment on how Britain will exit from the EU. It is expected that we will see a variation in the Pound performance in the coming period due to the divergence of the opinion polls results. This happened early in the week, as the GBP/USD moved down to the 1.2876 support and failed to hold onto the 1.2942 resistance, which paves the way towards 1.3000 psychological resistance. The Times' latest poll indicated that the Conservatives would emerge as the largest party, as a result of continued progress over Labor. Liberal Democrats are not far from Labor in third place, and the Brexit party seems likely to be able to vote in double digits.

The latest YouGov poll for The Times confirms growing support for Conservative Party, led by Boris Johnson, (37%), Labor (22%), Liberal Democrats (19%), Brexit (11%) and Green (7%). YouGov is likely to be the most closely watched by the markets because its 2017 polls were the most accurate. The markets believe that a majority of Conservatives will support the British Pound, because it will support that the ratification of the Brexit deal, and any future trade agreement between the two sides, and will also pass easier through the House of Commons.

In general, if there is a pending parliament, the uncertainty is likely to continue. The result could lead to further delays in the date of Brexit, ratification of Johnson's EU withdrawal agreement, or even a new Brexit referendum.

According to the technical analysis of the pair: With the GBP/USD correction success in testing support levels that we expected in yesterday's analysis, any attempt by the pair to move towards the 1.2800 support level will negatively affect the bullish outlook, and the pair will begin to reverse the trend, which still has a chance to rise. The 1.3000 psychological resistance will be the culmination of the strength of this trend. Developments of Brexit continue to be the most influential factor affecting the pair's direction, and we may witness a strong and unexpected fluctuation at any time with the results of the upcoming polls until the Dec. 12 elections.

As for the economic calendar data: the British Services PMI will be released. From the US, trade balance, ISM non-manufacturing PMI and number of jobs available will be released.