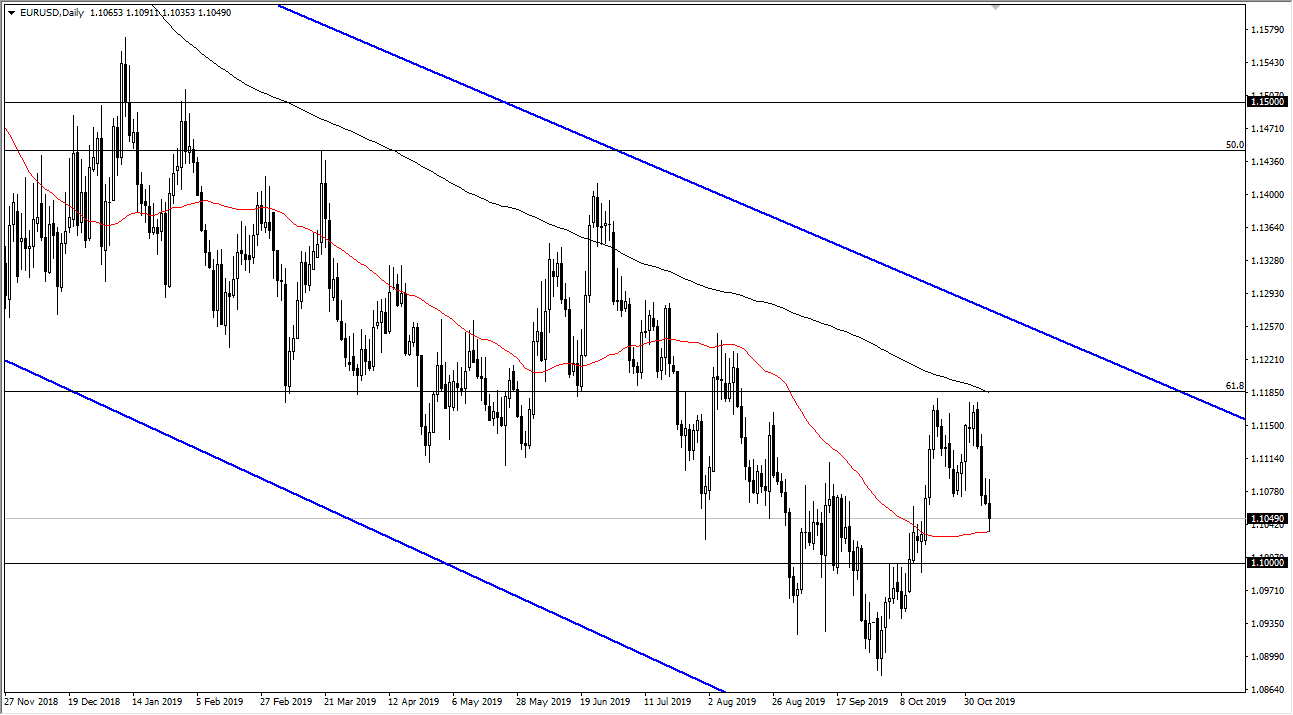

The Euro initially tried to rally during the trading session on Thursday but gave back the gains to rollover as the 1.11 level has offered enough resistance to turn things around. At this point, the 50 day EMA underneath continues to offer support, and I do think it’s only a matter of time before traders will try that level for support yet again. I do believe that market participants will probably break through there, and perhaps go looking towards the 1.10 level above. At this point, market participants would probably see another short-term balance, only to see sellers yet again.

The recent rally has ended with a big “M pattern”, which is a very negative sign. This is especially true considering that it happened at the 200 day EMA, which of course is an important longer-term indicator for trend. Ultimately, if we were to somehow turn around a breakthrough there it would be a very bullish sign but that doesn’t look very likely to happen. It much more likely that rallies will continue to be sold into, as the overall downtrend continues. In fact, this market has sold off every time there has been a rally for the last 18 months.

To the downside, it’s very likely that the market will go down to the 1.09 handle, and then possibly even as low as 1.05 after that based upon the fact that the 100% Fibonacci retracement level is just below. Overall, this is a market that will continue to offer a lot of short-term trading opportunities, because hanging on through all of this volatility is very difficult to deal with. That being said, keep in mind that the noisy trading is something that you should keep in the back of your mind when choosing time frames, as it’s more of a scalping market than anything else. Overall, I am a seller of rallies as it offers an opportunity to pick up the US dollar at a good price, something that continues to look attractive to traders around the world. With this in mind, I suspect that we are quite some way away from buying as the ECB is going to continue to loosen monetary policy while the Federal Reserve is on the sidelines, meaning that the monetary policy outlook for the two economies continue to be very divergent on the whole.