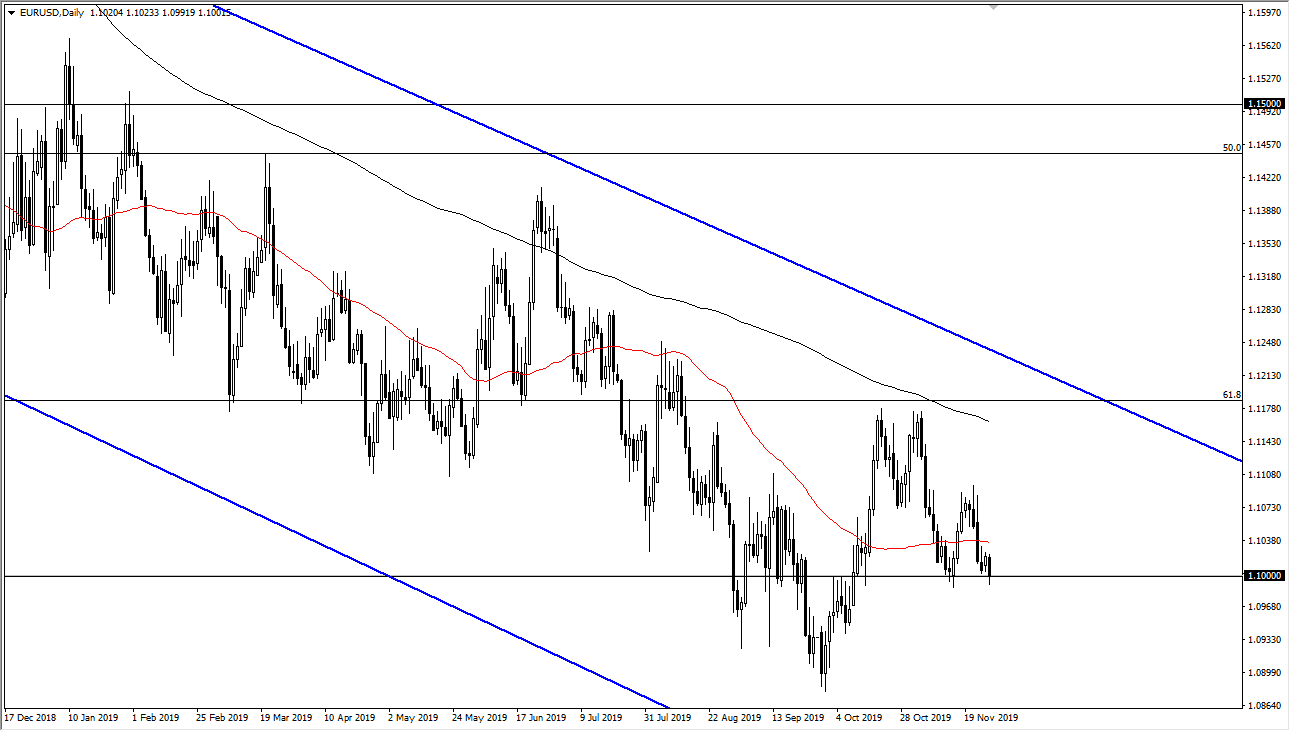

The Euro fell during the trading session on Wednesday, testing the 1.10 level. That is an area that has been important more than once, as it was previous resistance. At this point in time, it’s very likely that it will continue to cause a bit of a reaction but since we have slice through it a couple of times already, it’s not a huge surprise if and when we finally break down.

The European Central Bank continues to be very loose with the monetary policy, and therefore it should continue to weigh upon the Euro in general. At this point, the market will eventually find reasons to fall, and therefore I like the idea of selling rallies, just as they have worked for a couple of years now. At this point, the market breaking below the 1.10 level significantly should open the door to the 1.09 handle, and then eventually the 1.0750 level which is the scene of a major. That gap has yet to be filled, so it makes quite a bit of sense that we would drop down to that level, but it may take some time to get there.

This pair is choppy and the haunt of high-frequency trading, so don’t expect clean moves, it tends to chop around and trade very erratically on short-term charts. Longer-term traders have a much easier route, because they simply sell it wait until the big profits. I believe that the 1.11 level above could cause a bit of resistance, and of course the 1.12 level above there will as well, as it not only has been the scene of a double top recently, but it also features the 200 day EMA.

The US dollar continues to strengthen due to not only the weakness in the European Union, the reality is that the economic figures coming out of the United States during the trading session were on the hall very strong, so it makes sense that the greenback would pick up a bit of strength. At this point in time, the market is very likely to continue to see negativity, in general, this is a market that continues to be erratic but clearly is negative. I have no interest in buying the Euro until we get above the 200 day EMA, at the very least on the daily chart, if not the weekly chart. At this point, I like fading rallies that show signs of exhaustion.