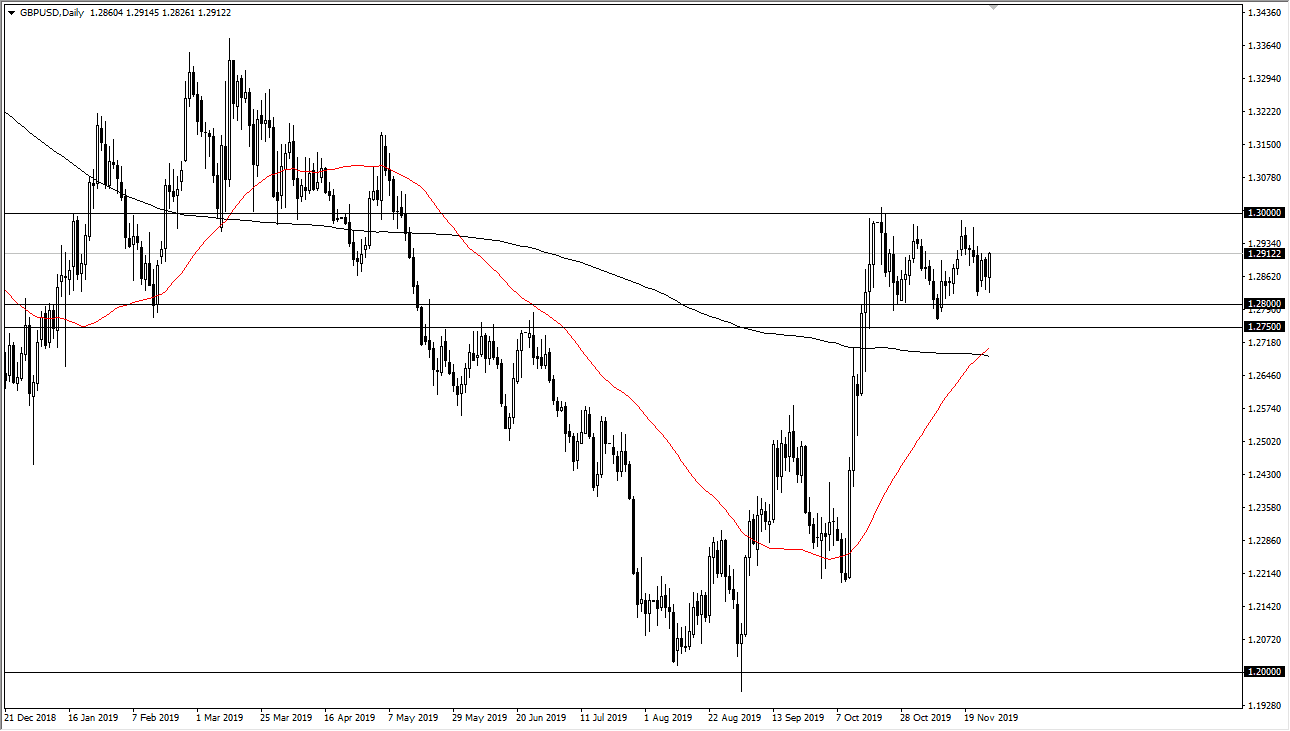

The British pound initially fell during the trading session on Wednesday but found enough support just above the vital 1.28 level to turn around and rally yet again. We continue to see this market go back and forth and try to form some type of flag, and that of course continues to be very bullish. Beyond that, we have also seen the 50 day EMA cross above the 200 day EMA, and as a result it’s very likely that longer-term traders are getting ready to “buy-and-hold.”

Looking at the structure of the market, we have been forming a bullish flag for some time, and now looking at this chart you can see that the surge higher has given way to sideways grinding. At this point, the market looks very likely to see a lot of volatility, as we approach the UK elections. At this point in time though, it’s very likely that we will eventually break out to the upside and perhaps show signs of strength.

Even if we were to break down below the bottom of the flag, the 200 day EMA should show support, and then of course the 1.25 level underneath is another area where you can see buyers. All things being equal, this is a market that should continue to see a lot of buyers underneath based upon the fact that it is so historically cheap. If the election’s go the way of the Tories, this could throw this market even higher as it gives a bit of stability to Boris Johnson and his plan believe the European Union. At this point, it does in fact seem as if that’s what’s going to happen in this should continue to put a little bit of a lift into this pair.

All things being equal, even if we see pullbacks, they should end up being buying opportunities. Think of it as value, and therefore look for value to start buying again. At this point, the market is very likely to offer plenty of opportunities, and therefore it’s likely that the market will continue to offer trades occasionally. I have no interest in shorting this market, as we have seen a significant amount of buying pressure, and of course we are at historically cheap levels. Ultimately, I think we break above the 1.30 level, and then reach towards the 1.33 level after that. Based upon the bullish flag, we could go as high as 1.38 given enough time.