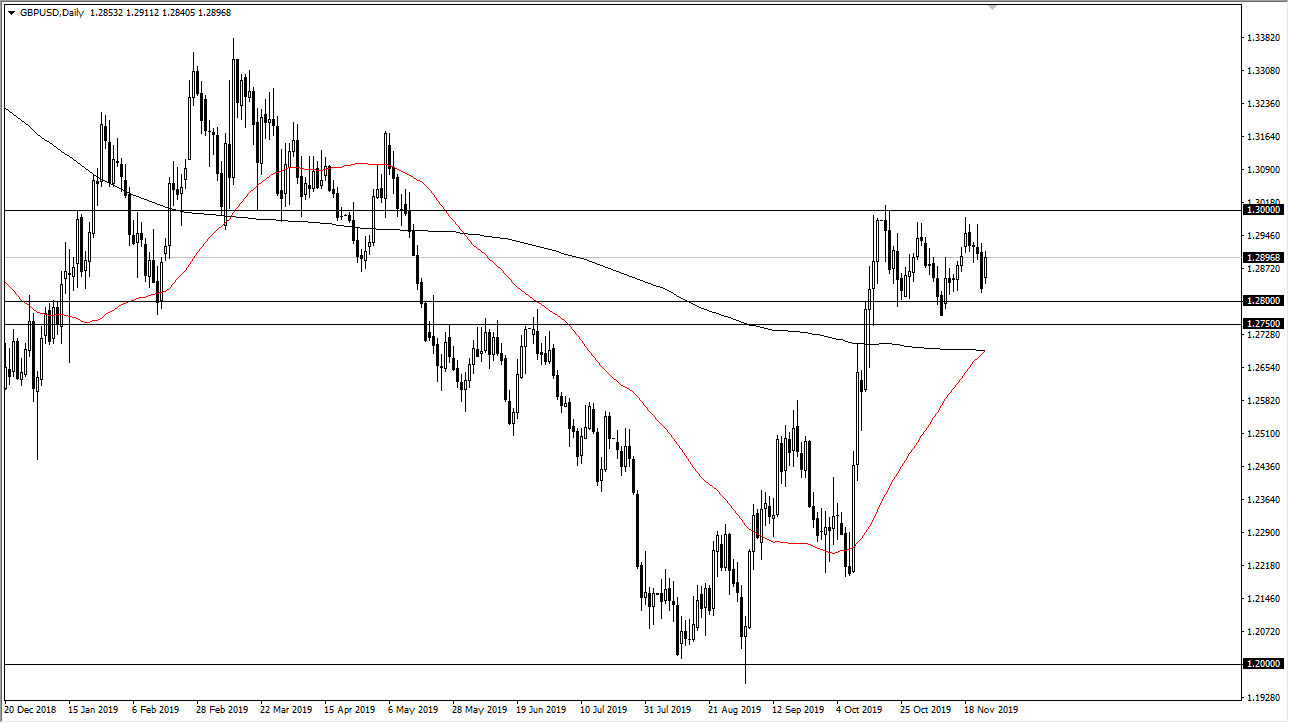

The British pound gapped higher to reach above and show signs of bullish pressure yet again. At this point, it’s probably a reaction to polls suggesting that the conservatives are going to take control over the UK Parliament, which paves the way for Boris Johnson to get his way as far as leaving the European Union is concerned. That would be a huge relief for the market, simply because it gives us a bit of stability in the idea what’s going to happen next, something that we have not seen for quite some time. Currently, it looks as if the market is going to continue to go back and forth between the 1.30 level above, and the 1.2750 below. At this point, it looks as if we are continuing to form a bit of a bullish flag which of course is a very good sign.

The 50 day EMA has been reaching towards the 200 day EMA, looking likely to break above there and form a bit of a “golden cross”, which of course is a very bullish sign. All things being equal I do think that the British pound continues you will higher and if we can get above the 1.30 level, the market will then reach towards the 1.33 level above. That is a significant move, but based upon the pole on the bullish flag, we could go as high as the 1.38 level above.

The market will also just pay attention to the 200 day EMA as per usual, so unless of course we get some type of ugly surprise coming out of the United Kingdom, it’s likely that we will continue the upward trend. Even if we were to break down, the market is likely to go down to the 1.25 level which is a large, round, psychologically significant figure. At this point, the market looks very bullish, but has a lot of noise to get through. Historically speaking though, the British pound is cheap, so therefore it would make quite a bit of sense that the market should go higher.

With that, I look at short-term pullbacks as buying opportunities, but recognize that it is going to take some type of headline or some type of significant shift to send this market much higher, as we will have a massive breakout that everybody is paying attention to. At this point, we are probably a bit of a holding pattern until the election.