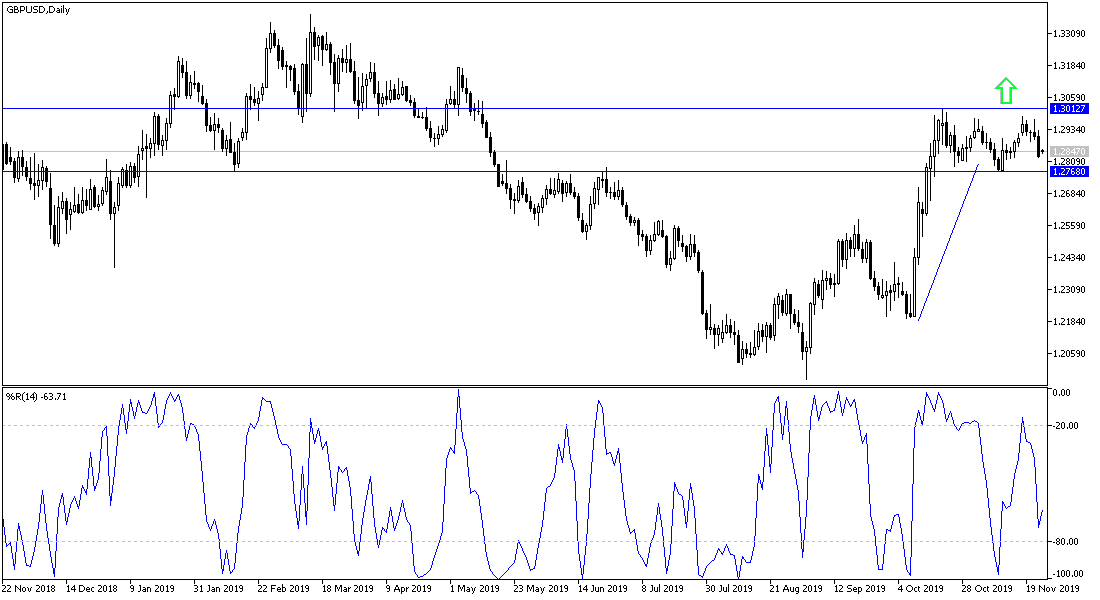

The strength of the US dollar has returned again, and therefore, the GBP/USD price dropped to the 1.2822 support during last Friday's trading session, ending all its recent gains that hit the 1.2985 resistance. The pound weakened from a five-month high as uncertainty over the country's general election, about 17 days from now, put pressure on the pound, which failed to break the 1.3000 psychological resistance barrier.

Adding to the pressure on the Pound was the release of a weak PMI survey which pointed to another contraction in the British economy in the last quarter, on the other side, the Conservatives, led by Boris Jonson with a margin in the polls over the Labor Party, but the bitter memories of Theresa May advancement in the 2017 elections, which proved to be wrong, contain a great enthusiasm for sterling. The Conservative majority government is likely to mean that Boris Johnson's October agreement on Brexit became law, paving the way for the UK's exit from the EU, but being constrained with a “transitional period”, during which the future relationship will be negotiated. It is crucial for the markets that the Johnson Accord succeed in ending the “no deal” Brexit threat, while early elections have avoided the economy and the pound more years of hesitation and collapse, if not the worst, under the opposition Labor government against the European Union.

The British election is important to expectations, but it is not the only thing that affects the pound against the dollar because the uncertainty of the future of the US-China trade deal would be the most profitable for the dollar as a safe haven.

There was a conflict over the status of the talks between the United States and China last week. Bloomberg News first reported that negotiators were trying to reach an agreement that would remove some tariffs imposed by each side in the past 18 months before any deal was reached. Before that, CNBC said China was pessimistic about the possibility of completing the "Phase 1" because the United States hesitated to remove enough tariffs.

Chinese Vice-Premier Liu He then telephoned US Trade Representative Wright Heze and Finance Minister Manouchein, the Chinese Ministry of Commerce said at a press conference. The two sides engaged in constructive discussions on the fundamental concerns of the Phase 1 agreement. And until now, wait still prevails.

According to the technical analysis of this pair: Any attempt for the GBP/USD to retreat below 1.2800 support will strengthen the bearish momentum and the first level of buying will then be the support at 1.2768 as shown on the daily chart below and breaking it would mean a reversal force. On the other hand, the future of the rally depends on the 1.3000 psychological resistance. The future of Brexit with the upcoming British elections and the US-China trade deal are the most influential factors on the pair's trends.

As for the economic calendar data today: There are no significant economic releases today from Britain or from the United States.