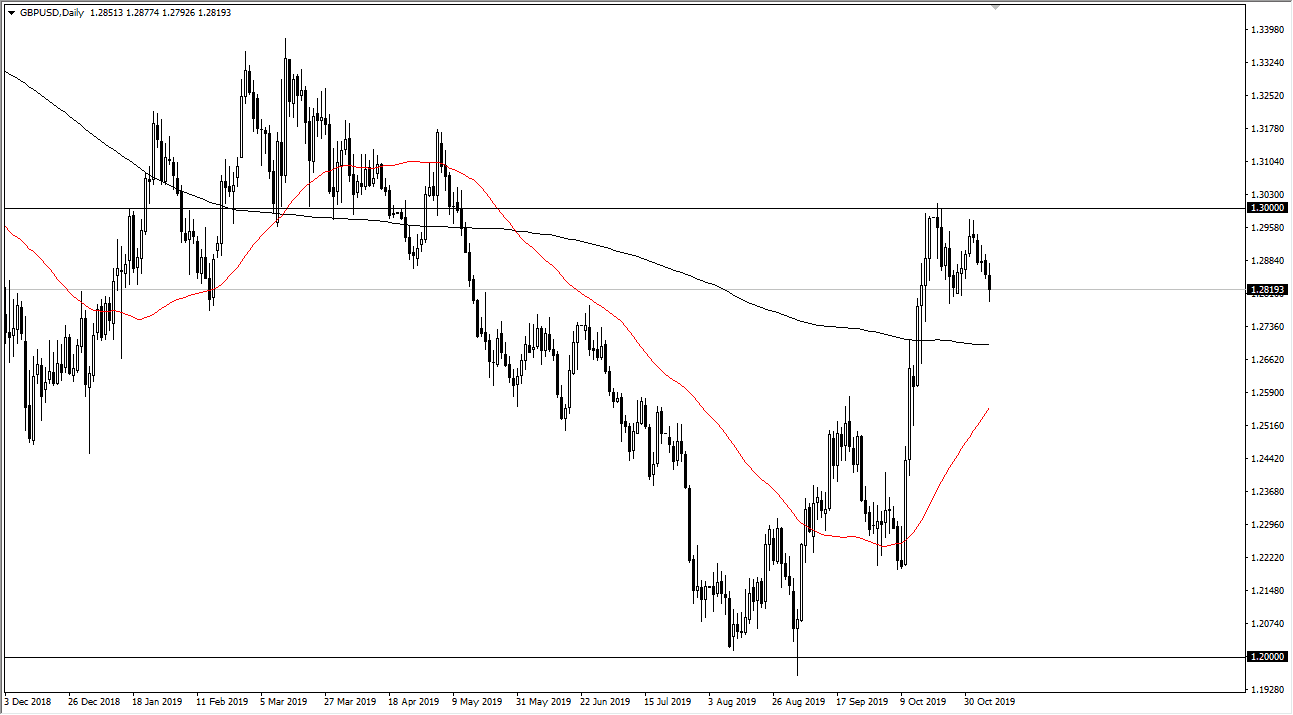

The British pound has fallen a bit during the trading session, after the Monetary Policy Committee surprised traders by having a couple of dissenters suggest that cutting rates would be appropriate. That being said though, the markets recovered after some time as the Brexit situation is going to be much more important than anything else. I believe that the market will find plenty of reasons to go higher, and as the Brexit situation calms down, that brings value hunters into the marketplace in order to take advantage of “cheap British pound.”

At this point, it looks as if the 1.28 level has offered enough support to turn things back around to continue the consolidation that we have been in. This was a nice bullish flag, and now it looks as if it’s only a matter of time before we do break above the top of the flag, at the 1.30 level, then it kicks off the next leg higher. That opens up the possibility of a move to the 1.33 handle, and then eventually the 1.38 level after that. After all, this is a market that will continue to see a lot of buying on rumors, and of course the fact that it is historically cheap.

Ultimately, even if we were going to break down from here it’s likely that the 200 day EMA would come into the picture as support, as it is a longer-term trend following mechanism that a lot of people will pay attention to. If the market were to break down below the 200 day EMA, that could change things but even then, I would expect to see a lot of support at the 1.25 handle. In other words, it’s very much like a scenario where you can buy the dips going forward, as there seems to be a lot of underlying demand. The Federal Reserve is on the sidelines, so central bank interference on that side of the equation would not be a major concern. Ultimately, this is a market that looks as if it’s trying to build up enough momentum to finally break out, and it is currently just killing time to take advantage of the massive surge higher that had sent the market all the way to the 1.30 level. At this point, a recovery for the short term probably makes quite a bit of sense as we have seen buyers from here previously.