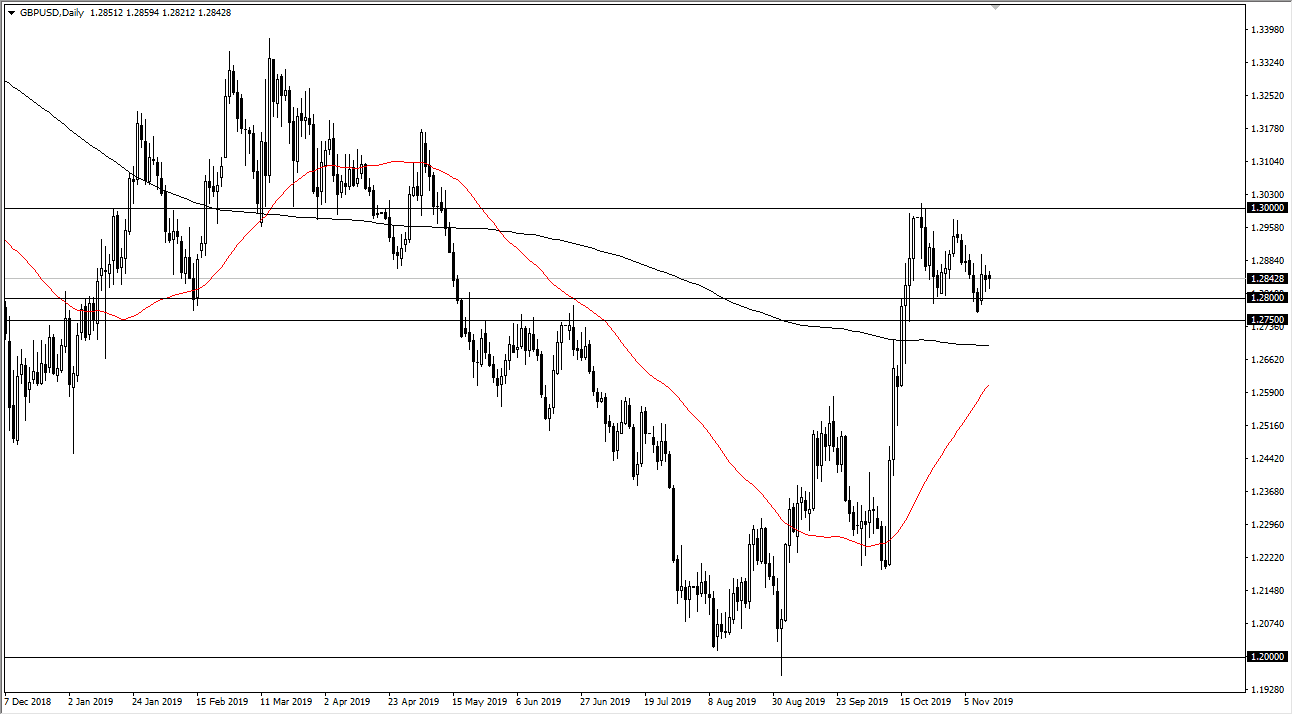

The British pound has initially pulled back during the trading session on Wednesday but turned around to form a bit of a support of candle. By doing so it looks as if the market is ready to rally again, and it should be noted that we are trying everything we can to form a bullish flag. With that being the case, it’s very likely that the market should continue to grind to the upside, perhaps reaching towards the 1.30 level. That is an area that is going to be difficult to overcome though, because quite frankly it’s a large, round, psychologically significant figure and of course an area where we had seen support previously.

If we were to break above the 1.30 level it opens up the door to the 1.33 handle given enough time, and then eventually the 1.38 level after that based upon the bullish flag measurement. The 200 day EMA sits just below the flat, and of course the 50 day EMA is racing towards the 200 day EMA. With that being the case, I think it’s only a matter of time before we find some type of buying pressure into the marketplace, which of course would be exacerbated by any type of good news coming out of the negotiations between various factions of the UK government.

Overall, this is a market that is starting to get a bit more optimistic in general, as we have seen the EU be a bit more conciliatory as of late, and of course Nigel Farage stating that the Brexit Party wasn’t going to contest conservative seats in the election gives Boris Johnson the likely outcome that he needs in order to push forward with the Brexit deal. While Mr. Farage isn’t necessarily a huge fan, the alternative might be a new referendum, something that he wishes to avoid. Quite frankly, at this point the market is it really concerned as to what the British do, but more interested in that they do something. Some type of decision and certainly needs to be had in this market in order for the British pound to continue going higher. That being said, it doesn’t necessarily mean that is going to be easy to go higher, but as we are at historic lows, it makes sense that we do get a bit of a bounce given enough time. Clearly, the momentum is to the upside more than anything else.