Despite the improvement in investor sentiment towards the largest economy in the Eurozone, the EUR/USD continued its decline, and is currently closest to breach the 1.1000 psychological support. Despite the improvement in investor sentiment towards the largest economy in the Eurozone, the EUR/USD continued its decline, and is currently closest to breach the 1.1000 psychological support. Yesterday's losses reached the 1.1002 level before settling around 1.1010 at the time of writing, and before the announcement of US inflation figures and Federal Reserve Governor Jerome Powell's important testimony before the US Congress Committee.

The influential ZEW survey showed additional reason for optimism about the bloc's economic outlook, as the attractiveness of US bond yields and US dollar gains added a lot of pressure to the single European currency. A survey of the Leibniz Center for European Economic Research (ZEW) in November, showed that analysts in the financial markets are becoming less optimistic about the current economic situation in Germany, and are turning to almost frank optimism about the outlook for the next six months. The six-month ZEW outlook rose 20.7 points this month to -2.1 while the current status index increased from -25.3 to -24.7. The broader Eurozone survey also rose in November.

The increase in the forecast index in November by respondents was attributed to the Brexit agreement concluded with the EU by Prime Minister Boris Johnson in October, and reports suggest that President Donald Trump is unlikely to impose tariffs on European car imports.

Markets are waiting to see if the German economy fell into recession in the third quarter, with the GDP data due at 07:00 on Thursday, although there are frequent signs recently that the recovery may already be in the first half of 2020. At the same time, if Trump announces a postponement of its decision regarding European car tariffs, markets may become more optimistic about the future of the Euro.

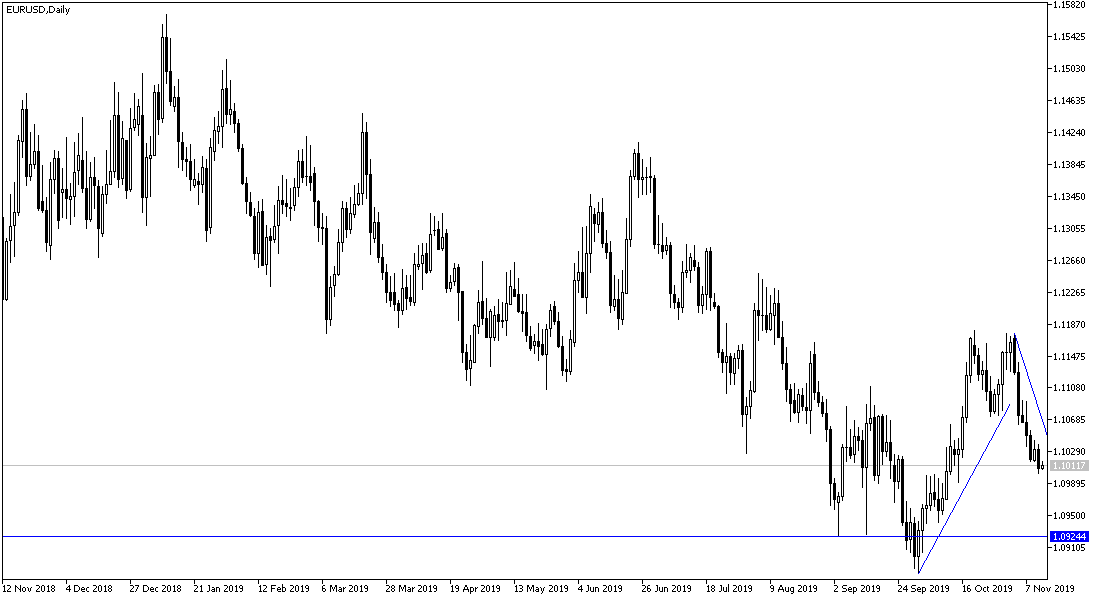

According to the technical analysis of the pair: I am still sticking to my technical view towards the EUR/USD, that a break below the 1.1000 psychological support will increase selling and push the pair towards stronger support levels that may reach 1.0955, 1.0880 and 1.0800 respectively. At the same time, the last two levels are examples of long positions on the pair. On the upside, the 1.1120 resistance continues to revive bullish correction expectations.

As for the economic calendar data: From the Eurozone, industrial production will be announced. Then from the United States, there will be a release of the most important CPI readings to measure inflation in the country. Later, Federal Reserve Governor Jerome Powell will testify before a special congressional committee explaining the economic situation and the bank's plans to revive the world's largest economy.