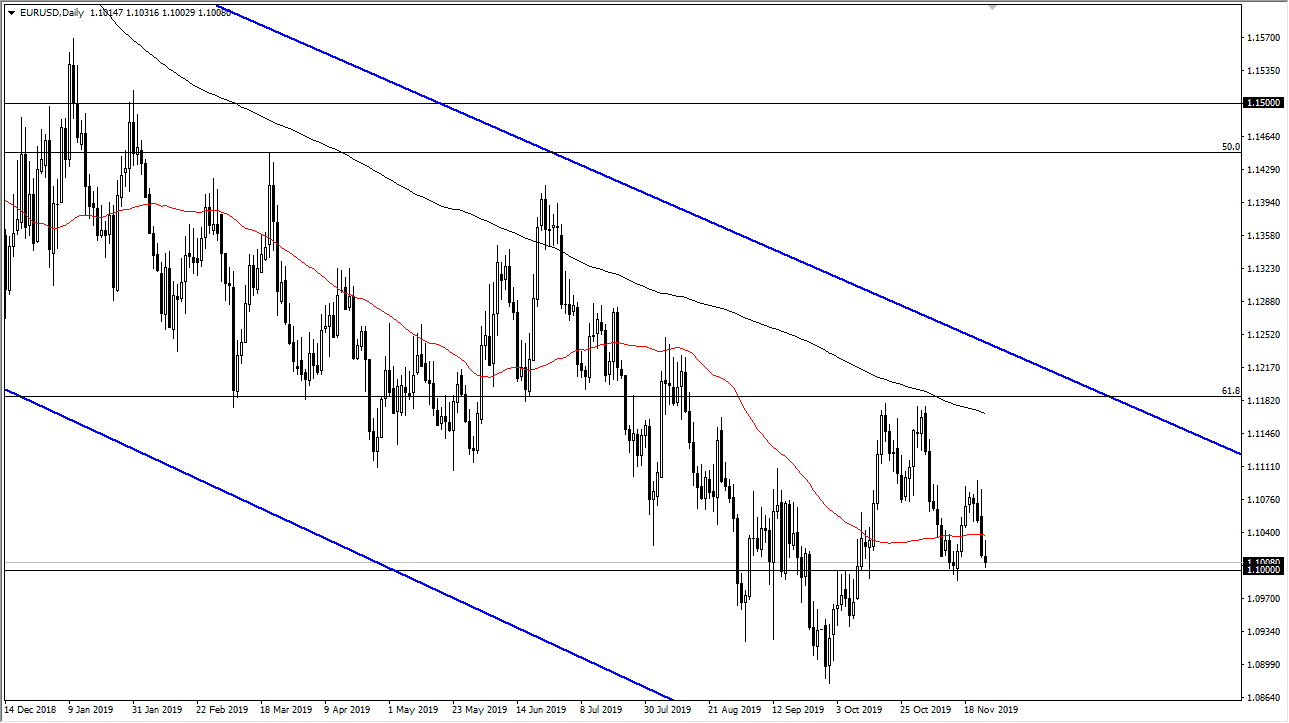

The Euro initially tried to rally during the trading session on Monday but found enough resistance yet again to turn around and form a bit of a negative looking candle. In fact, the 50 day EMA has shown itself to be important again, but the only thing that I think is keeping this market higher is the fact that the 1.10 level has a significant amount of importance put onto it as it is a “large, round, psychologically significant figure.”

At this point, if we can break down significantly below the 1.10 level, especially in a daily candlestick, it can kick this market off to the downside. At this point, if we were to break above the 50 day EMA, then the market could go to the 1.11 level above, as it is both previous support and resistance. Even if we were to break above there, I think that the 200 day EMA would cause some negative the as well.

The German Ifo numbers came out at 95 during the day, as opposed to the 94.1 anticipated figure. At this point, although it was slightly better than anticipated it is still somewhat muted and ugly. That suggests to me that the Euro is going to continue to suffer, and as a result it’s probably only a matter of time before we break down. To the downside I suspect that the market will go looking towards the 1.09 level, and then perhaps even lower than that. At this point, the market would probably go looking towards the 1.0750 level, an area where we have seen a major gap. If we were to break down below there, then the market probably goes down to the 1.07 level as it is the next large figure, and then possibly even as low as the 1.0450 level which is the 100% Fibonacci retracement level.

If the market did break above the 200 day EMA on a daily close, or better yet on a weekly close, that could signal a bit of a trend change, but we would need some type of catalyst to make that happen between now and then. Overall, the market will continue to be very choppy but that’s typical for the Euro as it is choppy and noisy to say the least. I still favor the downside, so look at rallies as selling opportunities over that break down below as a trade as well.