Earlier in the week, the EUR/USD pair struggled to avoid falling to the 1.1000 psychological support, so as not to sell further. Amid limited moves, the pair bounced back to the 1.1043 level. Market and investor expectations suggest that the single currency may remain under pressure until the end of the year. Rising US bond yields, persistent trade tensions and political uncertainty are key pressures on the EUR.

The dollar's gains were halted by comments by US President Donald Trump at the end of last week that negotiators were not as close as previously thought to a deal to remove more US tariffs on Chinese goods. In contrast, data from the Chinese Ministry of Commerce last week led investors to believe that not only can the new tariffs, which come into effect on December 15, be canceled, but some tariffs imposed in September could also be canceled. For his part, Trump told reporters on Saturday that there were many incorrect reports in the media about the status of trade negotiations, and that the "level of tariff lift" introduced in the press was incorrect. He also said he wanted to "make a deal, but the deal must be strong and right."

The two sides have tried to finalize the "first phase of the deal," which Trump had demanded on October 11, which strengthened global financial markets in recent weeks. Trump's comments are a reminder to markets that confidence between the world's two largest economies can change, anytime and quickly.

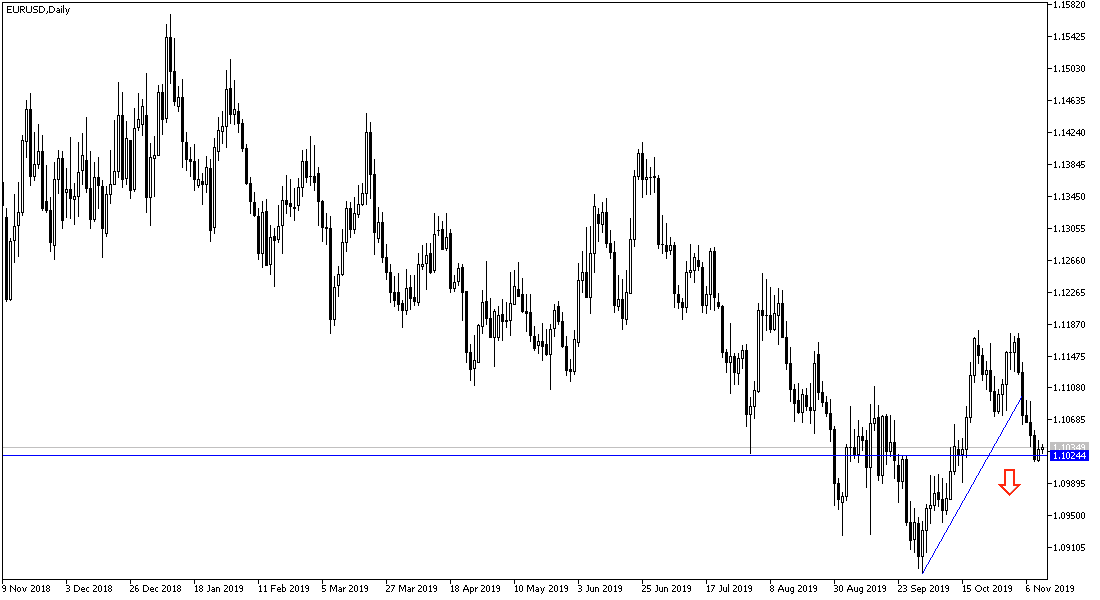

According to the technical analysis of the pair: The general trend of the EUR/USD is still bearish, and breaking the 1.1000 support will increase selling on the pair, and push it to test the support at 1.0900 and 1.0815 before the end of the year. The correction will not return without breaking the 1.1120 resistance. The weakness of the German economy, which is driving the slowing down of the Eurozone economy, will continue to prevent the Euro from making stronger gains in case the dollar weakens.

As for the economic calendar today: For the second day in a row, the calendar has no US economic data. From the Eurozone, the focus will be on the release of the German ZEW Economic Sentiment.