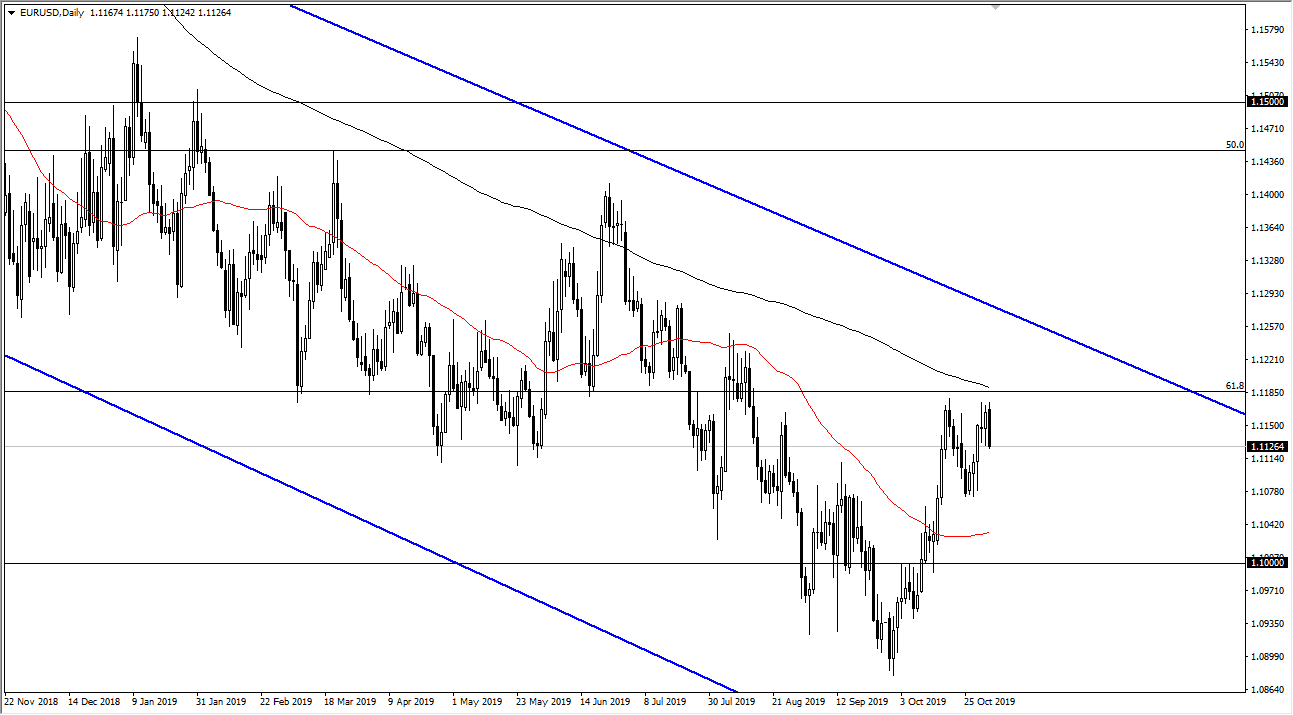

The Euro has broken down during the trading session on Monday yet again, the breakdown a bit as we grind back and forth in seemingly endless meandering. At this point, it’s likely that we will continue to go lower, perhaps reaching towards the 1.1075 level. At this point, the market is very likely to continue to see a lot of noise as per usual. After all, the central banks from both of these economies are looking to be very loose with monetary policy, and it’s likely that will remain the same.

That being said, European figures continue to be lower than US figures, so it suggests that we should continue to see this market drift lower, all things being equal. We have been in a long term downtrend for quite some time, and I do believe that it’s only a matter of time before the buyers give up and starts selling again. At this point, the 200 day EMA above continues to offer resistance, near the previous 61.8% Fibonacci retracement level. The 1.12 level should continue to offer a lot of resistance as well, as it is a large, round, psychologically significant figure.

At this point, the market should continue to find plenty of resistance above base not only that but just simply the last three years. Don’t get me wrong, I don’t think you should necessarily put a lot of money into this pair and quite frankly it’s very rare that you can make money in the Euro unless you can hang on to a position for quite some time. This dictates that you should be using small positions, because quite frankly this market can chop around at any moment. It’s very difficult to make any serious money trading the Euro, because we are at historically low levels but at the outset, if you are looking to trade this market you should be looking at more from a longer-term perspective and therefore be able to deal with the massive choppiness out there. Most of the time this pair serves as a tertiary indicator for other EUR related pairs for me. This shows overall strength of the Euro and therefore I can measure that against other currency such as the Australian dollar, the New Zealand dollar, or anything else like that. That being said, if we do get a break above the 1.1250 level, then we could be talking about a trend change.