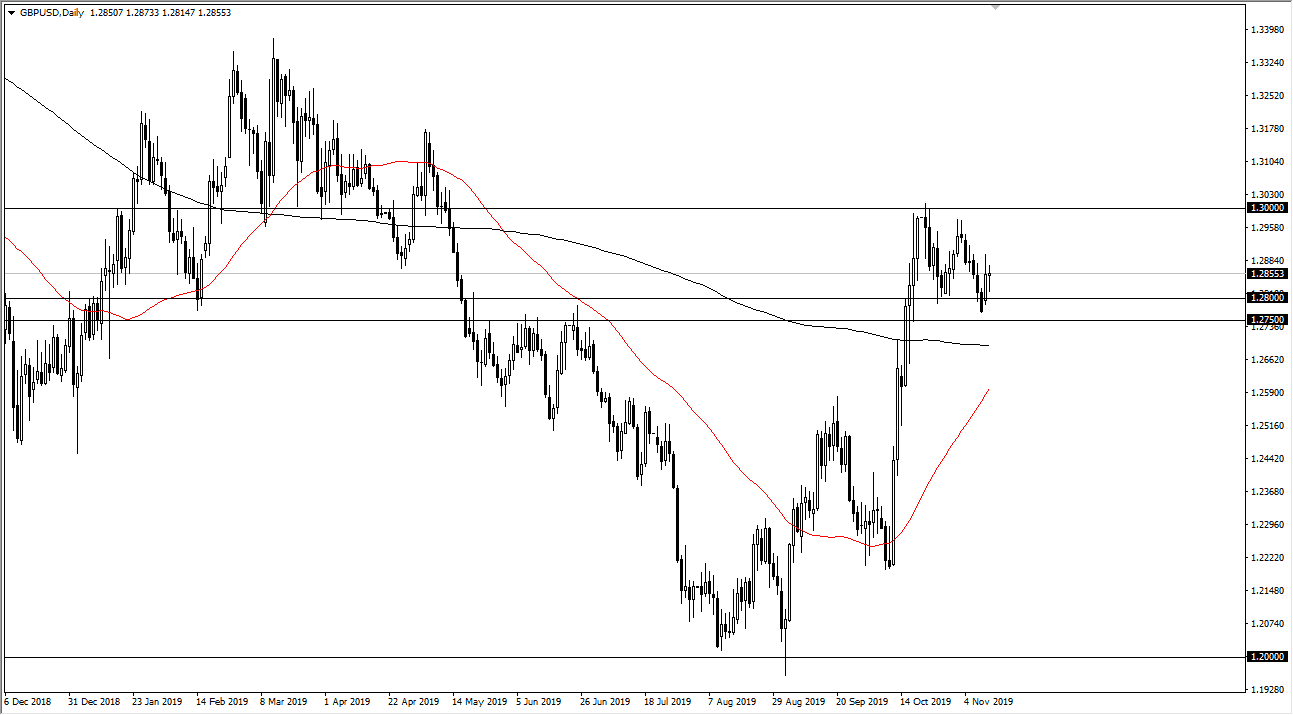

The British pound broke down a bit during the trading session on Tuesday, showing signs of exhaustion and reaching towards the 1.28 level underneath. That is an area that has been supportive, and at this point the market has turned around to form a bit of a hammer. That’s a very bullish sign and it looks very likely that the market will continue to find buyers on these dips. Ultimately, this is a marketplace that continues to see a lot of value hunting, as the Brexit situation calms down a bit. We are getting close to elections in the United Kingdom but with Nigel Farage stepping on the sidelines and refusing to go head-to-head with the Tories, this could give this market an opportunity to go higher.

At this point, the 200 day EMA underneath should continue to offer support, as there are plenty of buyers stepping into this market every time it seems to fall. With the idea of the Brexit being solved sooner rather than later due to the fact that Labour isn’t likely to take control of Parliament, this gives more credence to the idea that we will eventually get some type of settlement. The pair is starting to form a bit of a bullish flag, and that bullish flag could open up the idea of a move much higher.

Looking at this chart, it’s very likely that we will in fact trying to find buyers on dips going forward as well, and eventually could take out the 1.30 level above. If we do it’s likely that the market goes looking towards the 1.33 handle, followed by the 1.38 level above. The 1.38 level is a result of the pole on the flag, and therefore should be the long-term target. I like the idea looking for value and it certainly shows up from time to time. Overall, the British pound has escaped quite a bit of trouble and it looks like they will continue to favor the British pound in general, as it is historically cheap at this point. With that being the case, look for value on dips and trade accordingly. I would expect a lot of back and forth though, so it’s not until we break above the 1.30 level that you can make an argument for a bigger move. The 50 day EMA is getting ready to cross the 200 day EMA, which is the so-called “golden cross” that signifies buyers are coming in for the longer-term.