With the beginning of the week's trading, the European single currency, Euro, is up for an important date with the first official remarks by new ECB Governor Christine Lagarde, who took office on March 1, succeeding Mario Draghi. Investors are looking for strong indications about Lagarde's plans for the future of the bank's monetary policy. This is in light of the continuing slowdown of the Eurozone economy led by Germany. Ahead of the event, the EUR/USD is still trying to sustain its recent gains, which have hit the 1.1175 resistance where it closed last week.

The pair's gains were boosted by the Federal Reserve's rate cut by a quarter-point for the third time in 2019, to counter the negative consequences of Trump's protracted trade wars toward other global economies. Those disputes have adversely affected sectors of the US economy, the latest being the labor market, which the Fed has long boasted in tightening monetary policy over the past year. The US Labor Department announced at the end of last week that non-farm payrolls rose by 128,000 in October, compared with economists' estimates of an increase of about 89,000.

Despite stronger-than-expected job growth, the report said the unemployment rate rose to 3.6 percent in October from 3.5 percent in September. Rising from a 50-year low in the previous month, the report showed 36,000 jobs in the industrial sector were lost to a strike at General Motors, while government employment fell amid a decline in the number of temporary jobs for the 2020 census.

Similarly, manufacturing activity in the US continued to decline in October, but at a slightly slower pace, with the ISM Manufacturing PMI rising to 48.3 in October from 47.8 in September, although the reading is still below the 50 level which indicates a contraction in industrial activity. Economists had expected the index to rise to 48.9. The previous month, the index fell to its lowest level since 46.3 in June 2009, the last month of the Great Depression.

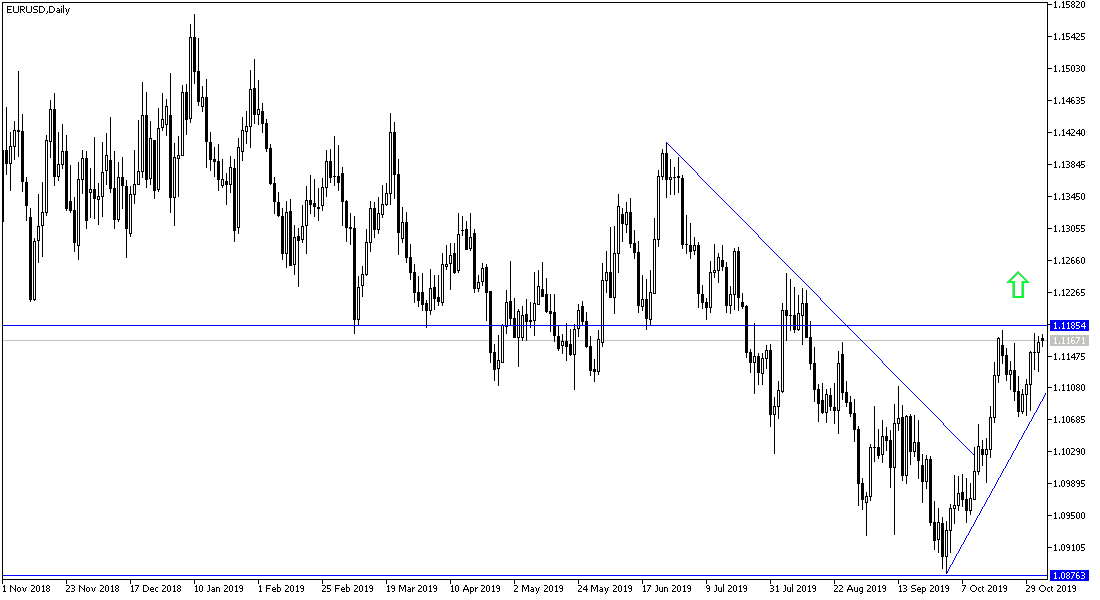

According to the technical analysis of the pair: The EURUSD price continues to maintain its movement within a clear bullish channel on the daily chart, supported by stability above 1.1120 resistance. Keeping in mind that the continuation of the new ECB management in easing monetary policy may affect bulls' morale. Currently, the nearest resistance levels are 1.1220, 1.1300 and 1.1385 respectively, areas that confirm the upward correction strength. On the downside, the current correction will not lose steam without the pair moving towards 1.1000 psychological support.

As for the economic calendar data today: From the Eurozone, the Manufacturing PMI for the cluster economies will be released. Later on, ECB Governor Christine Lagarde will make her first remarks. From the U.S, factory orders will be announced.