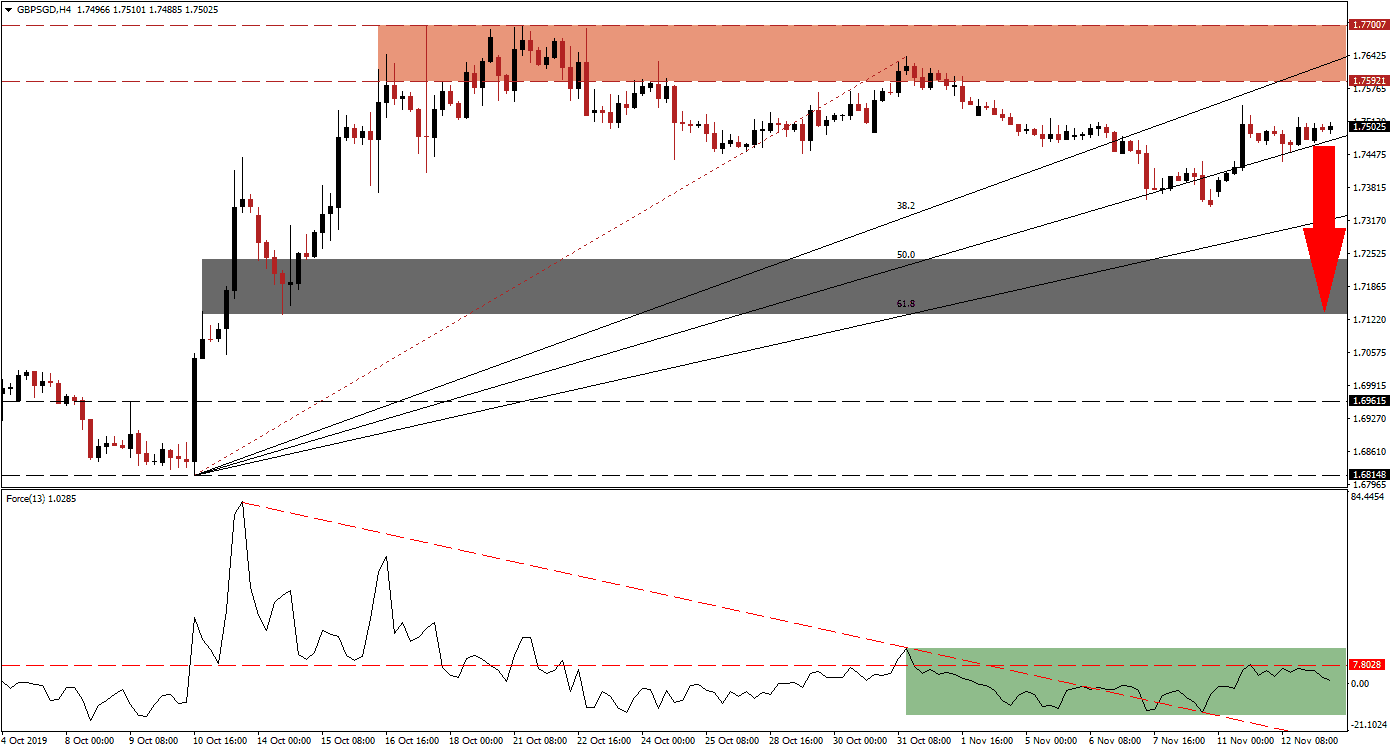

No-deal Brexit fears have eased after Nigel Farage announced that his Brexit Party will not contest any of the 317 seats the Conservative Party won in the last election while focusing on winning seats from the opposition parties. PM Johnson’s Tories have expanded their lead over Corbyn’s Labour Party, but the British Pound may have to fight another battle as the Bank of England’s MPC had two votes in favor of an interest rate cut. The GBP/SGD has already established a bearish chart pattern and price action is currently trapped between its 38.2 Fibonacci Retracement Fan Resistance Level and its 50.0 Fibonacci Retracement Fan Support Level.

The Force Index, a next-generation technical indicator, contracted below its horizontal support level and turned it into resistance after the GBP/SGD first moved into its resistance zone. A prolonged sideways trend allowed the Force Index to move above its descending resistance level, but the drift higher was rejected by its horizontal resistance level as marked by the green rectangle. This technical indicator is now sliding closer to the 0 center line and a move into negative territory is likely to trigger a renewed sell-off in this currency pair as bears will be in charge of price action. You can learn more about the Force Index here.

After the GBP/SGD entered its resistance zone, located between 1.75921 and 1.77007 as marked by the red rectangle, a breakdown followed which was reversed by the Fibonacci Retracement Fan trendline. This reversal led to a push back into the resistance zone, but also to a lower high from where another breakdown took price action briefly below the ascending 50.0 Fibonacci Retracement Fan Support Level. The recovery led to another lower high and bearish momentum is expanding. The Singapore Dollar continues to benefit from capital inflows out of Hong Kong due to the unrest in the financial hub.

Forex traders should now monitor the Force Index for a breakdown in negative conditions which is expected to lead the GBP/SGD into a double breakdown below its 50.0 and 61.8 Fibonacci Retracement Fan Support Levels and back into its short-term support zone. This zone is located between 1.71319 and 1.72401as marked by the grey rectangle and an increase in volatility should be expected as the election date approaches. While a breakdown in this currency pair below its short-term support zone remains unlikely without a fresh fundamental catalyst, the next long-term support zone awaits price action between 1.68148 and 1.69615.

GBP/SGD Technical Trading Set-Up - Breakdown Scenario

⦁ Short Entry @ 1.75000

⦁ Take Profit @ 1.72000

⦁ Stop Loss @ 1.76000

⦁ Downside Potential: 300 pips

⦁ Upside Risk: 100 pips

⦁ Risk/Reward Ratio: 3.00

A breakout in the Force Index above its horizontal resistance level, turning it back into support, may lead the GBP/SGD back into its resistance zone. Depending on the degree of bullish momentum behind such a move, a breakout cannot be ruled out and the next resistance zone is located between 1.78948 and 1.79564. Given the current fundamental picture, supported by the technical scenario, the next short-term move is expected to the downside while the long-term upside potential remains a possibility.

GBP/SGD Technical Trading Set-Up - Breakout Scenario

⦁ Long Entry @ 1.77350

⦁ Take Profit @ 1.79000

⦁ Stop Loss @ 1.76650

⦁ Upside Potential: 165 pips

⦁ Downside Risk: 70 pips

⦁ Risk/Reward Ratio: 2.36