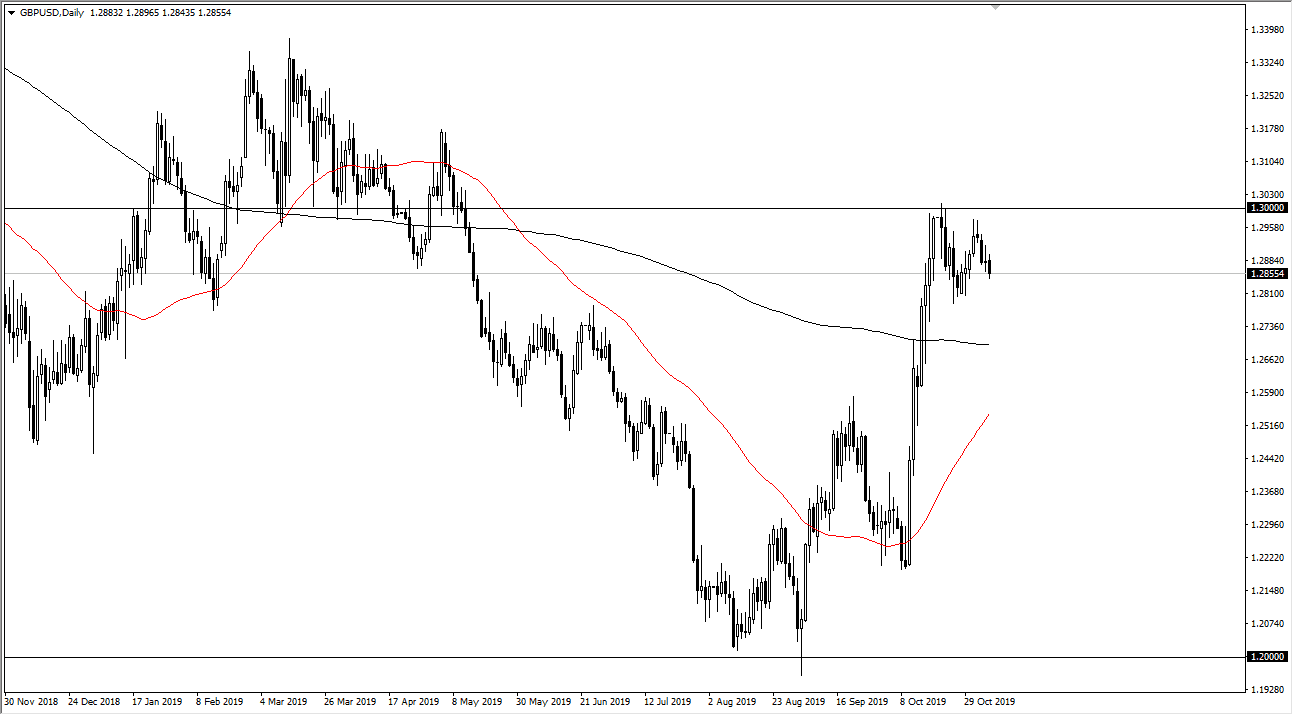

The British pound has fallen a bit during the trading session on Wednesday as we continue to see significant noise in the Forex markets. Having said that, it has held up rather well against the greenback, while the rest of the market has struggled. Because of this, I believe it’s only a matter of time before we see some type of movement that can make this market start going in more of a sustainable direction. It looks as if we are forming a bit of a bullish flag and that is most certainly something worth paying attention to.

If we were to break above the 1.30 level, then it’s likely that the market will continue to find buyers sending this market towards the 1.38 handle, possibly even higher than that between here and there I see a lot of resistance at the 1.33 handle, but quite frankly the volatility has been short-term more than longer term. I feel that the British pound is probably simply waiting for some headline that shows any type of longevity. Quite frankly, the bickering between the political parties in the United Kingdom alone cause major issues, not to mention the noise coming out of the European Union. At this point, the market continues to see a lot of headwinds in both directions, and I just don’t see that changing anytime soon. The 200 day EMA should offer plenty of support, and therefore I don’t think that we break down though. However, if we were to break down through their it’s very likely that the market will find support at the 1.25 level as well, so quite frankly think it’s only a matter of time before the buyers return.

The greenback has been strengthening for some time, but it doesn’t seem to be able to do it against the British pound and that of course is crucial to pay attention to. Ultimately though, this is a market that I think will offer a nice “buy-and-hold scenario given enough time, allowing longer-term traders to take advantage of it a historically cheap British pound. Overall, this is a market that I think will continue to find plenty of reasons to go higher, as soon as the politicians can start acting like adults. In the meantime, expect plenty of rumors and headlines the throw the spear around, but notice that every time we have pulled back there have been buyers.