For four consecutive trading sessions, the EUR/USD is under downward pressure pushing it towards the 1.1055 support, its lowest level in three weeks. The US dollar remains stronger against other major currencies after the recent optimism that a comprehensive trade agreement between the United States and China could be signed later this month. The Euro did not benefit from sentiment after the data indicated that the growth of the Eurozone may be ready to finally turn after a difficult year. The Eurozone services sector rebounded in October, with a reading of 52.2, against expectations of 51.8. Eurozone retail sales rose 3.1% year-on-year in September, beating market expectations of 2.5%, a figure that could mean that there is upward strength on current estimates of economic growth in the Eurozone as the yearend approaches.

The German factory sector showed positive results after German factory orders reading increase of 1.3%, against 0.1% expected by the markets. The German Services PMI was revised up to 51.6, up from 51.2 in the initial estimate. Germany's manufacturing sector fell last year and is widely believed to drag the country into a technical recession in the third quarter.

On the US front, the release of the ISM Services Index had a deeper view that the US economy is still gaining strength in the face of the global trade war. If a broader agreement with China occurs, the economy may quickly return to recovery and record highs, and the Fed will give up accelerating the rate cuts. US President Donald Trump is reportedly considering canceling some tariffs this week on imports from China again in September, a few days after Commerce Secretary Wilbur Ross said in an interview with the White House that he might decide to impose punitive tariffs on car imports from Europe, both are considered negative news for the Eurozone economy, as this fragile situation has forced the ECB to resort to further easing of monetary policies that are holding back the EUR.

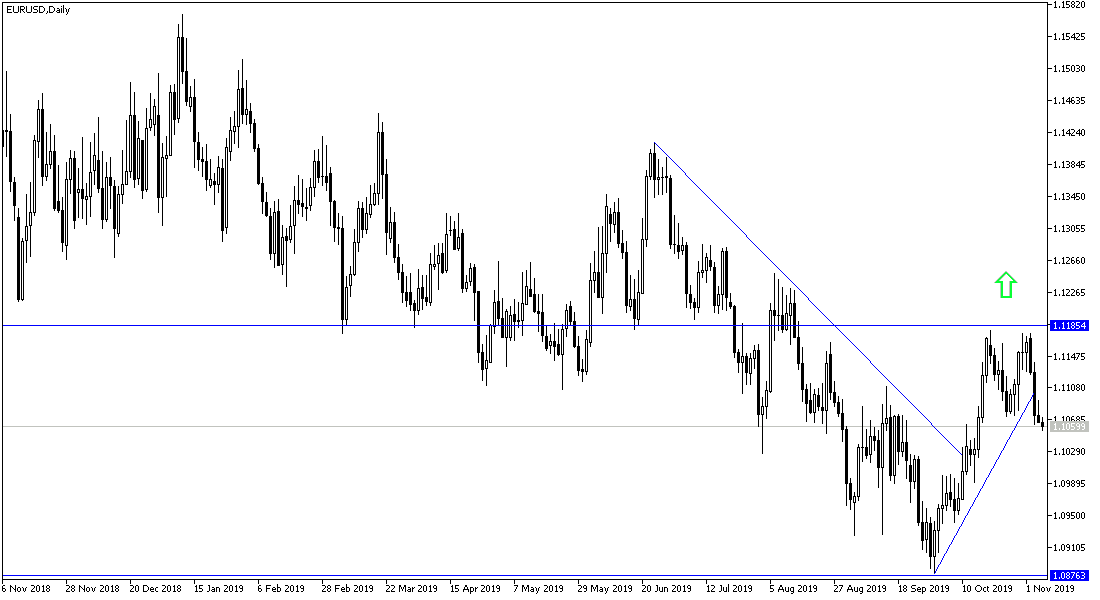

According to the technical analysis of the pair: EUR/USD moving towards 1.1000 the psychological support level will strengthen the current upward correction. Speculators are waiting for the pair to move back above 1.1120 resistance to have another opportunity to complete the correction. The Trump-led trade war compass shift to Europe after signing an agreement with China will negatively affect the Euro's performance for a long time.

As for the economic calendar data today: German Industrial Production is due. Then the EU Economic Outlook report and the ECB monthly report. from the United States we have unemployed claims.