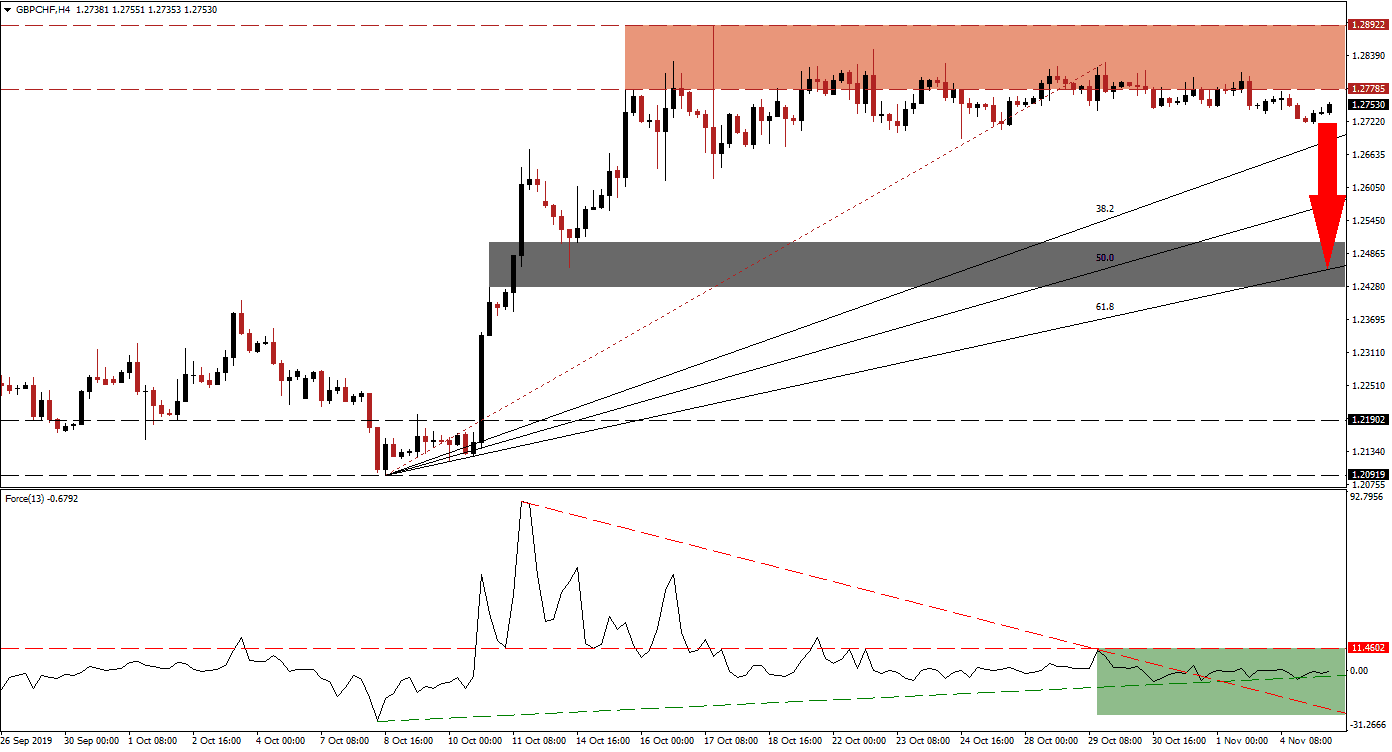

Following the election of a new Speaker of the House of Commons in the UK, uncertainty about next month’s snap election as well as Brexit remained elevated; it took four ballots to get the new speaker elected. The British Pound is likely to drift lower as forex traders will reduce exposure and minimize risk leading into the election. The GBP/CHF already completed a breakdown below its resistance zone following a sideways trend near the bottom range of it. The resulted in a re-drawn Fibonacci Retracement Fan sequence and price action is expected to extend to the downside until it can challenge its 61.8 Fibonacci Retracement Fan Support Level. You can learn more about the Fibonacci Retracement Fan here.

The Force Index, a next generation technical indicator, has maintained its position below its horizontal resistance level as bearish momentum is slowly on the rise. This sideways trend allowed the Force Index to cross its descending resistance level which failed to reverse momentum. This technical indicator is now testing its ascending support level, as marked by the green rectangle, from where a double breakdown is expected to take it back below its descending resistance level. The Force Index also trades in negative territory which suggests that bears are in charge of price action and the GBP/CHF is expected to follow the Force Index into a breakdown sequence.

Volatility is expected to remain elevated as elections new are set to dominate price action, while a pending risk-off session should benefit the safe-haven Swiss Franc. After the GBP/CHF completed its breakdown below its resistance zone, located between 1.27785 and 1.28922 as marked by the red rectangle, bearish pressures have increased. A profit-taking sell-off may now provide the necessary catalyst for a breakdown sequence below its re-drawn Fibonacci Retracement Fan to emerge. Forex traders are advised to monitor the intra-day low of 1.26925, this level represents the last instance where price action advanced off of the Fibonacci Retracement Fan trendline; a breakdown is likely to accelerate the corrective phase. You can learn more about a breakdown here.

Another fundamental catalyst may be provided by PMI data out of the UK which is expected to remain below 50.0; this indicates contraction. Should expectations be confirmed, this currency pair will have another bearish driver which makes a breakdown sequence more likely. The next short-term support zone is located between 1.24263 and 1.25059 as marked by the grey rectangle; the 61.8 Fibonacci Retracement Fan Support Level is nestled inside this zone. More downside in the GBP/CHF cannot be ruled out, but without a fresh fundamental event it remains unlikely; the December 12th snap election may provide one. The next long-term support zone is located between 1.20919 and 1.21902.

GBP/CHF Technical Trading Set-Up - Breakdown Extension Scenario

⦁ Short Entry @ 1.27550

⦁ Take Profit @ 1.24750

⦁ Stop Loss @ 1.28300

⦁ Downside Potential: 280 pips

⦁ Upside Risk: 75 pips

⦁ Risk/Reward Ratio: 3.73

In case of an advance in the Force Index, guided by its ascending support level, which will pressure this technical indicator above its horizontal resistance level, a breakout in the GBP/CHF becomes a possibility. The current fundamental environment is expected to limit upside potential in this currency pair; the next resistance zone is located between 1.30084 and 1.30653.

GBP/CHF Technical Trading Set-Up - Breakout Scenario

⦁ Long Entry @ 1.28500

⦁ Take Profit @ 1.30350

⦁ Stop Loss @ 1.27700

⦁ Upside Potential: 185 pips

⦁ Downside Risk: 80 pips

⦁ Risk/Reward Ratio: 2.31