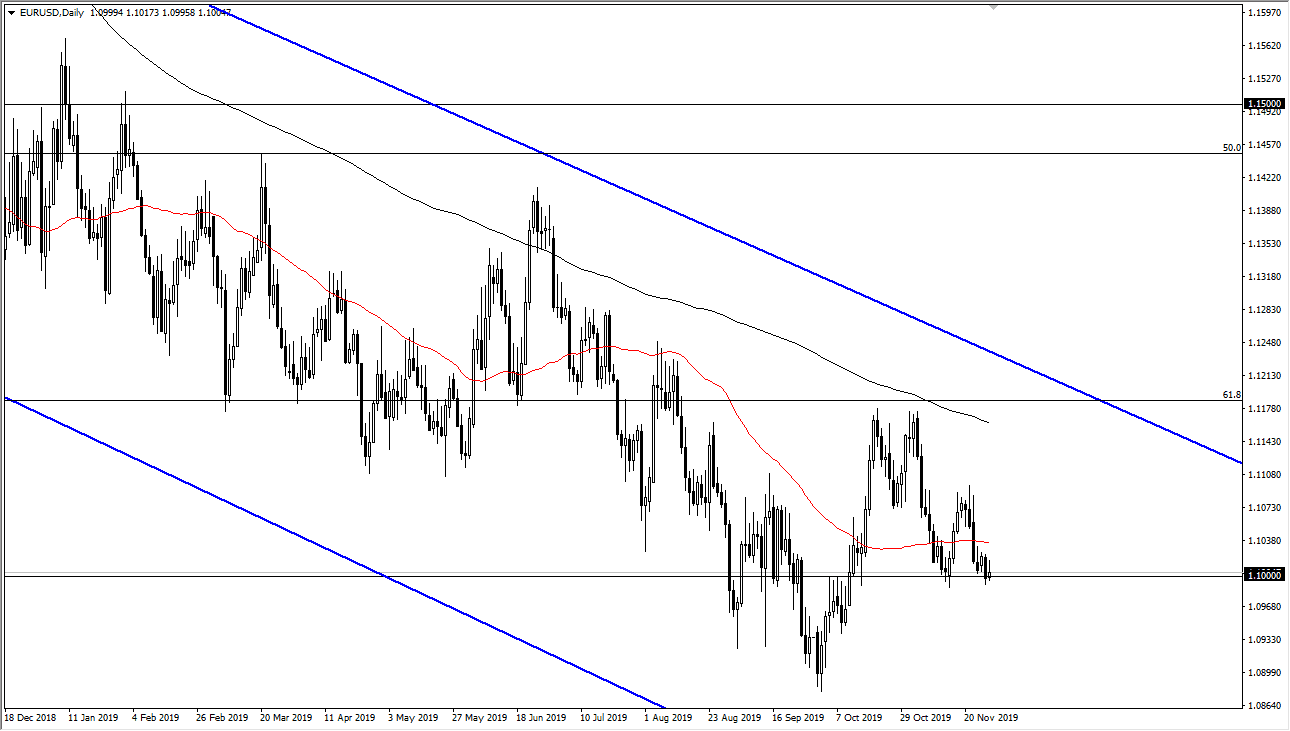

The Euro has initially tried to rally during the trading session on Thursday, but keep in mind that it was Thanksgiving Day, and therefore a huge portion of volume would have been missing from the market. In fact, as the Americans came in to focus, the markets were moving about to pips an hour. That being the case, it’s very likely that the market hasn’t really given us any information to work with during the trading session, but we will look at is that the longer-term trend is most certainly to the downside.

At this point, the market is likely to see sellers on every rally, because the European Union is much softer than the United States, and it should be noted that the trend should remain intact. To the downside, if we clear the 1.10 level significantly, then the market goes down to the 1.09 level after that. Below there, the 1.0750 level would be the next target as it is the gap down there has not been filled. Beyond that, we could go as low as the 1.0450 level as it is the 100% Fibonacci retracement level from the bigger move.

Don’t be wrong, this isn’t going to happen in the short term but the longer-term grind to the downside continues and if we continue to see a lot of economic slowing around the world, it would make quite a bit of sense that the US dollar picks up value as the bond markets will demand it. Rallies at this point continue to see a lot of resistance at the 50 day EMA, the 1.11 handle above, and of course the scene of the “double top” at the 1.12 handle. Because of this, I think that the 200 day EMA being at the 1.12 level is also crucial, so at this point it’s likely that we are going to see sellers every time we tried to reach higher. This doesn’t mean that you simply start shorting, but you look for either the breakdown mentioned below the candlesticks of the last couple of weeks, or you start selling at the first signs of exhaustion at these higher levels. It’s not until we get a move above the downtrend line from the larger channel that I would consider buying the Euro. Right now, the fundamental situation simply doesn’t line up for the common currency to pick up value.