The British pound has gone back and forth during the trading session on Tuesday as we continue to see a lot of noise in general. With Brexit headlines coming rather slowly lately, the British pound has calmed down. It should be noted that the US dollar was stronger during the day as the ISM Non-Manufacturing PMI figures came out stronger than anticipated and drove the value of the US dollar higher in general. At this point, the market continues to look very likely to react to that, but the US dollar has seen a lot of strength against currencies around the world, and the fact that the British pound has been relatively unchanged shows just how much strength there is in this market. When compared to the Euro or the Japanese yen for example, the market has held up quite remarkably.

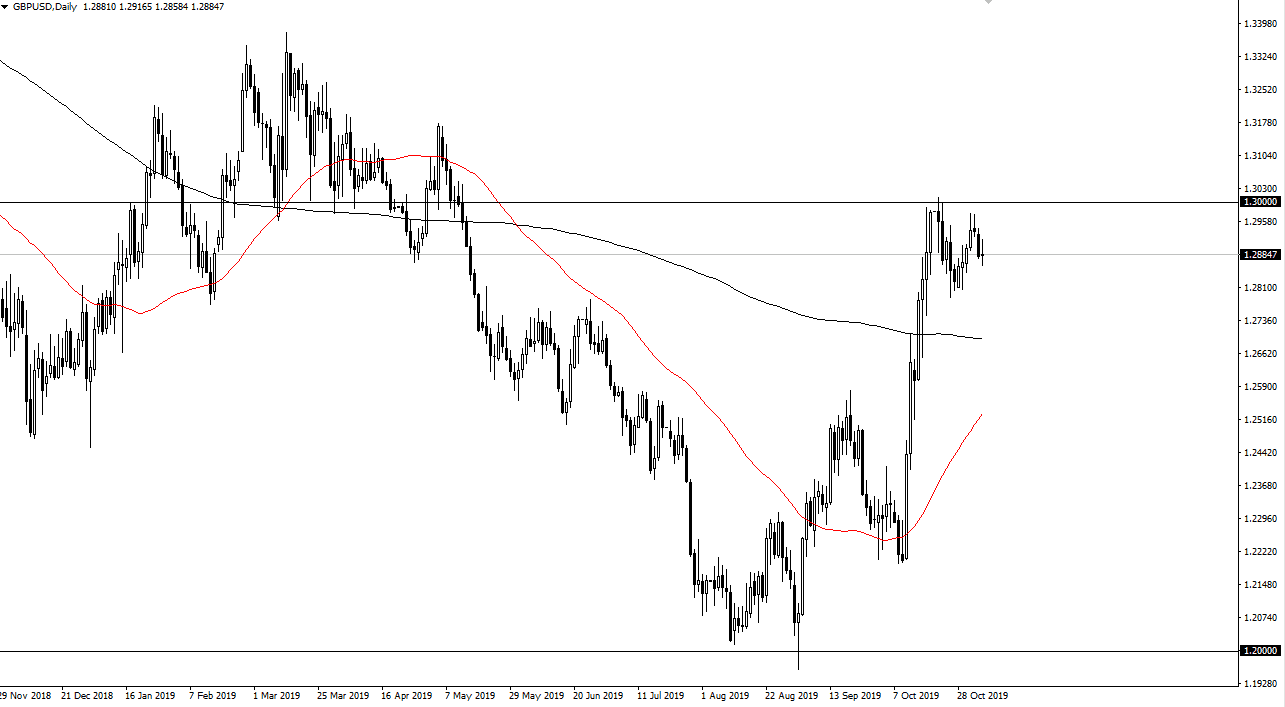

The 1.30 level above is significant resistance, but if the market can break above there is likely to go looking towards the 1.33 handle. It may take some time to get there, as there is a lot of structural noise in that general vicinity but at this point, I think it’s the most likely of scenarios. The question now is whether or not the British pound either breaks out, or if it finds support underneath on a pullback. I don’t have any interest in shorting this pair, because quite frankly the British pound has recovered quite nicely since the Brexit has calmed down, and as a result I do think that the British pound may be looked at as historically cheap. To the downside, I see plenty of support to be found at the 200 day EMA near the 1.2750 level, and then the 1.25 level which is structurally important and now has the 50 day EMA sitting at it.

I like buying dips, and I like buying breakout above the 1.30 level. I think building a core position is what most traders are trying to do with the British pound, and then eventually could break out for a longer-term “buy-and-hold” scenario. This is a market that should continue to find plenty of reason to go higher based upon the impulsivity, but it’s very likely that dips will occur occasionally. Look at those as opportunity in this market that has clearly changed the overall attitude and trend for the longer-term as we have seen such an explosive move higher.