After three unsuccessful attempts to break above the 1.1175 resistance, it was normal for the EUR/USD to correct down towards the 1.1127 support. The performance was limited at the beginning of this week's trading with the absence of drivers to complete the pace of the upward correction. Despite the improvement in the results of the industrial purchasing managers' index of the Eurozone economies, the important sector is still in the contraction zone. The index is still below the 50 level, which separates growth from deflation. The Euro has not gained momentum from comments by US Commerce Secretary Wilbur Ross that the White House may not impose tariffs on European car exports later this month. US President Donald Trump saw European car imports as a threat to national security.

He had previously threatened to impose punitive tariffs, but the European Commission, for its part, has threatened retaliation, a move that could open a new front in the global trade war, which is still bilateral between the United States and China. The decision on whether to impose tariffs on cars comes at a time when the economies of the Eurozone and the Euro are being hurt, both affected by the US-China trade war and already facing a whole host of other challenges.

The divergence of monetary policy between the European Central Bank and the Federal Reserve as well as the economic situation between the Eurozone and the United States is still in favor of the USD, threatening any gains for the pair.

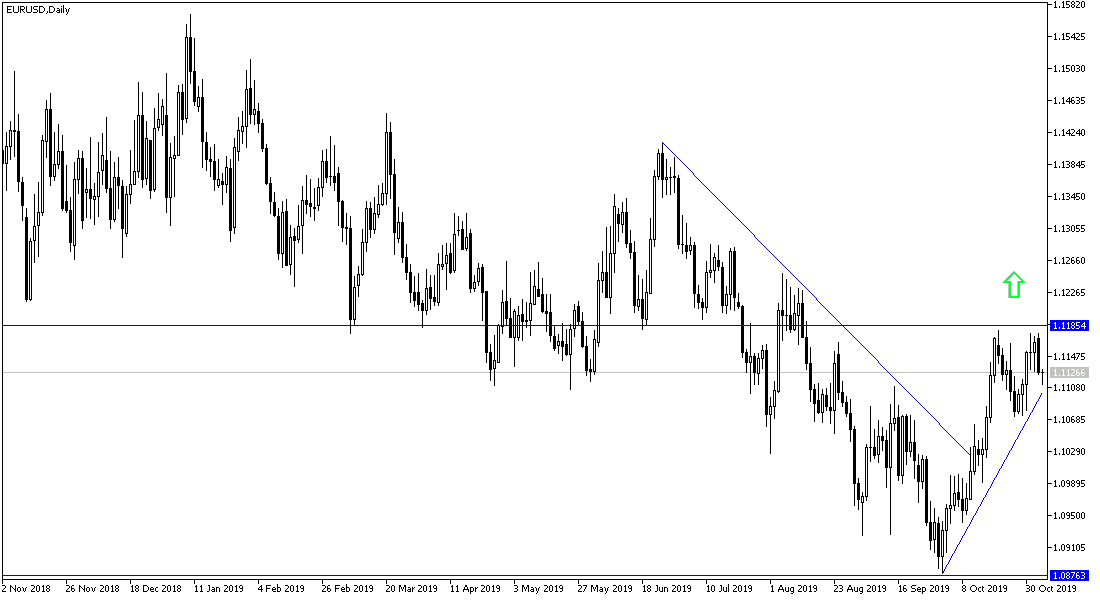

According to the technical analysis of the pair: the 1.1120 resistance is the last chance for the EUR/USD to maintain the upward correction. Pressure my increase and turn the pair downward again strongly if it moves around the 1.1000 psychological support. On the daily chart, the ascending channel faces the threat of a break.

As for the economic calendar data today: First, there is the announcement of the change in Spanish unemployment and then the announcement of the producer price index in the Eurozone. From the US, the trade balance, ISM non-manufacturing PMI and the number of jobs available in the country will be announced.