In the last two trading sessions of last week, the EUR/USD pair tried to correct higher, but the gains did not exceed the 1.1056 level and ended the week's trading near it. The recent sell-off has pushed the pair towards 1.0989 support, the lowest level in more than a month. The question is now for forex traders, who are particularly interested in the EUR/USD; where will gains reach?

The answer: Up to now, the bullish correction attempts are still weak, and were pressure on the dollar and not a strength of the Euro. The pair is still floating within a stronger bearish channel, and gains will not be strengthened without a return to confidence in the performance of the Eurozone economy, especially the German economy, which leads the block’s economy. It has stagnated because of the prolonged trade war between the United States and China and amid threats to impose tariffs on the European auto sector at any time.

The dollar index fell by about a third by 1% last week, and is now down in five of the past seven weeks, including the first half of Q4. The index recovered nearly half of the losses in October. However, the losses before the weekend caused the dollar index to fall slightly below 98.00, pulling back just over a third of the previous week's rally. A range of support appears between 97.60 and 97.80. A breach through this area might target a test of recent lows near 97.00. The MACD and Slow Stochastic are on the verge of decline.

For economic news. After announcing an unexpected drop in retail sales the previous month, the Commerce Department released a report showing that US retail sales rebounded slightly more than expected in October. It increased by 0.3 percent in October, reversing the decline of -0.3 percent in September. Economists had expected retail sales to rise 0.2 percent. The increase in retail sales was partly due to a rebound in sales of car dealers and spare parts, which rose 0.5 percent in October after falling 1.3 percent in September. Excluding the rebound in car sales, the report said retail sales rose 0.2 percent in October after falling 0.1 percent in September. Car sales were expected to rise 0.4 percent.

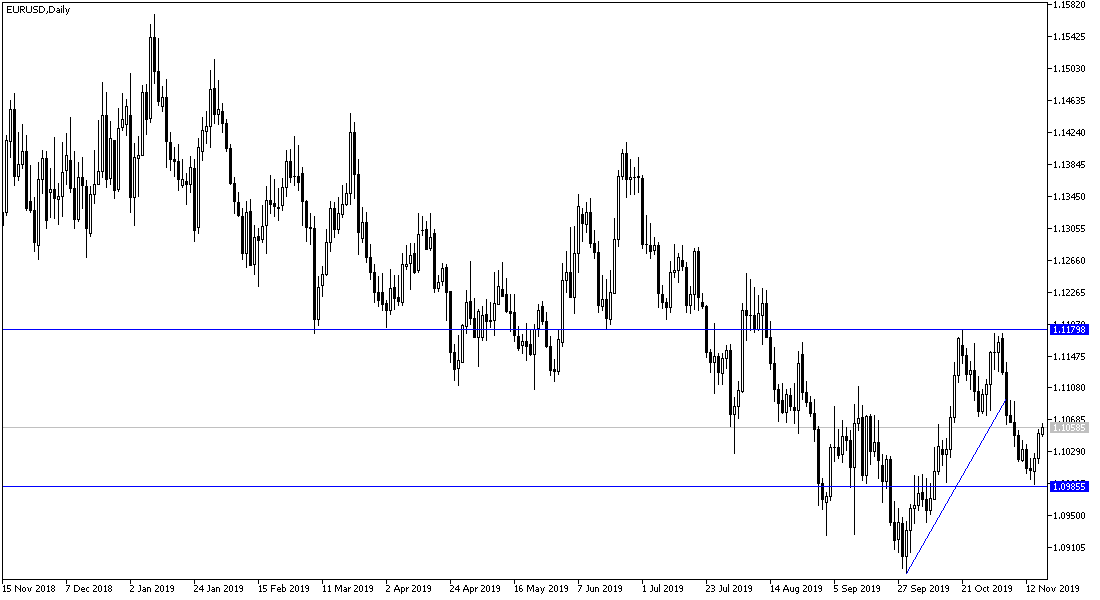

According to the technical analysis of the pair: On the long term, the price of the EUR/USD pair is still moving within a bearish channel, which is derived from a move below the 1.1000 psychological support. Moving below that level will increase short positions and test stronger support levels near and below 1.0965, 1.0880 and 1.0800 respectively. On the upside, the opportunity for a bullish correction will not be stronger without moving around and above 1.1120 resistance.

As for the economic news today: There are no significant economic releases from the Eurozone or from the US during the beginning of this week.