The British pound tried to rally during the trading session on Friday but gave back most of the gains as we simply can’t take off yet. This makes sense considering how many different potential headlines could be coming out of the Brexit situation, not the least of which would be an election in the United Kingdom. With this, there’s a lot of confusion but it does seem as if the United Kingdom will find a way to form some type of trade deal with the European Union to exit with as little disruption as possible. The EU and the UK have been a bit more consolatory toward each other as of late, so at this point it looks as if the trading community is at least starting to price out the possibility of a “no deal Brexit.”

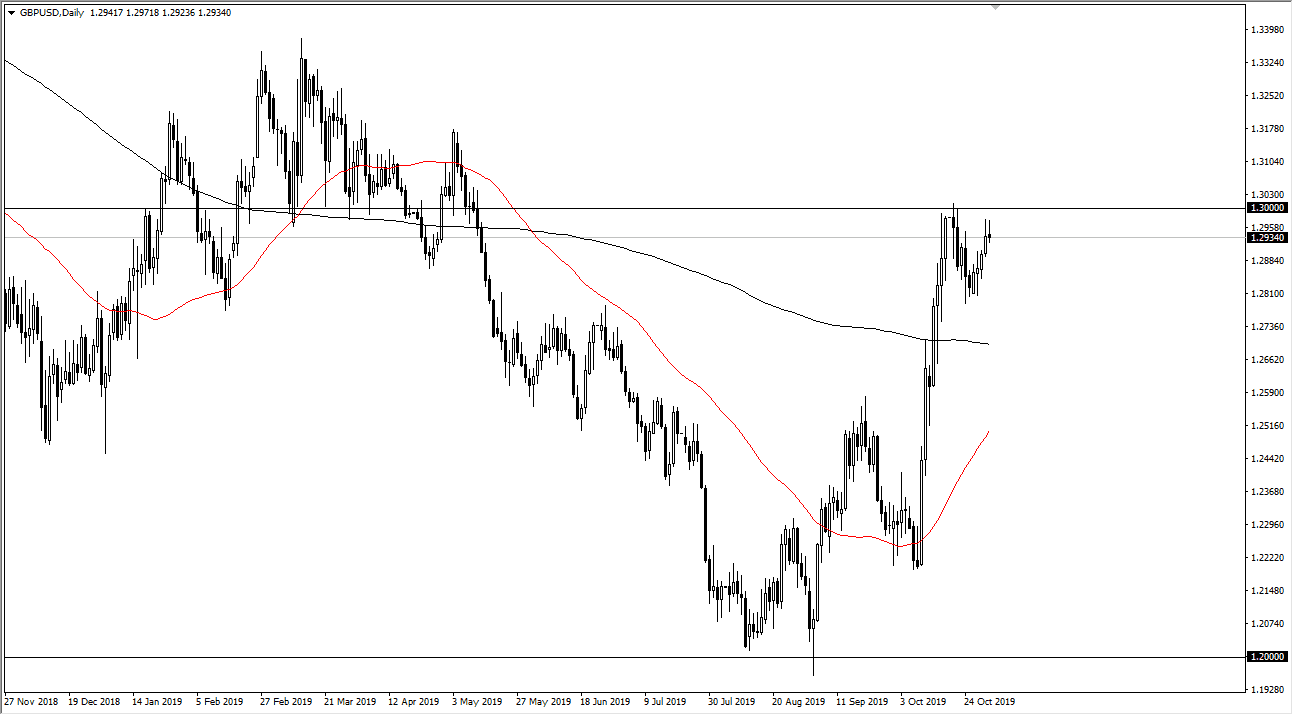

Looking at this chart, it doesn’t take a whole lot of effort to imagine that the 1.30 level would cause a lot of resistance. At this point, the market should continue to recognize as round figure as a major deal, as breaking above there could bring in fresh money to the marketplace. After that, the market very likely would go to the 1.33 level based upon previous consolidation. Don’t get me wrong, there’s a lot of noise between here and there but I also recognize that the multiple short-term levels in that area will make it a very choppy situation.

To the downside, I see the 1.28 level as support, as we have bounced from there recently. At this point in time, there is also a lot of support underneath at the 200 day EMA which is at the 1.27 level. After that, it’s very likely that the market goes down to the 1.25 level which is a large, round, psychologically significant number. That being the case, it makes quite a bit of sense that we would continue to see volatility and support in that area. Ultimately, this is a market that looks as if it is trying to form a bullish flag, and at this point it’s likely that the flag would be ready to kick off to the upside. By measuring the pole of the flag, it suggests that the GBP/USD pair could break as high as 1.38 over the longer term. Ultimately, this is a market that continues to find reason to go higher, and I don’t see that changing anytime soon.