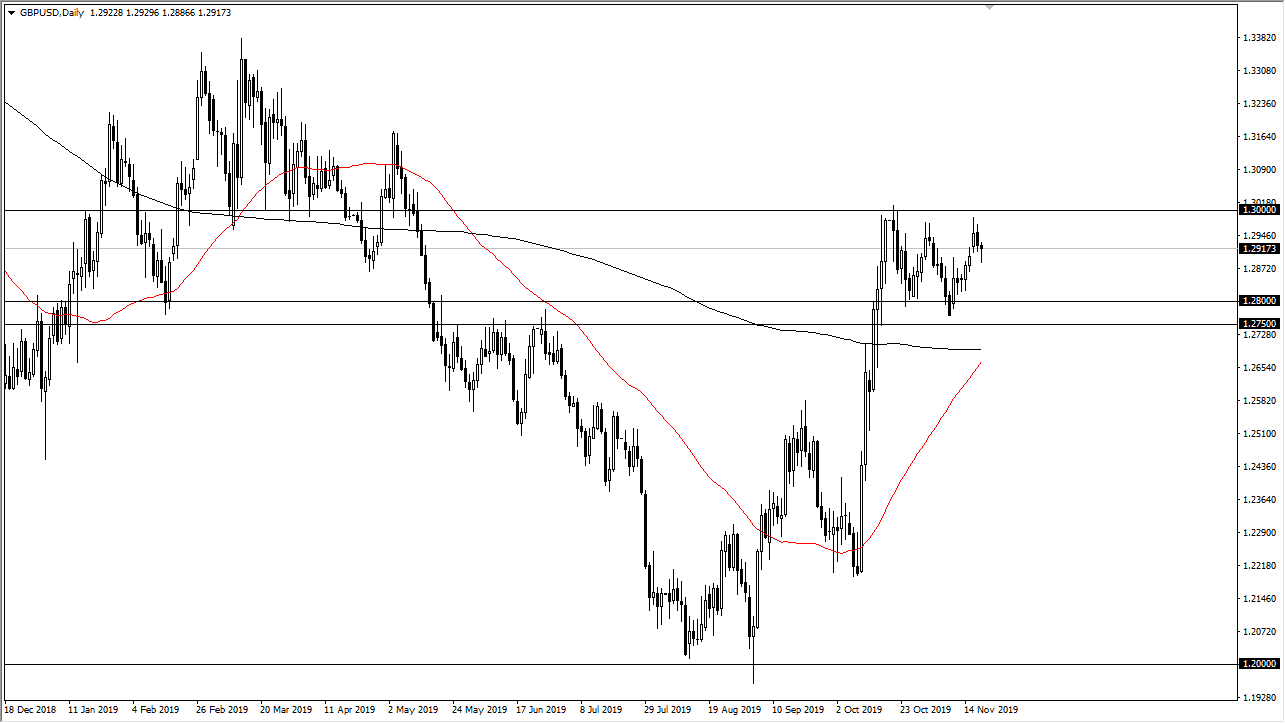

The British pound initially fell during the trading session on Wednesday, filling the gap from the beginning of the week, and we have then turned around to form a bit of a hammer. At this point it looks as if the market is trying to figure out where to go, but most certainly it’s to the upside longer term. We are forming a bullish flag and the 1.30 level above continues to be an area that traders will take a look at in this environment. At this point, it looks as if the 1.2750 level underneath continues to be massive support, while the 200 day EMA just below there will only reinforce that. Going further, the 50 day EMA is starting to reach towards the 200 day EMA, and if it can break above there then we have the so-called “golden cross” that so many longer-term traders pay a lot of attention to.

Regardless, we have been forming a bullish flag that I believe is the market trying to build up enough momentum to finally break out to the upside. Ultimately, if we can break above the 1.30 level on the daily chart, then the market is free to go looking towards the 1.33 level which is the next major resistance barrier. If we can break above there, then the market is free to live up to the measured move from the bullish flag, that opens up the door to the 1.38 handle after that. Don’t get me wrong, not think it happens in the short term, but longer-term that is a very reasonable target, especially when looking at the British pound through the prism of historical norms.

Looking at this chart, if we were to break down below the 200 day EMA I suspect that the next major support level will be done at the more .25 level as it is a large, round, psychologically significant figure. Beyond that, is also an area that has caused a lot of resistance I think at this point it’s difficult to imagine this market breaking down through there. I like buying dips, and I continue to look at this market is one that you should find value in. Overall, this is a market that I have no interest in shorting, because quite frankly the British pound has been priced in for Armageddon to come to London.