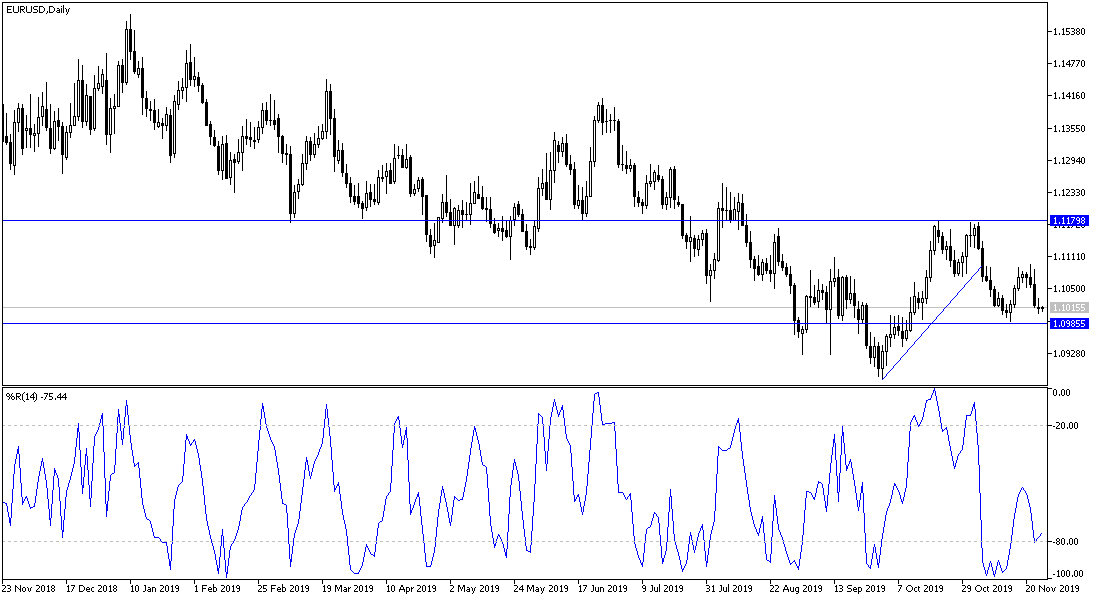

For the second day in a row, the EUR/USD is struggling not to break below the 1.1000 psychological support to avoid further selling. The pair ignored the rise in confidence of German companies to the highest level in four months, which confirms the extent of investors’ pessimism about the future of the Eurozone economy, especially with the absence of vision on the possibility of signing an agreement to prevent tariff war between the two largest economies in the world. Some analysts say the pair should find support near current lows in the coming days. As the pair performs on charts, rather than economic fundamentals or anything like that, it is possible that the Euro could see a final stage down to the base of the downtrend channel at 1.0865 and 1.0814 before recovering.

German business confidence rose to its highest level in four months in November, indicating that the German economy is ready to continue moderate growth in the fourth quarter of 2019. IFO survey data showed on Monday that the IFO business confidence index rose to 95.0 in November from 94.7 in October. The reading was almost compatible with expectations.

The institute said the German economy was showing resilience. The Eurozone's largest economy is likely to grow 0.2 percent in the fourth quarter.

By the end of last week, the new ECB governor, Christine Lagarde, said the Eurozone needs a new blend of European policy focused on boosting public investment to create a sustainable future, and the ECB's monetary policy review will soon begin. "Investment is a particularly important part of responding to today's challenges, because it is a demand today and a supply for tomorrow." She said. “Although the investment needs are country-specific, today there is a cross-cutting issue of investing in a more productive, more digitized and brighter future.” She added.

According to the technical analysis of the pair: No change in my technical view, the general direction of the EUR/USD is still bearish and the success of breaching the 1.1000 support will increase the bearish momentum strength, and the pair will be ready to test stronger support levels, and the nearest ones are currently at 1.0945 and 1.0880 respectively. The weak economic performance of the Eurozone will support bears' moves in strengthening the current trend. On the upside, I still hold the 1.1120 resistance as a key to the upside correction. The first phase agreement between the US and China may strengthen the pair rather than wait for the improvement of the European data results.

As for the economic calendar data: From the Euro-Zone, the German GFK Consumer Climate Index will be released. From the US, the consumer confidence, new home sales and the Richmond Manufacturing Index data will be released.