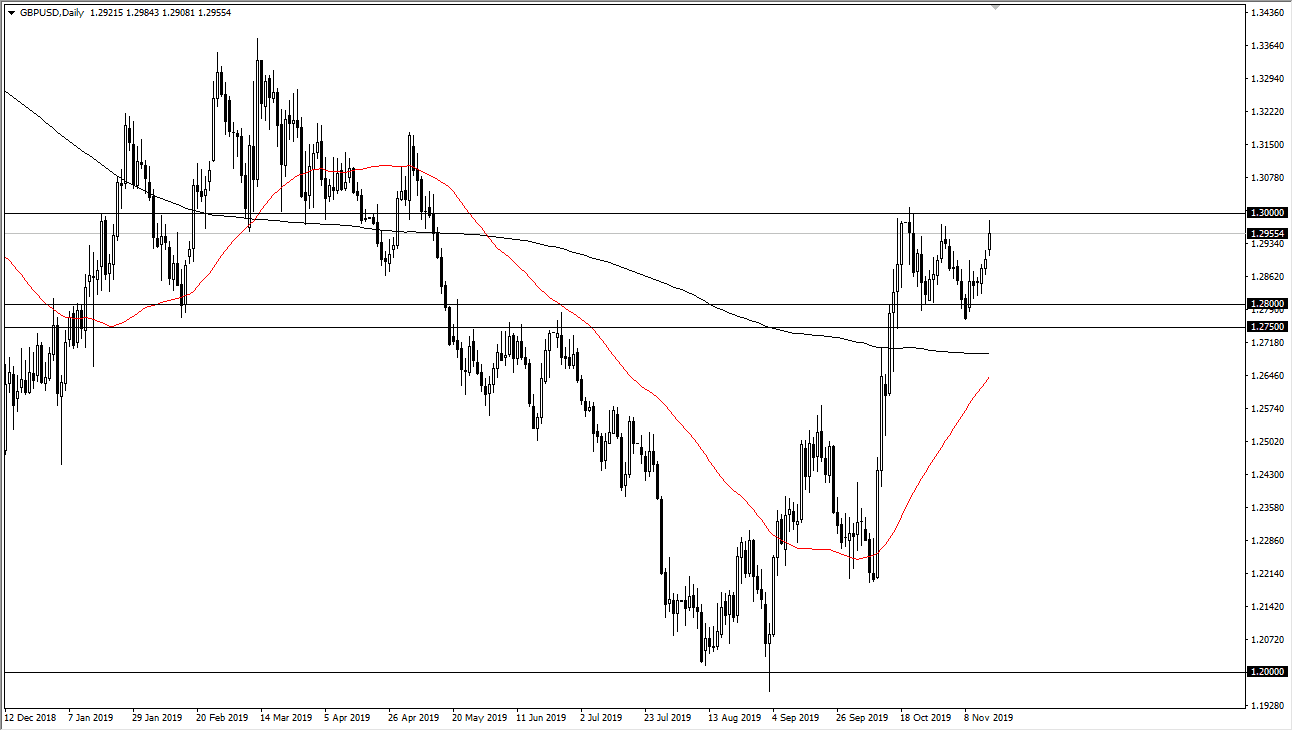

The British pound continues to rally overall, and of course Monday was no different. The market has been all over the place during the trading session, but it appears that it is hell-bent on trying to break above the 1.30 level. If we can break above that level then it’s likely that we will go much higher, perhaps reaching to the 1.33 level initially based upon the recent consolidation to that area, and then possibly as high as the 1.38 level based upon the flag being formed in the market right now. Furthermore, the market participants continue to pay attention to Brexit, which of course continues to favor Boris Johnson and the idea of leaving.

At this point, I don’t think people really care what happens, just as long as something happens. The 50 day EMA is starting to move towards the 200 day EMA currently, and that could send this market higher as it is considered to be the “golden cross” that so many people pay attention to. This is something that longer-term traders look to as a huge buying signal, so it’ll be interesting to see how this plays out.

If we can break above the 1.30 level, I suspect it will be a huge turning point in this market, and essentially the end of selling of the British pound longer term. I think that a longer-term value proposition will be primed to get going, as it will have finally broken through major resistance for yet another attempt to find the usual value that traders look towards. This is a longer-term “buy-and-hold” scenario just waiting to happen, so I do like the idea of buying pullbacks. I also recognize the 200 day EMA is a massive support level, and therefore I’m focusing on the 1.2750 level as essentially the “floor” in this market.

This doesn’t mean that it will be an easy move higher but should be thought of it as investing opportunity in the British pound. I have no interest in shorting, I believe those days are behind us. We may get a sudden knee-jerk reaction to the downside based upon a headline, but that is something that I would be looking at as potential value and would treat it as such. I believe the British pound has bottomed and will probably be 20 handles higher in the next two years as it is so historically cheap right now.