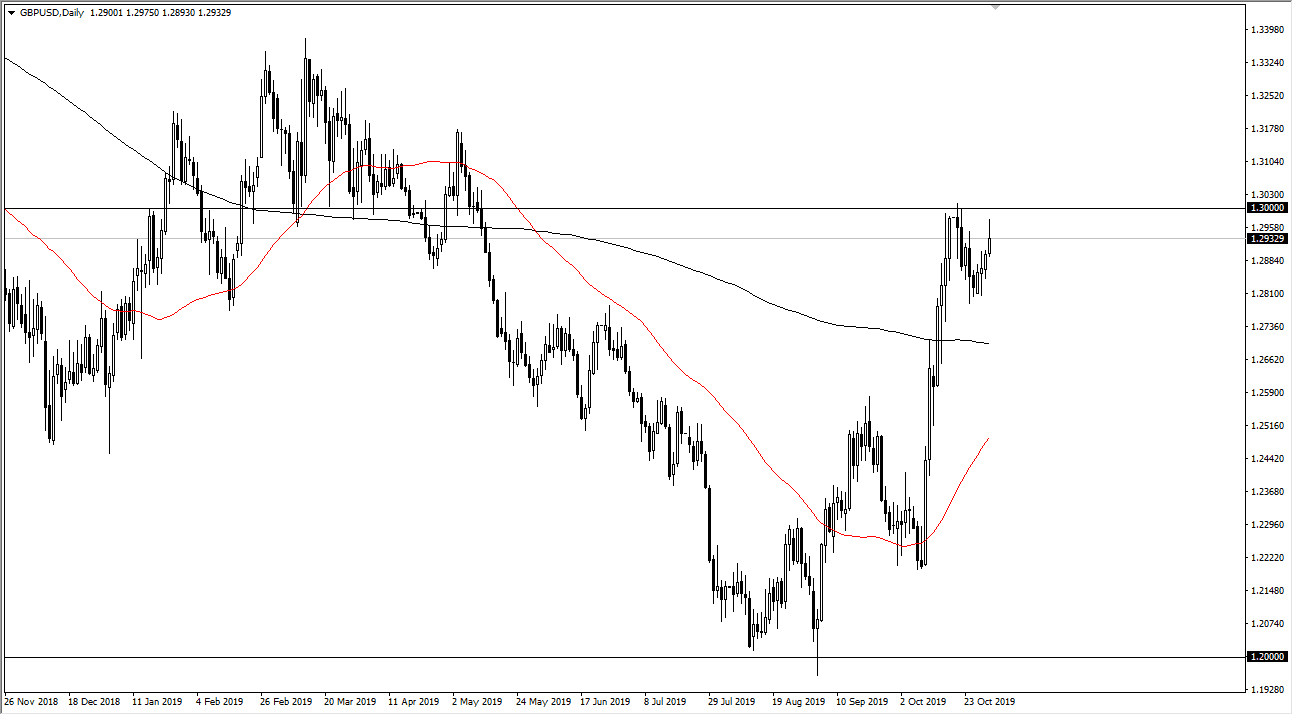

The British pound has rallied a bit during the trading session on Thursday, as we continue to reach towards the vital 1.30 level. That is an area that is of course a large, round, psychologically significant figure that will continue to attract a lot of attention. Beyond that, it has structurally been important in the past as well, so it’s no big surprise that we can’t break above there right away. Beyond that, the market had been parabolic leading to the move in this general vicinity cell at this point is probably best to see the market as one you should be looking for evaluation.

Short-term pullback should continue to be buying opportunities, especially of the 1.28 level, the 200 day EMA which is essentially the 1.27 level, and then the structurally important 1.25 level underneath there. The alternate scenario is that we finally break above the 1.30 level kicking off the next move higher. The first target would be the 1.33 level based upon that previous resistance, but when you look at the pole of the bullish flag, it measures for a potential move to the 1.38 level, meaning that we could have further to go. This doesn’t mean we get there overnight though, but keep in mind that it is a market that has seen a serious shift in attitude, and that is something that must be paid attention to.

Looking at the chart, I think these several support levels underneath give us plenty of opportunities to go along, and quite frankly I’m interested in seeing this market pullback or at the very least grind sideways in order to kill off time and digest the massive gains. That being said, the market breaking above the 1.30 level should open up the door to a significant move. I have noticed in shorting this pair but recognize that headlines dealing with the Brexit situation could crush it to the downside.

Overall, the market should continue to be driven by headlines, but it’s obvious to me that people are starting to price and the idea of Brexit having some type of deal. The Europeans have extended the situation by another 90 days, that of course is good for the British pound as well. Ultimately, I do think that we go much higher, mainly due to the fact that the market is at such historic lows.