The US dollar returned to rise again, and therefore, stopped EUR/USD gains which is stable around the 1.1072 level at the time of writing, and before the announcement of the contents of the last Federal Reserve Bank policy meeting’s minutes, which is not expected to affect the pair much, as the bank’s governor, Jeromy Powell confirmed the future of the Bank’s Policy through his testimony before the Congress last week, and also after his meeting with the US president at the beginning of this week, as the bank will stop the pace of US rate cuts until they see a reaction to the country's economic performance after the rate cut three times this year. The bank will stop the pace of US rate cuts until it sees the reaction to the country's economic performance after three rate cuts this year. The bank remains confident of US economic performance and continuously emphasizes the bank's independence.

According to economic news. The US Commerce Department announced that housing starts reached a seasonally adjusted annual rate of 1.31 million. Housing starts for single-family homes rose by 2%, largely due to construction in the west and south. Residential building construction rose 6.8% from the previous month. Low mortgage rates and a strong labor market have helped the housing market in recent months, however, housing starts are still falling 0.6% year on year due to land shortages and high construction costs. Affordability is a problem for potential buyers because the increase in house prices has outpaced wage growth.

The average 30-year mortgage rate is 3.75%, down from 4.94% a year ago, according to mortgage buyer Freddie Mac. Cheaper borrowing costs have increased demand from buyers, but the wider shortage of homes for sale has generally driven prices higher than income since 2012 when the market began to recover from the Great Depression.

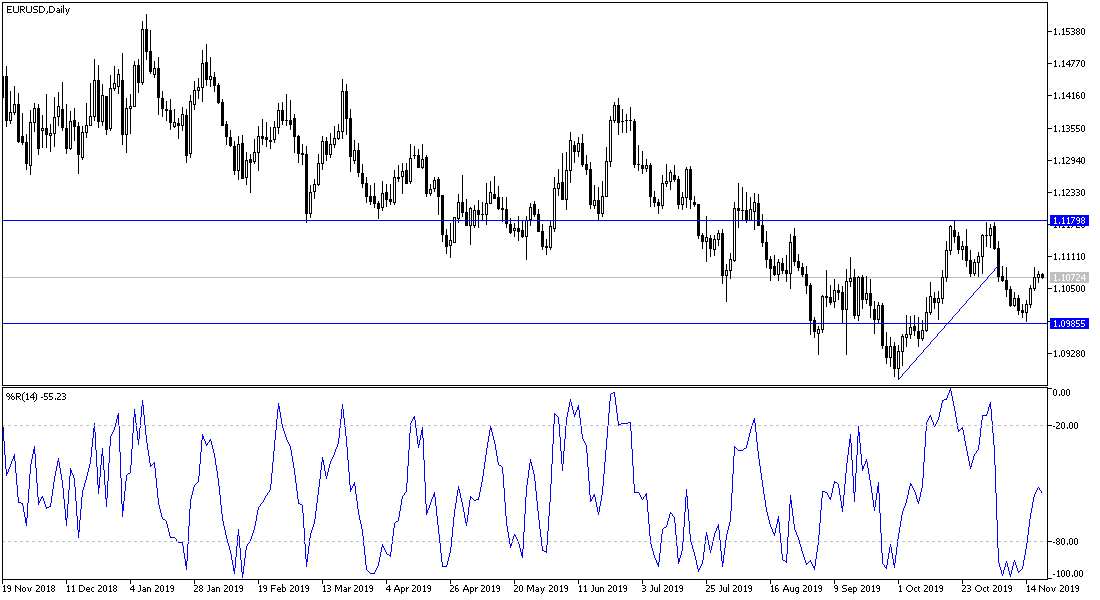

According to the technical analysis of the pair: There is no change in my technical view of this pair, and the technical indicators are pointing higher, but we are still looking for confirmation of the strength of this correction, which may be achieved with the pair moving towards higher resistance levels at 1.1120, 1.1185 and 1.1245 respectively. In general, any move by the pair around and below the 1.1000 support will threaten the upside correction expectations.

As for the economic calendar data today: The German PPI will be released. From the United States, crude oil inventories and the contents of the minutes of the last Fed meeting will be announced.