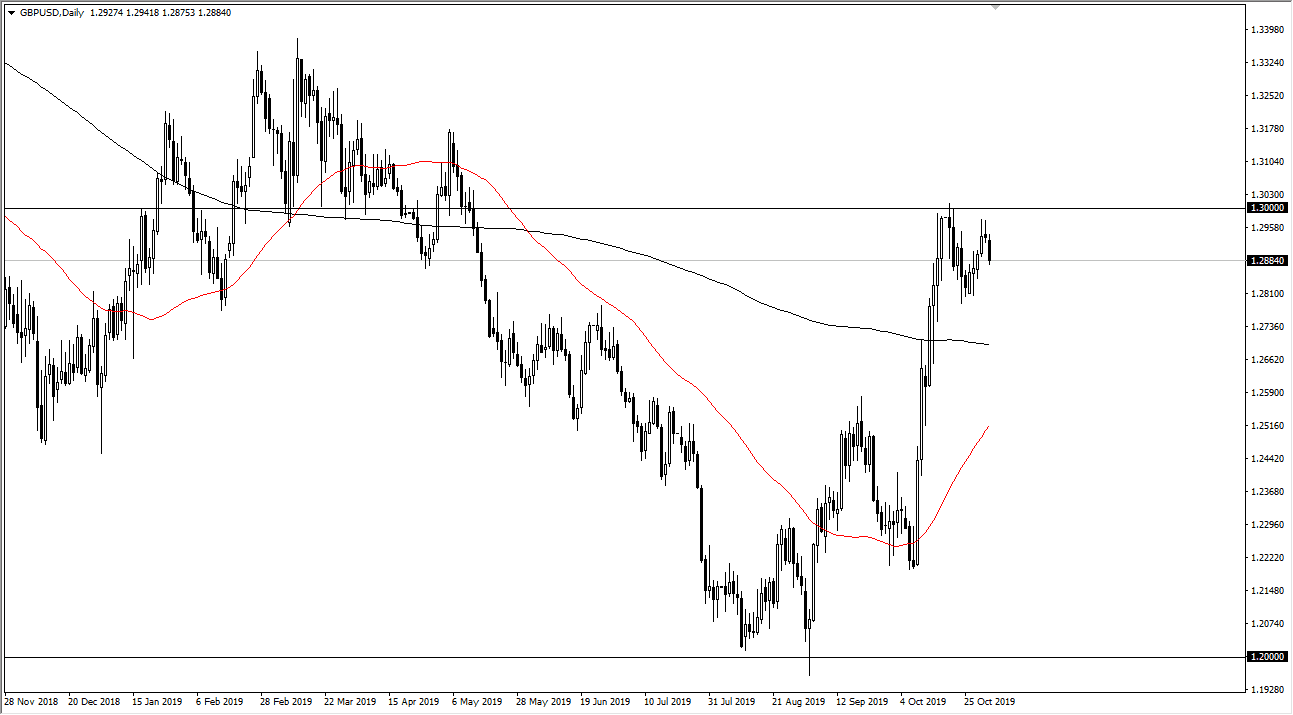

The British pound brought down a bit during the trading session on Monday to kick off the week, as we continue to see a lot of noise. This is an area that should continue to consolidate overall, and it’s very likely that the 1.30 level above should continue to be significant resistance, and if we can break above that level then the British pound is willing and likely to go towards the 1.33 level after that. Ultimately, this is a market that I think will continue to be very noisy and difficult, especially as there are a lot of various headlines out there that can move the British pound due to the Brexit situation.

There should be plenty of buyers getting involved in the market, and I believe that they are looking for value going forward, and therefore I think it’s probably very likely that we will see a “buy on the dips” type of mentality, but the recent surge higher suggests that we are going to continue to go higher. The market could be forming some type of bullish flag that the market is trying to rally from, and at this point could send the market much higher, perhaps even as high as the 1.38 handle.

If we were to break down below the 200 day EMA, then the market could go looking towards the 1.25 level underneath which is a large, round, psychologically significant figure. That being said, I do believe that the buyers will continue to look at this market as one that they can pick up value in. I believe that this point the overall downtrend in the British pound is over, and I believe a lot of people think that as well. Overall, this is a market that should continue to find a lot of choppiness due to all of the headline risks out there, but ultimately this is a market that is historically cheap and therefore as we start to price out the idea of a “no deal Brexit” markets will try to rally from here. If the situation finally clears itself out, the market will shoot straight up in the air. However, if things sour in the United Kingdom, that could send this market much lower. All things being equal though it does look like the UK in the EUR trying to sort things out.