For three trading sessions in a row, the EUR/USD price is moving in an upward correctional performance with gains reaching 1.1090 resistance, for this correction to succeed, as per the performance on the daily chart, the pair still needs to establish above the 1.1120 resistance. Forex traders who are interested in trading this pair, will remain cautiously awaiting the release of the content of the minutes of the Fed and ECB monetary policy meeting this week for clues on future interest rate expectations, while manufacturing and services sector’s PMI surveys for November will provide updated economic growth outlook. The minutes of the ECB meeting in October are unlikely to have a major impact on the Euro because it relates to the recent meeting of former President Mario Draghi.

A rise in the manufacturing and services PMI for the Eurozone economies will be consistent with the message from the German ZEW survey for November, which showed that financial market analysts are becoming more optimistic about the outlook for economic growth. The optimism is largely due to Prime Minister Boris Johnson's Brexit agreement with the bloc in October and reports that President Donald Trump is unlikely to impose tariffs on European car imports.

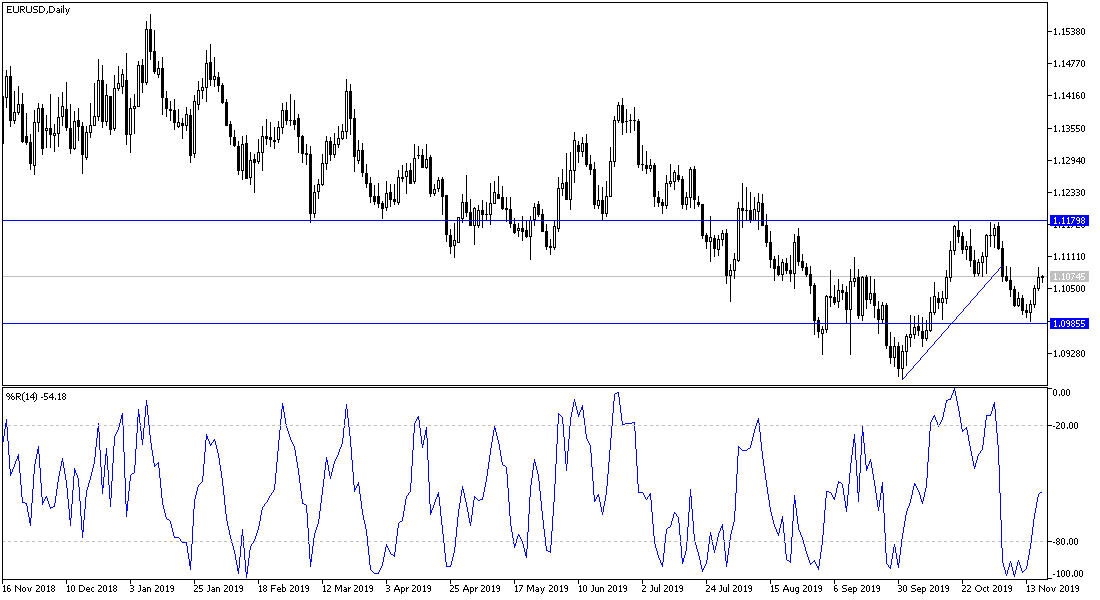

According to the technical analysis: EUR/USD recent gains have helped to turn the technical indicators up, but we are still looking for confirmation to the strength of the correction and this may be achieved if the pair moves towards higher resistance levels at 1.1120, 1.1185 and 1.1245 respectively. Those hopes may disappear if the pair returns to move steadily below the 1.1000 support. Lagarde's remarks and the results of the PMIs for the industrial and services sectors in the Eurozone will be a good reason for stronger moves for the pair, and thus strengthen the performance in one direction.

As for the economic calendar data today: from the Eurozone, there will be announcement of the current account data. From the U.S.A, building permits and housing starts data.