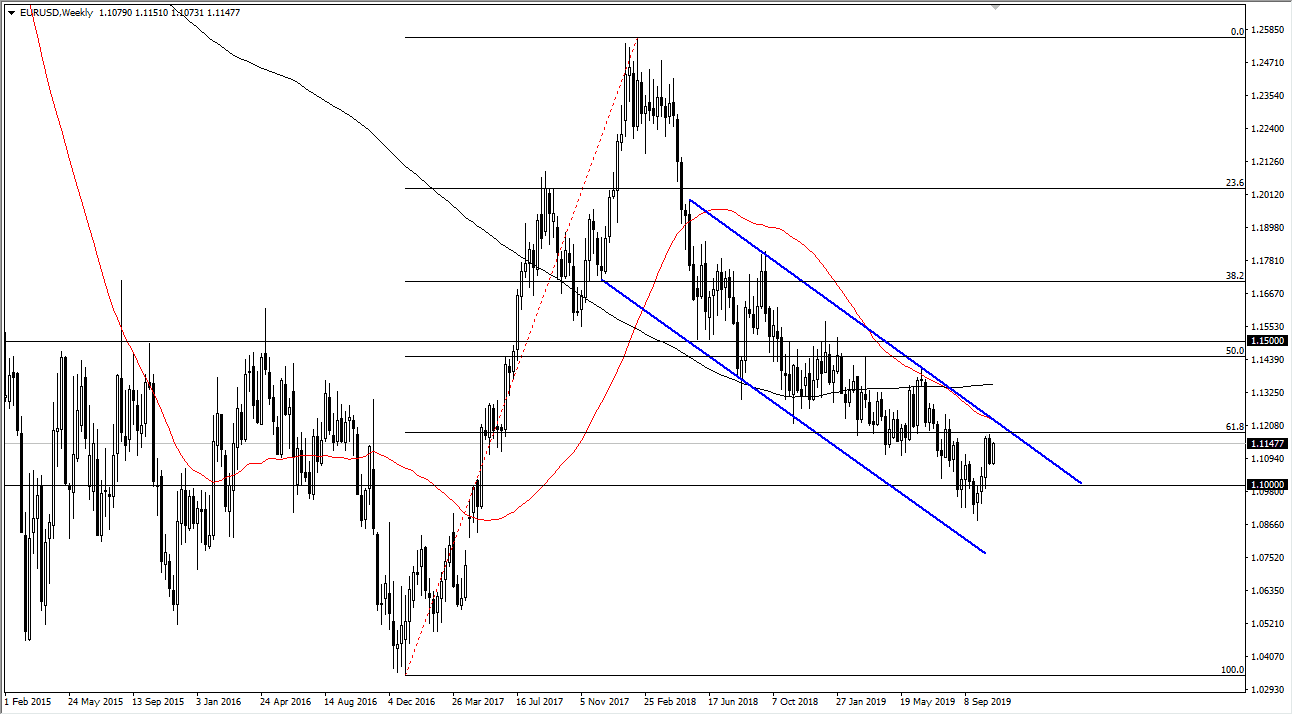

The Euro has rallied it during the month of October, as we continue to chop back and forth. On the longer-term chart you can see that a bit of a channel has formed, and now it looks as if the 50 week EMA is starting to trace the downtrend line part of that channel, although I am the first person to admit that this channel isn’t exactly perfect. That being said, the most important take away here is that we have in fact been very negative for quite some time, and now the market finds itself going into the month of November hanging about the 61.8% Fibonacci retracement level. We had previously broken through there, and typically when we see that it’s not uncommon to see the market try to go looking towards the 100% Fibonacci retracement level.

There are concerns about liquidity when it comes to the US dollar, as demand for dollars has been strong for quite some time. In fact, it got so bad that the repo operations by the Federal Reserve continue. This tells you that the US dollar will continue to be at least relatively well bid, but there are several levels that I will be watching on this chart in order to determine the directionality of the next move.

If the 1.1250 level holds as resistance, it would essentially confirm the 50 week EMA as offering resistance, and of course the downtrend line from the top of the channel. Overall, that would be an excellent place to start shorting again and aiming towards the 1.10 level, and then eventually the 1.09 level. At this point, there are a lot of reasons to think that the trend should continue, not the least of which is that the European Union economic conditions aren’t very strong to say the least.

The Federal Reserve did cut interest rates during the month of October, but now they look perfectly comfortable with being on the sidelines for a while, and that of course can be bullish for the greenback. The trend is your friend so to speak, and we are in a downtrend. Look for signs of exhaustion to take advantage of but if we get a weekly close above the 1.1250 level, then we can start to see the Euro gain from more of a longer-term standpoint. In the meantime, I suspect that rallies will continue to offer selling opportunities.