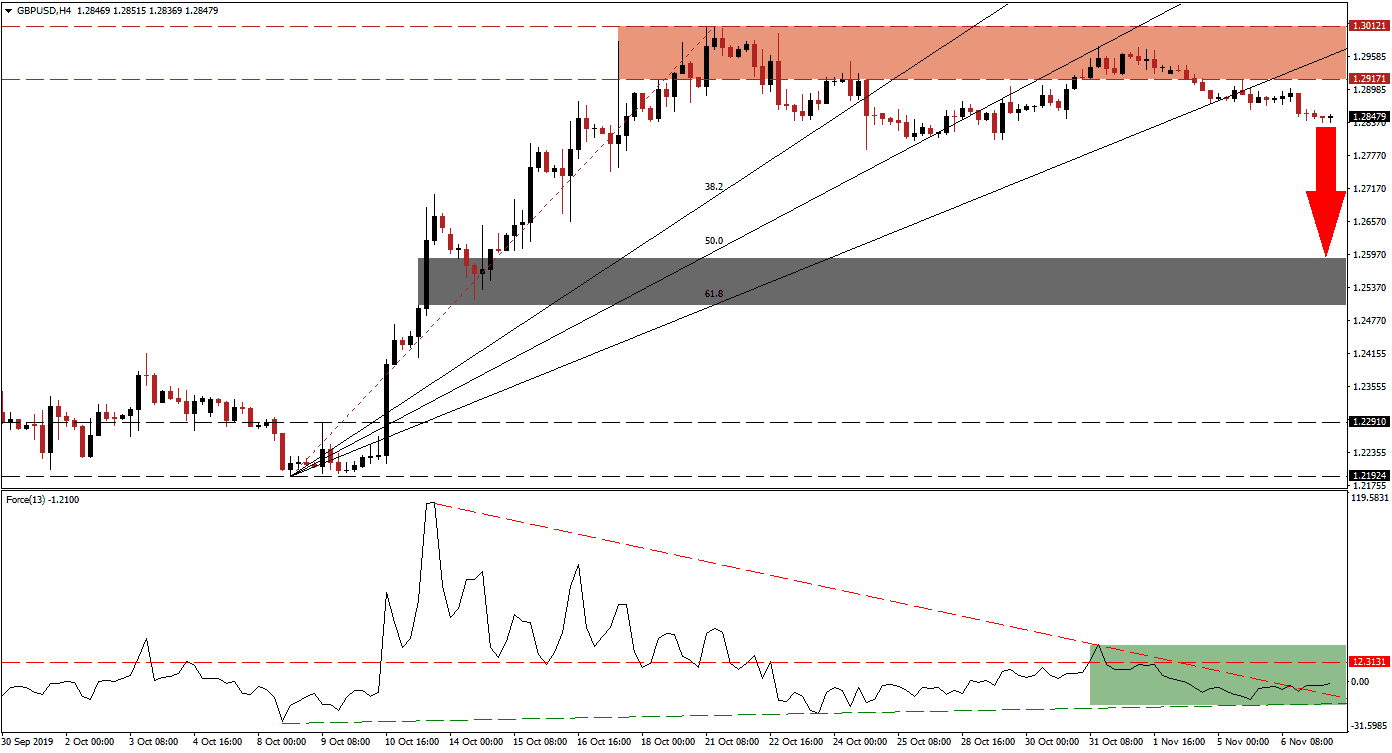

With five week’s left until the UK election, which will take place on December 12th 2019, the British Pound is under selling pressure as concerns grow that even an election will not resolve the Brexit impasse it was mean to eradicate. After the GBP/USD touched the 1.30000 level, the upside was exhausted and this currency pair completed its first breakdown. This was briefly reversed by its 50.0 Fibonacci Retracement Fan Support Level, but led to a lower high and an extension of the breakdown which has now take price action below its 61.8 Fibonacci Retracement Fan Support Level and turned the entire Fibonacci Retracement Fan in to a fading resistance level.

The Force Index, a next generation technical indicator, formed a negative divergence as this currency pair first entered its resistance zone; this marked the first major red flag that the uptrend is vulnerable to a corrective phase. As the GBP/USD completed its initial breakdown below its resistance zone, the Forced Index moved below its horizontal support level and turned it into resistance. A brief spike was reversed by its descending resistance level, but this technical indicator was able to drift above it in negative conditions as marked by the green rectangle. A double breakdown could follow and initiate the next wave of sell orders in this currency pair. You can learn more about the Force Index here.

Following the lower high which led to a breakdown in the GBP/USD below its resistance zone, located between 1.29171 and 1.30121 as marked by the red rectangle, bearish momentum has accelerated. Given the preceding strong advance in this currency pair, there is no support level until price action can reach its next short-term support zone. Economic news have been mixed, but merger activity in the UK remains strong despite the ongoing Brexit delay. The British Pound is expected to see a rise in volatility as the election date nears while the US continues to print mixed economic data; the long-term fundamental picture favors an increase in price action, but the current profit-taking sell-off is expected to extend farther to the downside.

Forex traders should now monitor the intra-day low of 1.27882 which marks the low of the first breakdown in this currency pair below its resistance zone; a move below this level is expected to increase selling pressure in the GBP/USD. The next short-term support zone awaits price action between 1.25044 and 1.25897 as marked by the grey rectangle and the long-term uptrend would remain intact, if support holds. While this zone is likely to pause the correction, fundamental factors will determine if another breakdown will follow or if the GBP/USD can reverse to the upside. The next long-term support zone is located between 1.21924 and 1.22910. You can learn more about a support zone here.

GBP/USD Technical Trading Set-Up - Breakdown Extension Scenario

⦁ Short Entry @ 1.28500

⦁ Take Profit @ 1.25900

⦁ Stop Loss @ 1.29200

⦁ Downside Potential: 260 pips

⦁ Upside Risk: 70 pips

⦁ Risk/Reward Ratio: 3.71

Should the ascending support level in the Force Index lead to a breakout above its horizontal resistance level, the GBP/USD may attempt to push through its 38.2 Fibonacci Retracement Fan Resistance Level and attempt a breakout above its resistance zone. A sustained advance without a fresh fundamental catalysts, more precisely in regards to Brexit, remains unlikely. The next resistance zone is located between 1.31306 and 1.31758.

GBP/USD Technical Trading Set-Up - Breakout Scenario

⦁ Long Entry @ 1.30450

⦁ Take Profit @ 1.31700

⦁ Stop Loss @ 1.29850

⦁ Upside Potential: 125 pips

⦁ Downside Risk: 60 pips

⦁ Risk/Reward Ratio: 2.08