After today, there will be no major economic releases until the end of this week's trading. In the US session, there will be a package of important and influential US economic data ahead of the Thanksgiving holiday in the United States, which starts Thursday. For three consecutive trading sessions, the EUR/USD has been moving in a limited range between 1.1003 and 1.1027 under downward pressure, and the recent performance foreshadows a strong move ahead. Although China's top trade negotiator said on Tuesday that they and their US counterpart, agreed to continue to work for a preliminary agreement to resolve a trade dispute between the two countries on tariffs. However, investors need to know when and where the final signing of the trade deal will be, and what details and features of the second or even third phase of those agreements are, where Trump has stressed that it is the first stage, which means that it will not be a one-off agreement, but one in several stages.

As for the German economy, which is leading the Eurozone economy, it saw this week the release of the IFO business climate index in the country, which was at its highest level in four months as well as an improvement in the GFK index of consumer confidence, but the single European currency is still waiting for new stimulus plans by the new ECB administration .

This week, Federal Reserve Governor Jerome Powell said that even with the unemployment rate nearing a 50-year low of 3.6%, there is still "much room" for higher wages and more Americans to join the workforce. He noted that annual inflation remains below the Fed's target of 2%. Powell said the three interest rate cuts helped spur more home purchases, contributing to continued economic growth, now in its 11th year, the longest ever.

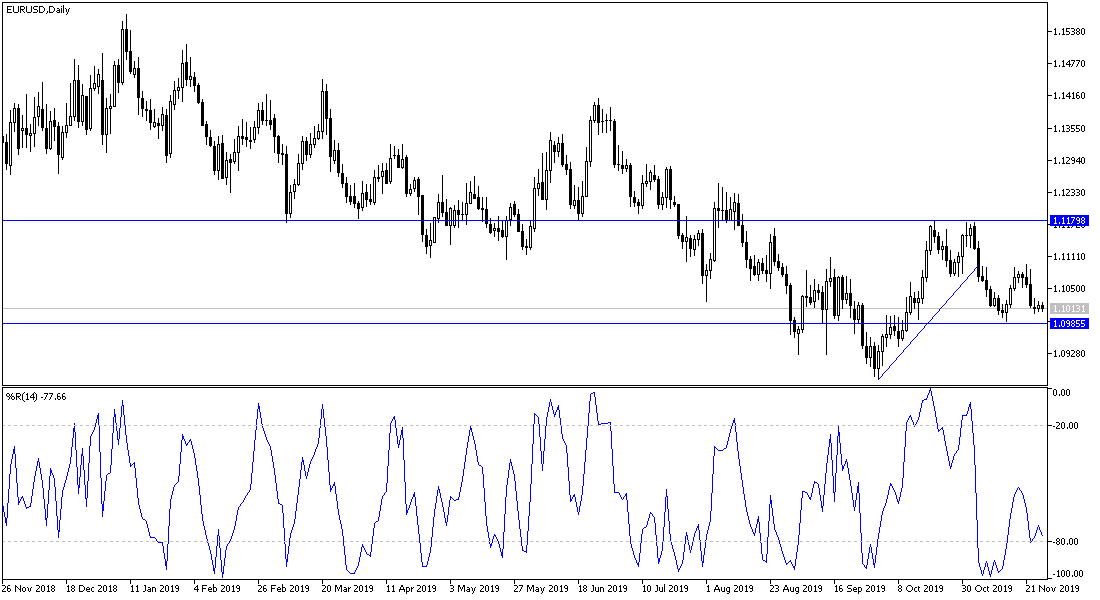

According to the technical analysis of the pair: the general trend of the EUR/USD is still bearish, and the success of breaking through the 1.1000 support will increase the strength of the bearish momentum and make the pair ready to test stronger support levels, with the nearest ones being currently at 1.0945 and 1.0880 respectively. The weakening of the Eurozone economy will support bears' move in strengthening the current trend. In case of a correction up, I still hold 1.1120 resistance as a key to the upward correction strength again. The first phase agreement between the US and China may strengthen the pair's strength rather than wait for the improvement of the European data results.

For the economic calendar data: After the announcement of German import prices, attention will be on the US session data, where durable goods orders, GDP growth rate, jobless claims, Chicago PMI, and the Fed's preferred inflation gauge, the CPI, will be announced, followed by the US citizen's income and spending rate data. Finally, pending home sales and US oil inventories data will also be released.