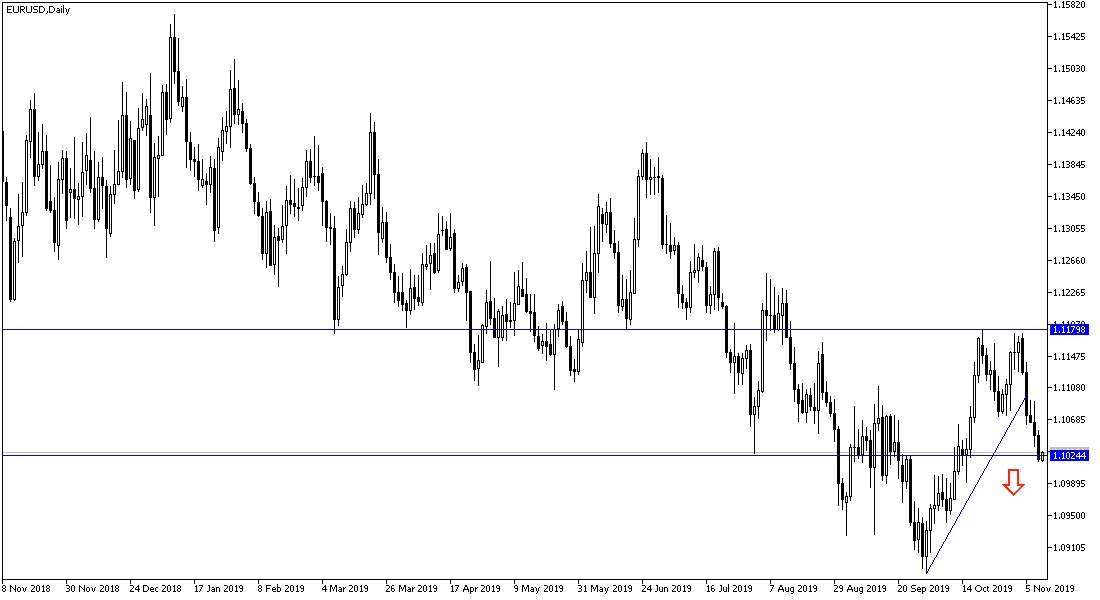

Over the course of last week's trading, the EUR/USD has been under downward pressure from a three-month high of 1.1175 resistance to 1.1016support, where it closed the week around. The pessimistic outlook for the future of the Eurozone economy has increased the pressure on the single European currency. In return, the US currency gained momentum amid expectations that a trade agreement between the United States and China will stop the pace of tariff warfare between them for a period of time, which will be positive for the US economy. So far there has been no agreement, and there seems to be no meeting on a specific day as there is no agreement on when or where the US and Chinese leaders could meet to make the official signature.

In contrast, EU manufacturing continued to decline as evidenced by the October PMI, while the services sector continued to be more flexible. The larger-than-expected rise in German factory orders was offset by a larger-than-expected decline in industrial output. Chinese exports and imports were weaker than expected, while Germany's exports were stronger than expected.

The Euro is on an important date this week with the announcement of the Spanish election results, and US President Trump's decision on tariffs that he might impose on the European Union, as well as the industrial production figures from the Eurozone. Spain voted on Sunday in its fourth election in four years as Prime Minister Sanchez failed to reach an agreement with Podemos after the last election in April. Next Wednesday, we will be waiting for President Trump's decision on whether to impose additional tariffs on cars imported from the EU.

According to the technical analysis of the pair: The four-hour chart of the EUR/USD performance of the shows a decline in a steady downtrend to new lows. The RSI Momentum indicator has dropped into oversold territory, increasing the risk of a pullback, however, it is not enough to deny a downtrend that is likely to continue reaching new lows. A break below 1.0963 could provide confirmation that the downtrend will continue to the next psychological support at 1.0900. In the same context, the daily chart shows the exchange rate in a long-term downtrend that is likely to continue for a while. A break below 1.0963 support will continue the downtrend as the main trend line to 1.0800 support. A broader look of the weekly chart confirms the same downtrend.

As for the economic calendar data: Today is a holiday in the US markets. From the Eurozone there is only the announcement of Italian industrial production data.