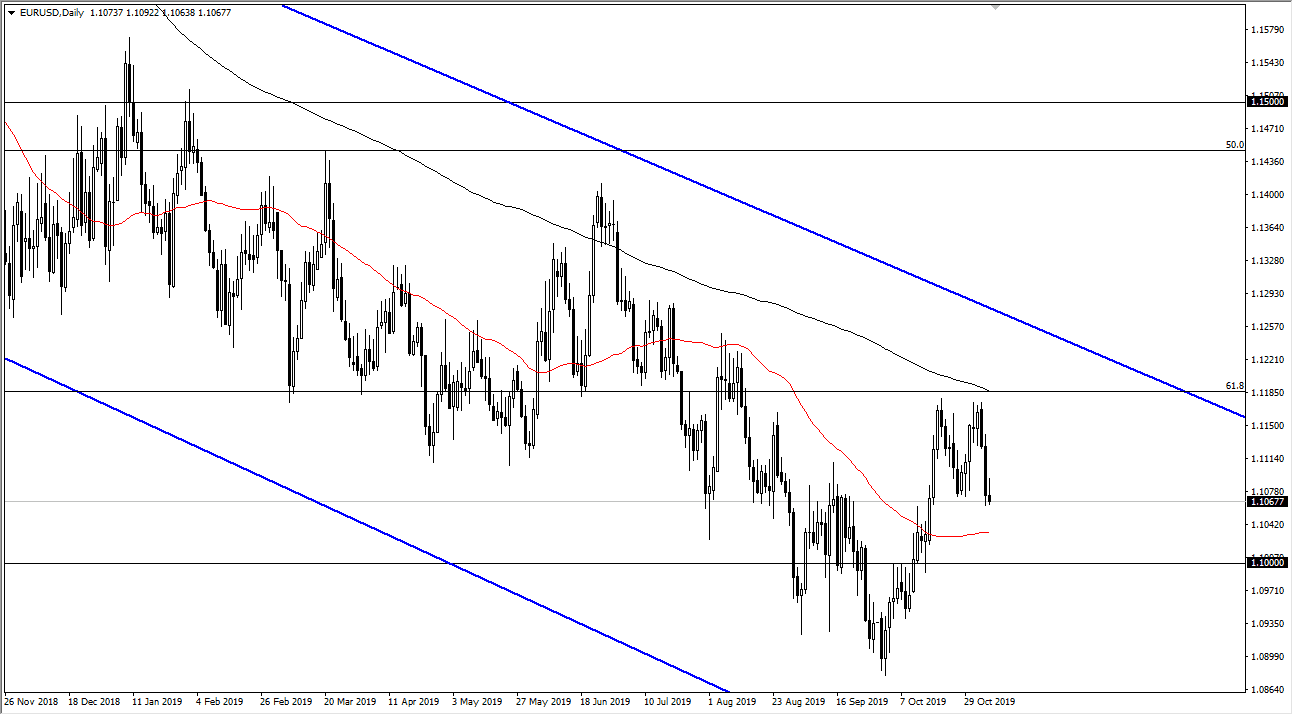

The Euro initially tried to rally during the trading session on Wednesday but gave back the gains a turnaround and form a bit of an inverted hammer. The question now is whether or not we can continue to go lower. It’s obvious that there is a little bit of support underneath, and it’s also likely that the Euro will react to the 50 day EMA underneath. At this point, the market is likely to continue to see a lot of noise, but when you look at the overall pattern, we have seen sellers step in every time the Euro tries to rally. This makes quite a bit of sense considering that the European Union has to deal with weak economic conditions, and of course a central bank that is likely to continue loosening monetary policy. On the other side of the Atlantic, we have the Federal Reserve is standing on the sidelines now, meaning that the US dollar can strengthen against the Euro over the longer term.

To the upside, the 200 day EMA sits at the 61.8% Fibonacci retracement level, which is at roughly 1.12. The market has been in a downtrend for a couple of years now, and even though we’ve seen a nice rally as of late, if you look at the chart you can also recognize a “M pattern”, in this means that it’s more than likely going to continue to go lower. This is essentially a nice reversal pattern right at a major resistance barrier. Obviously, I can’t guarantee anything happens but at this point it certainly looks as if the market will continue to drift lower, but obviously we will have the occasional chop, because that’s what this pair does: chop.

The 1.10 level is certainly somewhat psychologically important but at the end of the day we are more than likely going to go below there are less something drastically changes in either the United States or the European Union. The economic numbers have gotten slightly better during the day on Wednesday as far as Services PMI figures in the European Union, as well as German Factory Orders, but it’s just a blip on the radar, not enough to turn the markets around completely. I suspect that the Euro will continue to struggle. Overall, this is a market that has offered nice trading opportunities longer-term, or short-term scalping, both in the direction of lower.