As the risk-on mood is showing signs of fatigue, the Japanese Yen could see a slow inflow of capital from risk averse traders. Details surrounding the phase one trade deal between the US and China are also lacking and the overall phase one deal should be considered more of a truce which is not expected to have the positive impact markets expect. Uncertainty over the UK elections have provided a ceiling over the British Pound and breakdown pressures in the GBP/JPY are on the rise. You can learn more about a breakdown here.

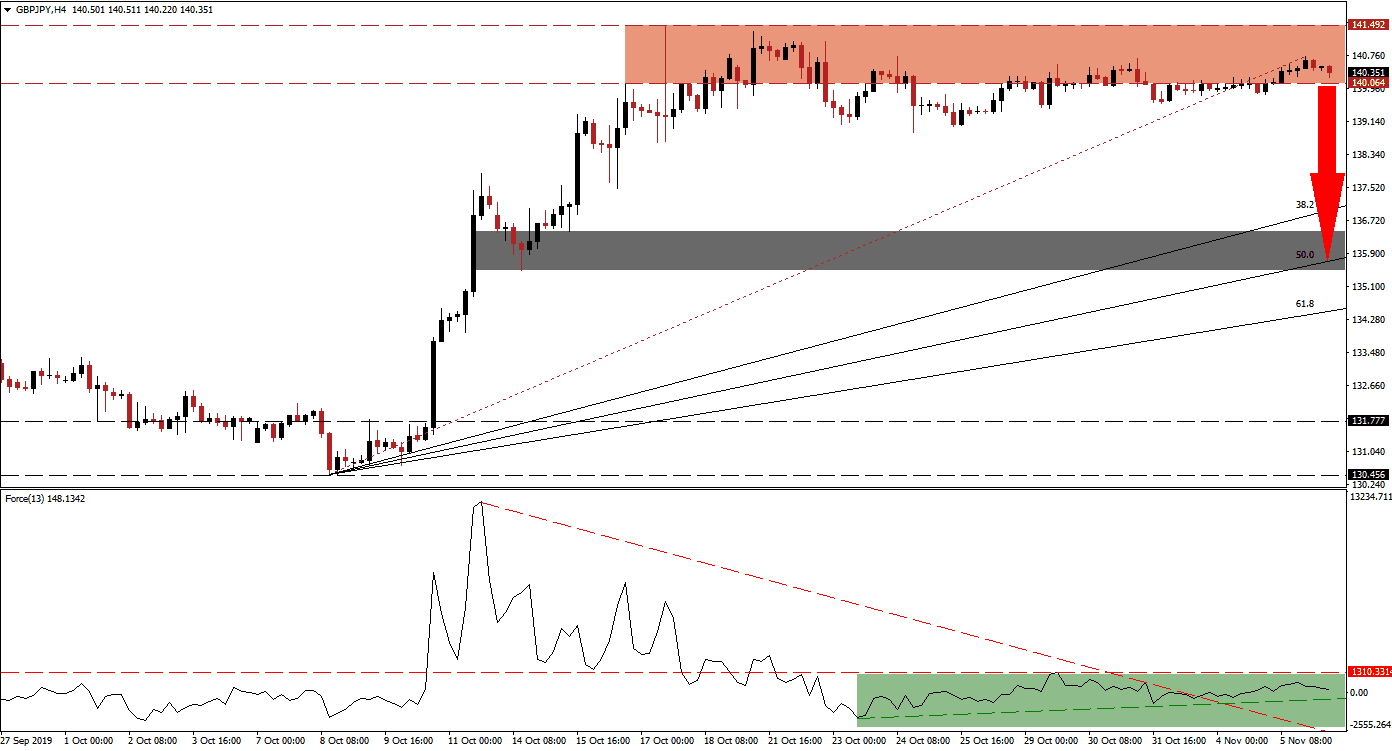

The Force Index, a next generation technical indicator, has been confined to a narrow range after completing a breakdown below its horizontal support level which turned it into resistance. The sideways trend allowed a crossover by the Force Index above its descending resistance level as marked by the green rectangle, but bullish momentum remains depressed. This technical indicator is now vulnerable to a breakdown below its ascending support level which will also take it into negative territory and give bears control of the GBP/JPY.

Preceding the sideways trend, a series of price spikes took this currency pair from its long-term support zone, located between 130.456 and 131.777, into its resistance zone which is located between 140.064 and 141.492 as marked by the red rectangle. As a result of this move, a big gap between the Fibonacci Retracement Fan and the GBP/JPY developed and a corrective phase is expected to close it; the prolonged sideways trend resulted in the re-drawing of the Fibonacci Retracement Fan. With price action below the Fibonacci Retracement Fan trendline, a breakdown below its resistance zone is now pending. You can learn more about the Fibonacci Retracement Fan here.

Forex traders are advised to monitor the intra-day low of 139.812 which marks the low after this currency pair moved below the Fibonacci Retracement Fan trendline; it is also located just beneath its resistance zone and a push lower could trigger a profit-taking sell-off. The GBP/JPY is expected to accelerate to the downside until it will reach its 50.0 Fibonacci Retracement Fan Support Level which is currently crossing its short-term support zone located between 135.493 and 136.446 as marked by the grey rectangle. News flow in regards to the UK election campaign is likely to increase volatility in this currency pair, especially as the December 12th election date approaches.

GBP/JPY Technical Trading Set-Up - Breakdown Scenario

⦁ Short Entry @ 140.350

⦁ Take Profit @ 135.900

⦁ Stop Loss @ 141.550

⦁ Downside Potential: 445 pips

⦁ Upside Risk: 120 pips

⦁ Risk/Reward Ratio: 3.71

A push higher in the Force Index by its ascending support level may result in the GBP/JPY drifting to the top range of its resistance zone, but given the current fundamental scenario, a breakout remains highly unlikely unless a fresh catalyst emerges. The next resistance zone is located between 143.230 and 143.760, but prior to the UK election results this appears out of reach for this currency pair.

GBP/JPY Technical Trading Set-Up - Limited Breakout Scenario

⦁ Long Entry @ 141.750

⦁ Take Profit @ 143.250

⦁ Stop Loss @ 141.100

⦁ Upside Potential: 150 pips

⦁ Downside Risk: 65 pips

⦁ Risk/Reward Ratio: 2.31