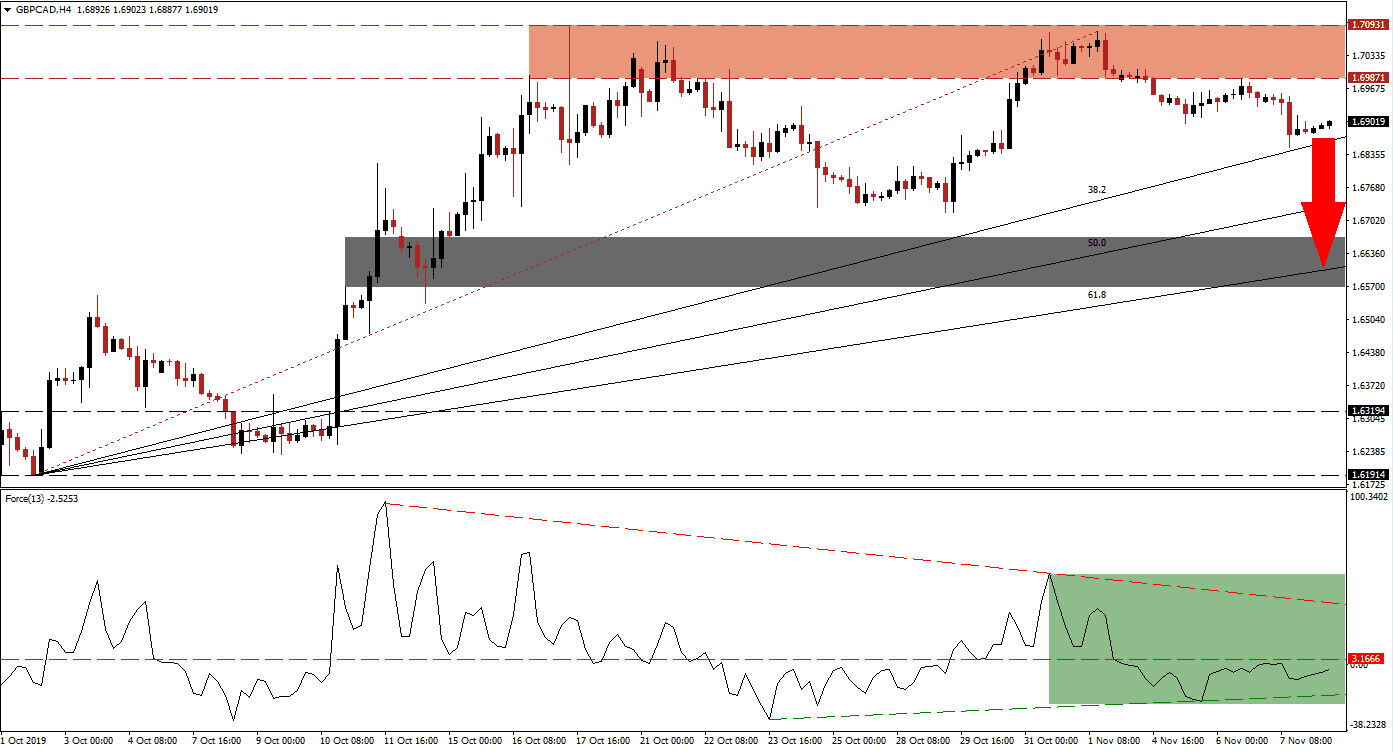

Yesterday’s surprise vote by two of the nine MPC voting members of the Bank of England in favor of an interest rate cut further rattled the British Pound. The consensus was that the British central bank will wait for after Brexit to increase interest rates, but the ongoing Brexit delays, as well as the uncertain outcome of next month’s snap election, prompted a change in attitude. The GBP/CAD already completed a breakdown below its resistance zone and is now expected to challenge its 38.2 Fibonacci Retracement Fan Support Level to the downside as bearish momentum persists. You can read more about the Fibonacci Retracement Fan here.

The Force Index, a next-generation technical indicator, confirmed the breakdown in the GBP/CAD below its resistance zone with a breakdown below its horizontal support level which turned it into resistance. The Force Index was able to drift higher after reaching its ascending support level, but this technical indicator remains below its horizontal resistance level and in negative conditions, as marked by the green rectangle. With negative fundamental news flow surrounding the British Pound, the Force Index is likely to drift lower as this currency pair is set to extend its breakdown sequence; the descending resistance level is further adding bearish pressures on price action.

Adding to breakdown pressures in the GBP/CAD is the Fibonacci Retracement Fan which is approaching the resistance zone, located between 1.69871 and 1.70931 as marked by the red rectangle. Price action is already trading below the Fibonacci Retracement Fan trendline and as the gap between the 38.2 Fibonacci Retracement Fan Support Level and the bottom range of the resistance zone narrows, this currency pair is expected to accelerate to the downside. Today’s Canadian employment report may add a short-term fundamental catalyst and a move blow 38.2 Fibonacci Retracement Fan Support Level may also trigger a profit-taking sell-off.

Until the December 12th election is concluded and the make-up of the next Parliament clear, the British Pound is likely to trend lower, and back into a strong support level. The possibility of an interest rate cut by the Bank of Canada is limiting the downside potential of the GBP/CAD which is likely to descend into its next short-term support zone which is located between 1.65681 and 1.66690 as marked by the grey rectangle. The 61.8 Fibonacci Retracement Fan Support Level is currently passing through this zone from where a price action reversal may emerge. You can learn more about a support zone here.

GBP/CAD Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 1.69000

- Take Profit @ 1.66500

- Stop Loss @ 1.69700

- Downside Potential: 250 pips

- Upside Risk: 70 pips

- Risk/Reward Ratio: 3.57

Should the Force Index complete a breakout above its horizontal resistance level, the GBP/CAD may advance back to the top range of its resistance zone. Given the current fundamental scenario, a breakout above its resistance zone remains highly unlikely and any advance into it should be considered a solid short-selling opportunity until the UK election week approaches.

GBP/CAD Technical Trading Set-Up - Limited Price Action Reversal Scenario

- Long Entry @ 1.69900

- Take Profit @ 1.70900

- Stop Loss @ 1.69500

- Upside Potential: 100 pips

- Downside Risk: 40 pips

- Risk/Reward Ratio: 2.50