The EUR/USD fell to the 1.0992 support during Wednesday's session, as the pressure on the Euro continues with the contrast economic performance between the US and the Eurozone, as well as the monetary policy of the European Central Bank, which supports further easing to face a slowdown in Eurozone growth, and the Federal Reserve, which is still confident of the US economy, has thus stopped the pace of US rate cuts. The pair is stable around 1.1007 at the time of writing. The US dollar rallied against most of its major currency rivals as investors reacted to new developments confirming that the US-China trade deal would be close. White House negotiators said late Tuesday that negotiations were in "final days" to stabilize the "first phase" announced by President Donald Trump and Chinese Vice Premier Liu He on October 11.

The US demands for progress were recognized by the Chinese Ministry of Commerce, which noted that Vice Premier Liu He spoke with Treasury Secretary Stephen Mnuchen and Trade Representative Robert Lightitzer on Tuesday. China said it had "discussed how to resolve each other's fundamental concerns and reached consensus on how to resolve related issues."

The two sides are working around the clock because the new US tariffs are set to affect imports from China on Dec. 15 unless the White House decides otherwise. The deal is believed to have been stalled by disputes over the future of tariffs imposed over the last 18 months, which should be removed.

The dollar was also supported by better than expected US GDP growth and a strong rise in durable goods orders, as well as a more-than-expected drop in jobless claims. The lower than expected rise in the consumer price index (CPI), the Federal Reserve's preferred inflation gauge, was offset by a lower than expected rise in the Chicago PMI. However, spending rose as expected, confirming continued US consumer confidence.

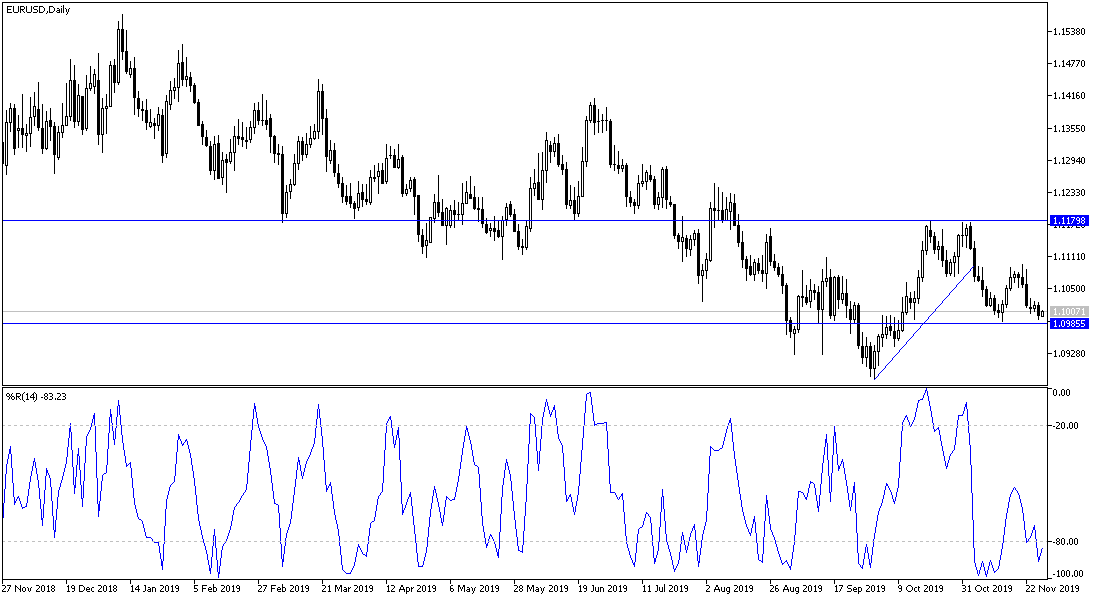

According to the technical analysis of the pair: No change in my technical view, the general trend of the EUR/USD is still bearish and the successful breach of the 1.1000 support will increase the strength of the bearish momentum, and thus push the pair to test stronger support levels at 1.0945 and 1.0880 respectively. A weak Eurozone economy will support the current performance. In case of an upward correction, I still see the 1.1120 resistance as key to the correction strength again. The first phase agreement between the US and China may strengthen the pair's rather than wait for the improvement in European data results.

As for the economic calendar data: Today is a public holiday in the United States for Thanksgiving. From the Eurozone, German and Spanish CPI will be announced, then we have the announcement of the money supply for the Eurozone.