The Euro sold off during the trading session on Friday again, as the US dollar continues to strengthen against the Euro based upon a multitude of reasons. The first reason of course is that the Federal Reserve is done cutting interest rates while the European Central Bank is likely to continue easing monetary policy.

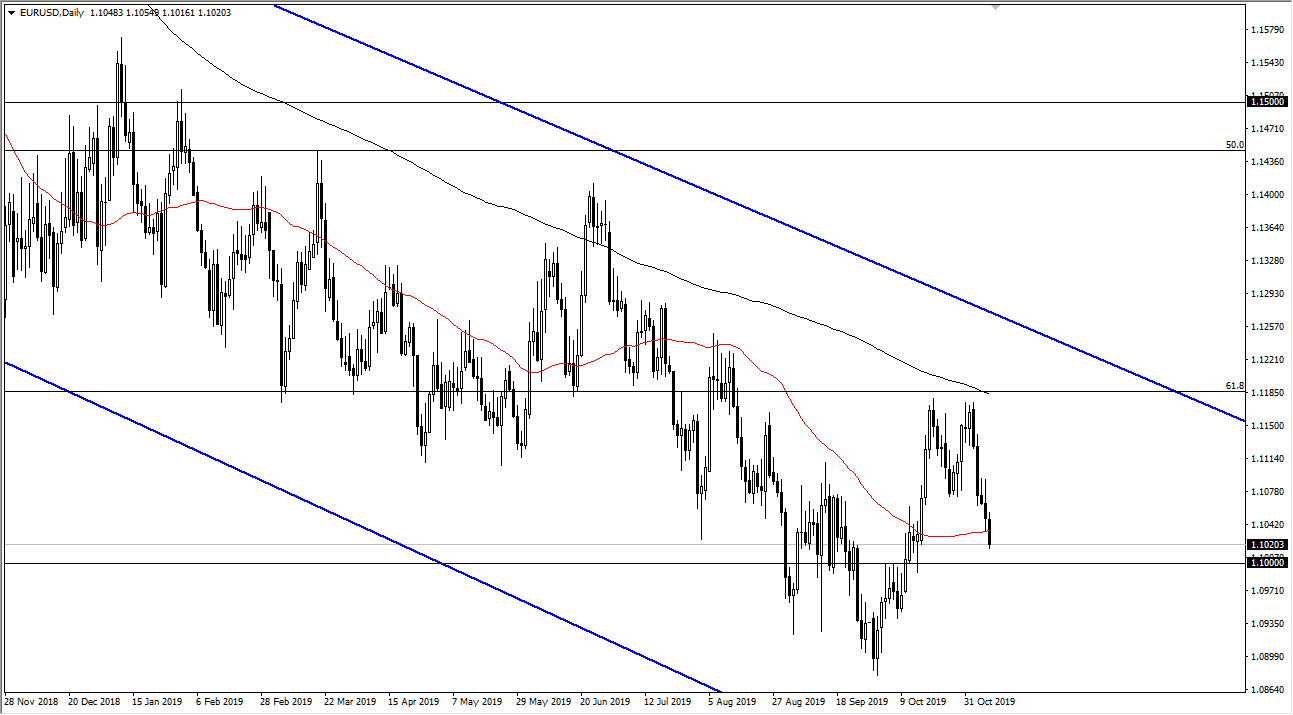

At this point, the 1.10 level underneath should be targeted next, and it could cause a short-term bounce but that has been sliced through a couple of times already, so it won’t take much to push lower. The market has bounced towards the 200 day EMA recently, and then bounce back into it to form a bit of a M pattern.

The market should continue to find reasons to go short of here not only due to the central bank issues, but also the fact that the European economic figures continue to be a bit soft. Ultimately, the US economy is steaming ahead and therefore it makes sense that the US dollar will continue to attract a lot of attention. Beyond that, the US/China trade war has been all over the place, and as a result bonds have been all over the place as well. This is a market that should continue to see negativity, and rallies at this point should be selling opportunities. In fact, it’s not until we break above the 1.12 level that I would consider shorting this market, and even then, I would probably need to see a weekly close above that level.

The last couple of days have been rather brutal for the Euro, but it is a continuation of what we seen over the last three years, that every time it rallies itself thought. That doesn’t mean that it’s going to be an easy move, and of course it will be very choppy and erratic. Because of this, unless you are a short-term trader you probably don’t have any interest in trading the Euro, because the thing is so difficult to get a grasp on for a longer-term move. At this point, fading rallies is just an extension of what we’ve been doing for ages now, and although it looked rather bullish at one point, the longer-term trend has reasserted itself so you can’t fight that as we are so obviously bearish over the longer term. To the downside, I think the next target is closer to the 1.09 level.