The British pound has rallied a bit over the last 30 days as October was very kind to Sterling. At the same time, the New Zealand dollar has been hammered due to the fact that the US/China trade situation has been getting worse. Having said that, the market looks at the US/China situation as starting to stabilize a bit, so it’s interesting to see where the New Zealand dollar goes from here, but at this point in this pair it’s more important to pay attention to the British pound, as Brexit continues to be a major issue.

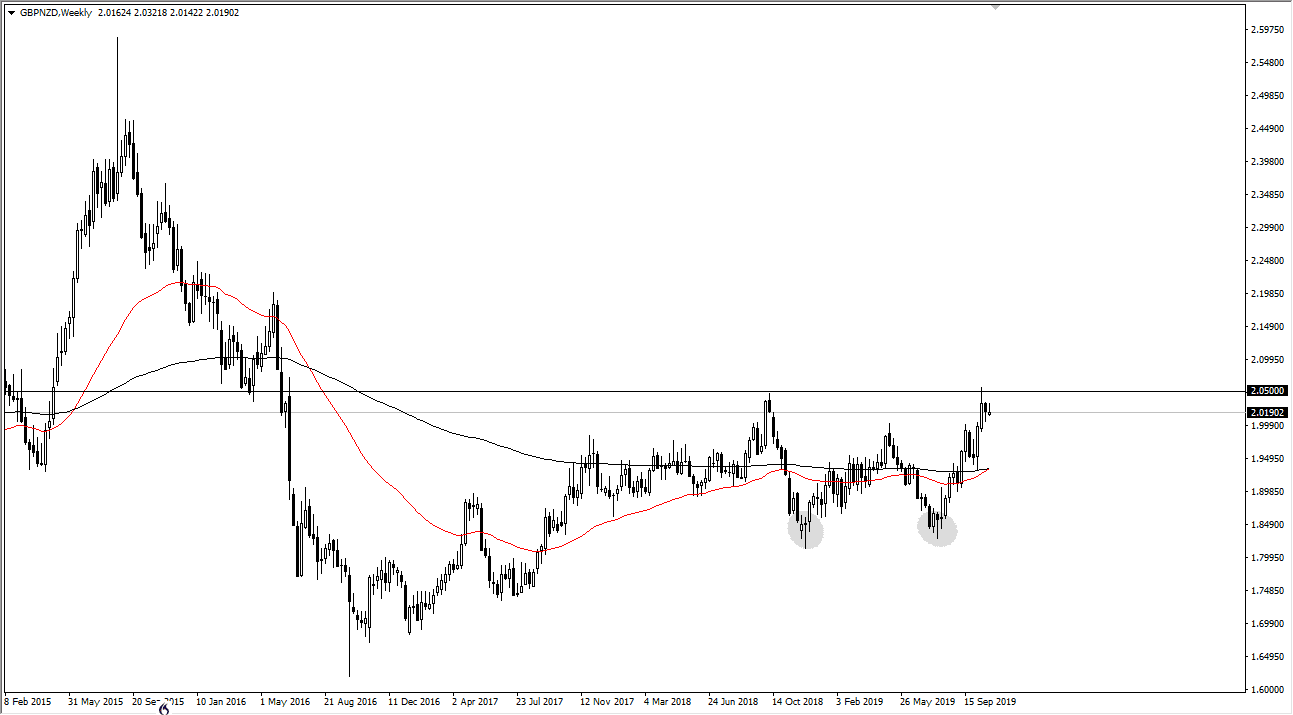

Looking at this chart, it’s easy to see that there is a potential “W pattern”, and a daily close above the 2.05 NZD level could send this market much higher. In fact, based upon the W pattern, it could send this market all the way to the 2.20 NZD pair, although it wouldn’t necessarily be this month. Given enough time, that breakout should offer a nice “buy-and-hold” trade setting up, or the occasional pullback trade. With this, simply waiting for that breakout is probably the best way to play this market over the next month, but if we were to break down below the hammer from the third week of the month, it’s likely that we go down towards the 1.95 NZD level. All things being equal, this will be moving based upon the British pound more than anything else, and therefore you will be able to see where this market should be going based upon the British pound against most currencies, not just this one. In other words, it should be a huge move all around the Forex markets if it does in fact kick off.

If we get a lot of negativity involving Brexit, and let’s be honest here we certainly can, then this market probably pulls back. Beyond that, there’s not much to say other than this is a massive bottoming pattern that is right on the edge of confirming itself, and these patterns are quite often seen by most traders around the world as an opportunity to go along for a bigger move. With that in mind, keep an alert on your charts somewhere near the 2.0550 level, and simply wait for that opportunity. As far as selling is concerned, although it certainly could be valid based upon a breakdown, it will be as exciting of an opportunity and certainly not as big of an opportunity.