The Euro initially tried to rally during the trading session on Thursday but gave back quite a bit the gains as we get close to the 1.11 level. This is an area that continues to be a thorn in the side of buyers of the Euro, so it’s not a huge surprise to think that we would rollover the way we have seen several times. At this point, the market should continue to see a lot of volatility and choppy behavior which is typical for the Euro. Quite frankly, all you have to do is look back a couple of years to see how noisy this pair typically is. Because of this, yet to be willing to trade either shorter time frames or settle for smaller moves.

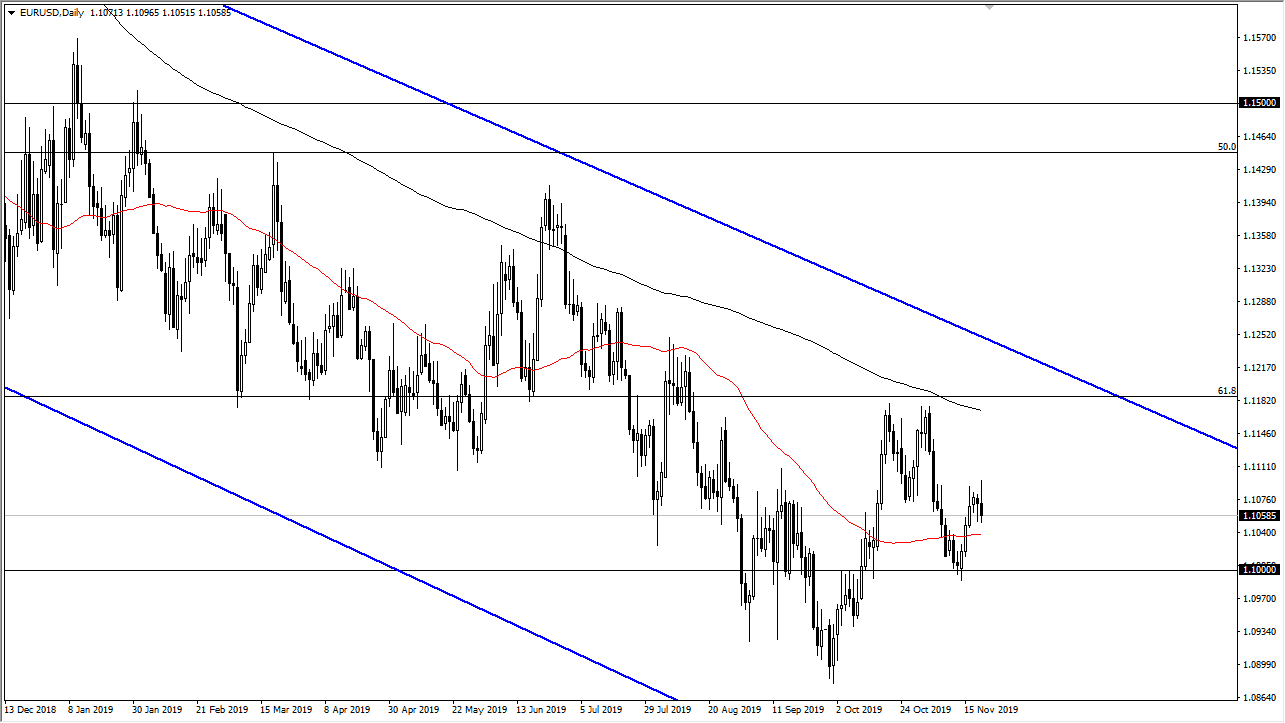

Looking at the chart, it’s very easy to see that we should continue to drift lower to the downside, perhaps reaching down to the 1.10 level which is an area that has attracted a lot of attention several times in both directions. Because of this, I believe that the market will continue to be very difficult for anything more than a quick scalp in one direction or the other, but I still favor the downside as the fundamentals line up against the Euro in general.

The European Union is likely to continue to be sluggish at best, and while the United States isn’t exactly on fire when it comes to economic figures, it is most certainly much stronger than most of the other major economies, EU included. The European Central Bank continues to look likely to liquefy and loosen its monetary policy, so that of course will work against the value of the Euro as well. Because of this, I think that every time this pair rallies, you should be thinking of when you can start to sell it again. Ultimately, I do believe that this pair will reach towards the 1.09 level again, but it’s going to be very noisy between now and then. Looking at longer-term charts an argument can be made for a move down to the 1.0750 level, which is an area that has a major gap at it. Ultimately, we have already broken through the longer-term 61.8% Fibonacci retracement level, and that typically means that you go looking towards much lower levels as it is a major break of Fibonacci support. What we have seen over the last several months is simply a repeat of what we’ve been seen for some time.