A limited range move has been the hallmark of the GBP/USD pair since the beginning of this week between 1.2835 support and 1.2910 resistance, and the pair is stable around 1.2850 at the time of writing. As mentioned in the latest technical analysis of this pair, we now stress that the future of Brexit, which hangs on the upcoming elections in Britain on Dec. 12, will continue to be the most influential factor on the direction of this pair, and will determine its future. After each party announced its agenda to run the country, the Conservatives lost some progress, according to the latest polls. Kantar's poll showed that support for the ruling Conservative Party dropped by 2 percentage points this week and that the radical opposition Labor Party got five percentage points. The ballot took place between November 21 and 25, meaning that participants had more time to assess the opposition statement released on November 22 than the Conservatives announced on Sunday.

The Pound enjoyed a strong rally for most of November, with opinion polls showing Conservatives leading the Labor Party in the main battlefields, although the voting gap between the two has not been closed. However, Japan's MUFG, the world's fifth-largest bank, recommended earlier this month that clients sell the pair around 1.2826 and look for a drop to 1.26 before the election. Capital Economics said on Friday that Labor's election victory would send the pound to 1.20 against the US dollar, a level not seen since the early days of Prime Minister Johnson's leadership when fears of a "disagreement" over Britain's exit from the European Union were at their peak.

At the American level. US consumer confidence fell for the fourth consecutive month, but slightly. US new home sales fell slightly in October compared to September, but remained well above last year's levels, as mortgage rates fell, helping to boost buying. Powell, governor of the US central bank, said that even with the unemployment rate nearing a 50-year low of 3.6%, there is still "much room" for higher wages and more jobs. He noted that annual inflation remains below the Fed's target of 2%.

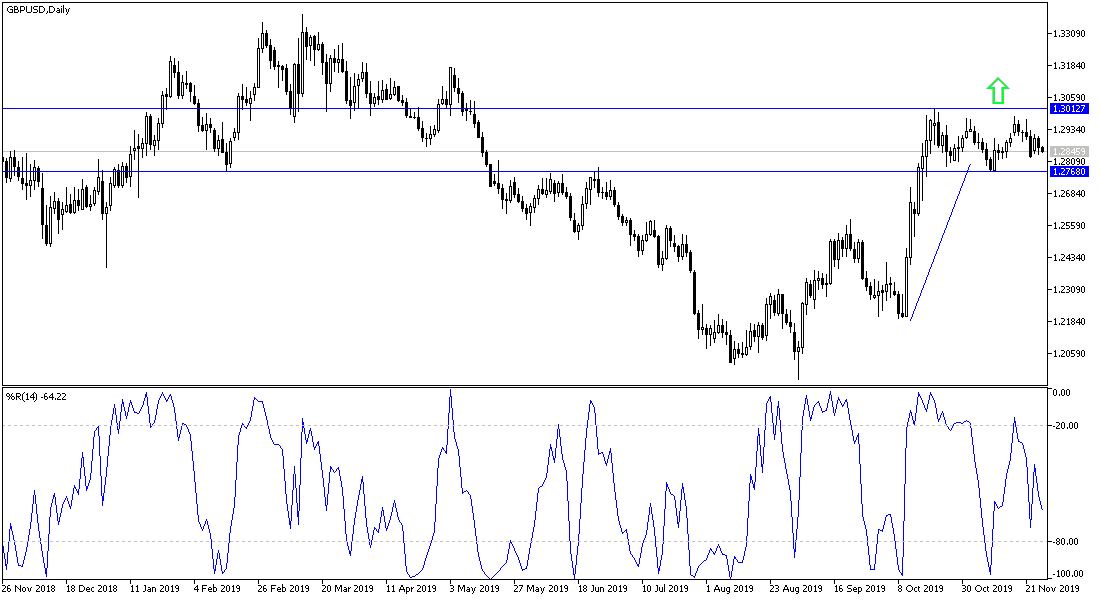

According to the technical analysis of the pair: On the daily chart, the GBP/USD still has the opportunity for an upward correction as long as the Conservatives are ahead and closest to win in the next elections. Technically, the 1.3000 psychological resistance is still a confirmation of the strength of this trend, and stability above that level will support the test of stronger resistance levels. In case of a downward correction, a fall below 1.2800 support would further strengthen the bearish momentum and increase selling to move towards lower buying levels ahead of the elections on Dec. 12. We still prefer to buy the pair from every bearish level.

As for the economic calendar data today: All focus will be on the US session data, where durable goods orders, GDP growth rate, jobless claims, Chicago PMI, and the Federal Reserve's preferred inflation gauge, the CPI will be announced. Then we will have the US Citizen income and spending data. Finally, pending home sales and US oil inventories will be announced.